Mueller Industries Insiders Signal Caution with US$3.0m Stock Sell-Off.

February 2, 2023

Trending News 🌥️

Mueller Industries ($NYSE:MLI), Inc. is a leading manufacturer of copper, brass, aluminum, and plastic products with operations across the United States, Mexico, Canada, South America, Europe, Asia, and Africa. The company’s products are used in a broad range of industries, including automotive, plumbing, HVAC, refrigeration, electrical, and energy markets. Mueller Industries has long been viewed as a reliable and profitable company with significant growth potential.

However, recent news that insiders have sold US$3.0 million worth of stock could be a sign that they are approaching the company with caution. This could be due to a variety of factors, including concerns about the current macroeconomic environment or the potential for slowing demand for their products. It could also be related to the company’s financial position and outlook for future performance. The sale of stock by insiders could also be a sign that they are taking profits off the table and preparing for the possibility of a downturn in the stock price. It could also indicate that they are no longer as bullish on the company’s prospects as they once were. In either case, it is important for investors to conduct their own research and assess the company’s current situation and potential future performance before making any decisions regarding their investments in Mueller Industries.

Market Price

Mueller Industries Inc. has been in the news lately for mostly positive reasons. On Tuesday, the company’s stock opened at US$63.3 and closed at US$65.6, a 3.9% rise from the prior closing price of US$63.1.

However, despite the positive news, Mueller Industries insiders have signaled caution by selling off US$3.0 million worth of stock. This insider selling activity is often seen as a sign of potential market instability and a lack of confidence in the company’s future prospects. Insiders are typically aware of news about the company that hasn’t been released to the public yet and their stock sell-offs indicate that they don’t expect the company to continue performing as well as it has been in recent months. Mueller Industries is a leading manufacturer of copper, brass, aluminum, and plastic products. They are also a leading distributor of plumbing and heating products in North America and Europe. The company has been successful in recent times and is well-positioned to take advantage of a recovering economy. Despite the positive news surrounding the company, Mueller Industries insiders have nonetheless chosen to sell off US$3.0 million worth of stock. This suggests that they are cautious of the company’s future prospects or are expecting a possible downturn in the near future. Investors should keep this in mind when making decisions about their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mueller Industries. More…

| Total Revenues | Net Income | Net Margin |

| 4.06k | 645.01 | 15.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mueller Industries. More…

| Operations | Investing | Financing |

| 647.13 | -31.01 | -213.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mueller Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.11k | 455.1 | 28.58 |

Key Ratios Snapshot

Some of the financial key ratios for Mueller Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.4% | 66.6% | 21.2% |

