Franklin Resources Boosts Position in CorVel Co. as Insiders Cash Out Millions in Shares

June 12, 2023

☀️Trending News

CORVEL ($NASDAQ:CRVL): CorVel Corporation is a technology-driven provider of innovative services and solutions to the workers’ compensation industry. The company uses proprietary technology to provide risk management solutions and services that are designed to help reduce medical and indemnity costs associated with managing workers’ compensation claims. CorVel also provides medical case management, including care coordination, utilization review, medical bill review, and other services to employers, insurance companies, and third-party administrators. Franklin Resources Inc., a leading global investment management organization, has recently boosted its stake in CorVel Co. while insiders of the company have sold off millions of dollars worth of shares.

The decision by Franklin Resources Inc. to increase its holdings in CorVel Co. is indicative of the confidence they have in the company’s potential for growth. While it is unclear why insiders of the company have sold off so many shares, it could be an indication that they are looking to cash in on their investment. Time will tell if this decision proves to be a profitable one for both parties involved.

Stock Price

On Friday, CORVEL CORPORATION saw a slight dip in its stock price. Initially opening at $201.8, the stock ultimately closed the day at $200.3, a 1.7% decrease from last closing price of 203.9. This downtrend was attributed to the sale of millions of dollars worth of shares by CORVEL insiders. Despite the change in ownership structure, the company remains committed to providing quality services to its clients. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Corvel Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 718.56 | 66.36 | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Corvel Corporation. More…

| Operations | Investing | Financing |

| 86.33 | -29.82 | -79.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Corvel Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 393.92 | 191.75 | 11.35 |

Key Ratios Snapshot

Some of the financial key ratios for Corvel Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.7% | 11.7% | 11.8% |

