CIBC Asset Management Inc Increases Stake in Brown & Brown, by 3.8%

June 14, 2023

☀️Trending News

As one of the world’s largest independent insurance intermediaries, Brown & Brown ($NYSE:BRO) provides insurance and reinsurance products and services to corporate, institutional, governmental, nonprofit and individual clients throughout the United States. In its most recent filing, CIBC Asset Management Inc revealed that it had increased its ownership in Brown & Brown, Inc. by 3.8% during the fourth quarter. This news is likely to be welcomed by existing shareholders of the company as well as potential investors looking for an attractive stock to invest in.

Analysis

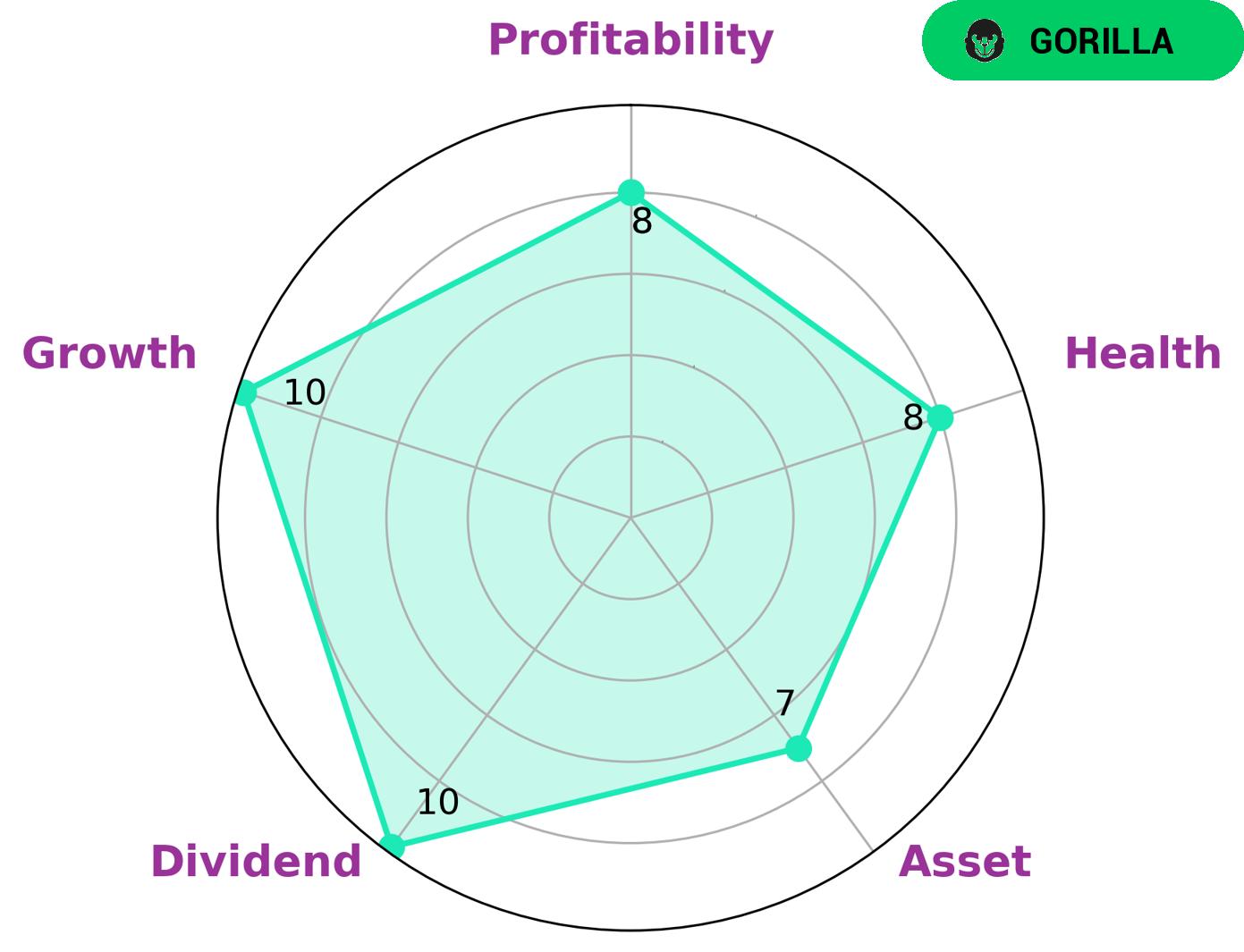

GoodWhale conducted an analysis of BROWN & BROWN’s wellbeing and the results are encouraging. The Star Chart indicated that BROWN & BROWN is strong in asset, dividend, growth, and profitability. Its health score of 8/10 takes into account its cashflows and debt, indicating that BROWN & BROWN is capable of sustaining future operations even in times of crisis. Additionally, BROWN & BROWN is classified as a ‘gorilla’ which means that it has achieved a stable and high revenue or earning growth due to its strong competitive advantage. For these reasons, BROWN & BROWN is an attractive investment for many types of investors. It is likely to appeal to those looking for a stable company with strong and consistent returns. Additionally, the company’s competitive advantage makes it attractive to those looking for long-term capital appreciation potential. Therefore, it appears that BROWN & BROWN has much to offer for a wide range of investors. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BRO. More…

| Total Revenues | Net Income | Net Margin |

| 3.77k | 678.7 | 17.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BRO. More…

| Operations | Investing | Financing |

| 837.6 | -1.51k | 306.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BRO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.4k | 8.55k | 16.27 |

Key Ratios Snapshot

Some of the financial key ratios for BRO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 18.3% | 28.6% |

| FCF Margin | ROE | ROA |

| 20.7% | 14.3% | 5.0% |

Peers

Brown & Brown, Inc. is an American insurance brokerage firm. Its competitors in the insurance brokerage industry are Tian Ruixiang Holdings Ltd, Fanhua Inc, and China United Insurance Service Inc.

– Tian Ruixiang Holdings Ltd ($NASDAQ:TIRX)

Tian Ruixiang Holdings Ltd is a Chinese holding company with investments in a range of businesses, including real estate, education, and healthcare. The company has a market cap of 6.97M as of 2022 and a Return on Equity of -5.01%. Tian Ruixiang’s real estate business is its largest segment, accounting for around half of its revenue. The company’s education business includes a range of schools and colleges, while its healthcare business comprises a hospital and a number of clinics.

– Fanhua Inc ($NASDAQ:FANH)

Fanhua Inc. is a provider of financial services in China. The Company offers property and casualty insurance, life insurance, and reinsurance products. It also provides auto financing, rural financing, and other services. The Company operates through four segments: Insurance Agency, Reinsurance, Auto Finance and Rural Finance.

– China United Insurance Service Inc ($OTCPK:CUII)

54.82M

China United Insurance Service Inc is an insurance company that focuses on providing insurance services to businesses and individuals in China. The company has a market cap of $54.82M and a ROE of 29.69%. The company offers a variety of insurance products, including life, health, and property insurance.

Summary

Brown & Brown, Inc. is an insurance and risk management services company, and recently saw a 3.8% increase in investment from CIBC Asset Management Inc in the fourth quarter. Furthermore, the company has seen strong earnings growth and a dividend yield of 2%, offering potential investors a good opportunity to generate returns. With solid fundamentals and signs of growth, Brown & Brown may be an attractive investment for those looking for meaningful returns.

Recent Posts