| FCF Margin | ROE | ROA |

| 15.1% | 34.4% | 25.6% |

Analysis

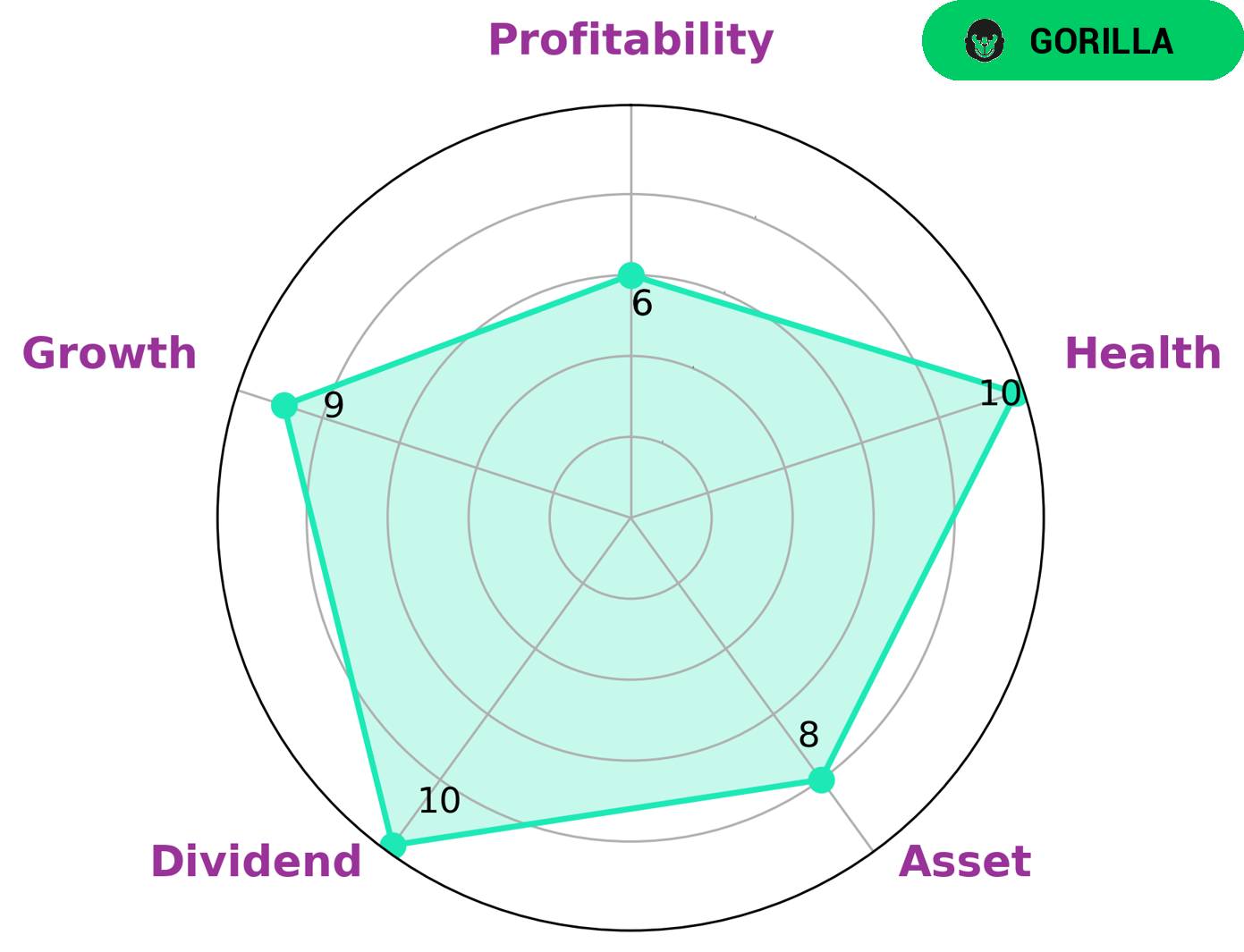

MUELLER INDUSTRIES is a strong financial performer, with a ‘gorilla’ classification due to its strong competitive advantage and stable and high revenue or earning growth. According to the Star Chart, its asset, dividend, and growth performance are all strong, while its profitability is rated as medium. This makes MUELLER INDUSTRIES an attractive investment for a range of investors. Value investors may be interested in MUELLER INDUSTRIES because of its strong asset performance, which indicates that the company is likely to have a low cost of capital. Income investors may also be drawn to MUELLER INDUSTRIES because of its strong dividend performance, which suggests the company has a steady stream of income. Growth investors may be attracted to this stock because of its strong growth performance, indicating that it is well-positioned to continue to expand. Furthermore, MUELLER INDUSTRIES has a high health score of 10/10 with regard to its cashflows and debt, meaning that it is capable of sustaining operations in times of crisis. This makes MUELLER INDUSTRIES an attractive investment for risk-averse investors. Its solid asset, dividend, and growth performance make it attractive to value, income, and growth investors. Additionally, its strong financial health score gives risk-averse investors further confidence in their investment decision. More…

Peers

Its competitors include Franklin Electric Co Inc, Furukawa Electric Co Ltd, PT Tembaga Mulia Semanan Tbk.

– Franklin Electric Co Inc ($NASDAQ:FELE)

Franklin Electric Co Inc is a manufacturer of submersible motors, pumps, and related parts and equipment. The company has a market capitalization of $3.95 billion as of 2022 and a return on equity of 18.79%. The company’s products are used in a variety of applications including residential, agricultural, commercial, and industrial water pumping.

– Furukawa Electric Co Ltd ($TSE:5801)

Furukawa Electric Co., Ltd. engages in the manufacture and sale of electric and electronic materials, products, and systems. It operates through the following segments: Electronic Devices, Optics, and Communication; Materials; Automotive; and Energy. The Electronic Devices, Optics, and Communication segment offers copper clad laminates, printed wiring boards, lead frames, optical fibers, optical fiber cables, and optical connectors. The Materials segment provides aluminum wire rods, aluminum alloys, aluminum foils, rare metals, and chemical products. The Automotive segment supplies automotive parts such as electric wires and cables, connectors, and battery terminals. The Energy segment offers power cables and power distribution equipment. The company was founded by Masaru Furukawa on June 8, 1949 and is headquartered in Tokyo, Japan.

– PT Tembaga Mulia Semanan Tbk ($IDX:TBMS)

PT Tembaga Mulia Semanan Tbk is one of the largest mining companies in Indonesia with a market cap of 593.25B as of 2022. The company is engaged in the exploration, mining, and smelting of copper and gold.

Summary

Mueller Industries is a leading global manufacturer of copper, brass, aluminum, and plastic products. Recent news has shown that company insiders have sold off US$3.0m worth of stocks, signaling caution in the market. Despite this, the stock price has risen the same day, indicating that investors are still optimistic about the company’s future performance. Analysts suggest that investors should exercise caution when investing in Mueller Industries, keeping in mind the news of stock sells-off and monitoring the company’s performance in the coming months before making any decisions.

Recent Posts