| FCF Margin | ROE | ROA |

| 7.8% | 26.6% | 13.4% |

Analysis

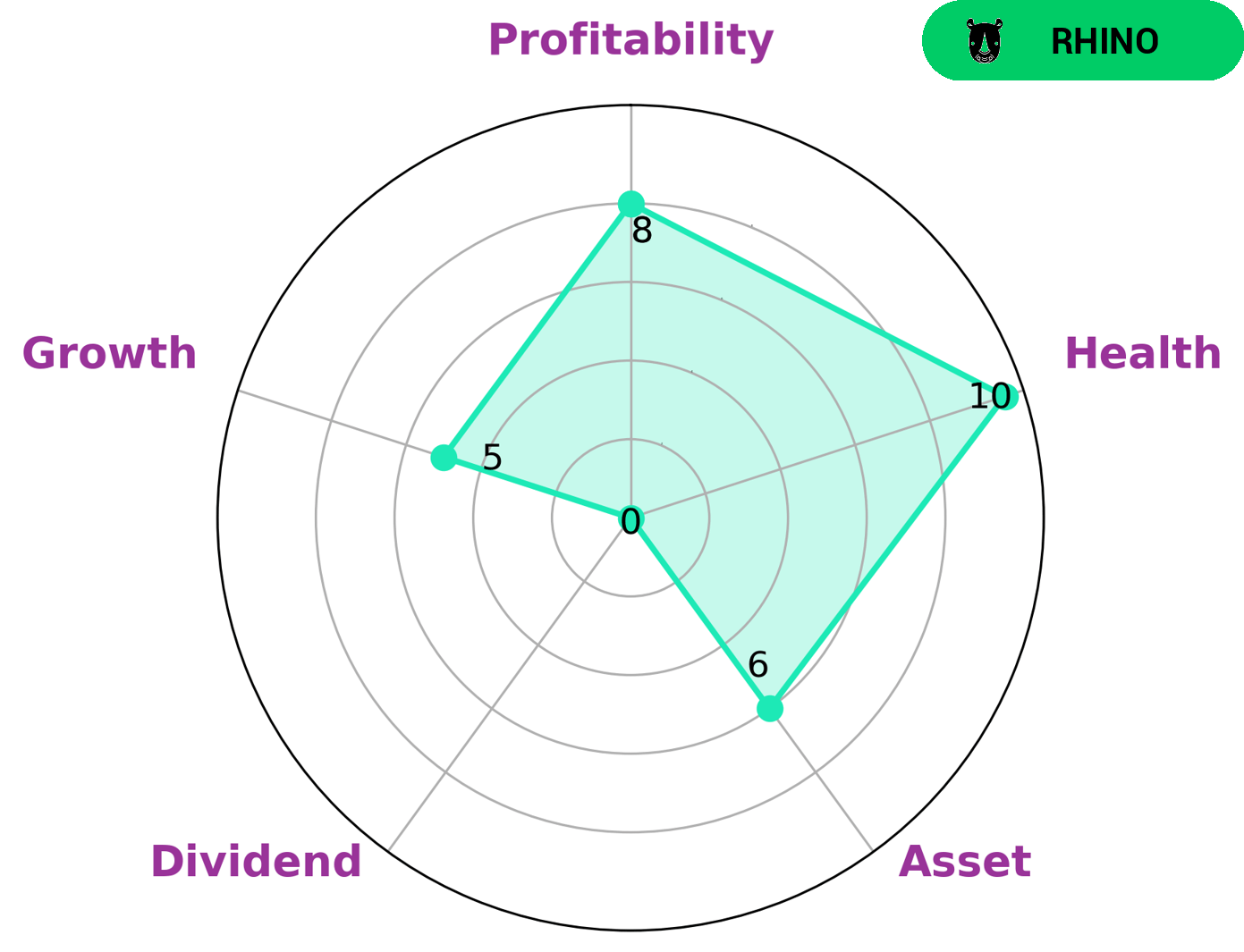

At GoodWhale, we have conducted a thorough analysis of CORVEL CORPORATION’s fundamentals. The Star Chart indicates that CORVEL CORPORATION is strong in terms of profitability, medium in terms of asset, growth, and weak in dividend. As such, we classify CORVEL CORPORATION as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given its strong profitability and moderate growth, we believe there are likely to be a variety of investors who may be interested in CORVEL CORPORATION. For instance, value investors may be attracted by its strong profitability and low dividend, while growth investors may be tempted by the potential upside of advancing the company’s growth. Additionally, CORVEL CORPORATION has a high health score of 10/10 considering its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. More…

Peers

As the healthcare industry continues to grow, so does the competition between CorVel Corp and its competitors. GoHealth Inc, Star Health and Allied Insurance Co Ltd, and NIB Holdings Ltd are all major players in the healthcare industry, and each company is constantly looking for ways to improve their services and products. While each company has its own strengths and weaknesses, they all share one common goal: to provide the best possible care for their patients.

– GoHealth Inc ($NASDAQ:GOCO)

GoHealth Inc is a health insurance company that provides health insurance plans and services to individuals and families. The company has a market cap of $62.23M and a return on equity of -105.56%. GoHealth Inc offers a variety of health insurance plans and services, including health savings accounts, health insurance exchanges, and Medicare Advantage plans. The company also offers a variety of other products and services, including health care provider networks, health care reform consulting, and health care software solutions.

– Star Health and Allied Insurance Co Ltd ($BSE:543412)

Star Health and Allied Insurance Co Ltd is a health insurance company with a market cap of 413.78B as of 2022. The company has a Return on Equity of -15.88%. Star Health and Allied Insurance Co Ltd offers a range of health insurance products and services. The company is headquartered in Mumbai, India.

– NIB Holdings Ltd ($ASX:NHF)

NIB Holdings Ltd is an Australian health insurance company. It has a market cap of 3.28B as of 2022 and a Return on Equity of 16.83%. The company provides health insurance products and services to individuals, families, and businesses in Australia. It offers a range of products including hospital cover, extras cover, and ancillary cover.

Summary

Franklin Resources Inc. recently increased its position in CorVel Corporation, a provider of workers’ compensation and related solutions. This follows a period of insider selling of shares for millions of dollars. Analysis of the company shows that CorVel Corporation has a strong balance sheet and significant cash flows from operations. It also has a low debt-to-equity ratio, making it an attractive investment choice.

The company is well-positioned to capitalize on the growing trend of workers’ compensation services and has positioned itself to benefit from the shift towards digitalization of the healthcare sector. Overall, CorVel Corporation is a well-managed business and an attractive investment opportunity.

Recent Posts