Uber Technologies: Uniting People with Above-Average Driving Through the Wild Ride of a Busted IPO.

February 8, 2023

Trending News 🌥️

The company began as a peer-to-peer ridesharing service, but quickly grew to become a multi-dimensional transportation provider. Uber Technologies ($NYSE:UBER) now provides services such as food delivery, freight hauling, and autonomous vehicles. The company made headlines in 2019 when it had one of the most successful IPOs of all time. This success was short-lived, however, as the stock has been on a wild ride ever since. Since its IPO, Uber Technologies has faced numerous challenges. The company continues to be dogged by lawsuits and regulatory issues, while competitors such as Lyft have emerged as viable alternatives.

Additionally, the global pandemic has had a huge impact on the ridesharing industry, causing Uber Technologies to slash its workforce and reduce its spending on research and development. Despite these struggles, Uber Technologies remains an industry leader and continues to innovate in the transportation space. The company recently announced plans to launch an electric scooter service and is investing heavily in autonomous vehicle technology. It is also leveraging its vast network of drivers to move freight and deliver food. Uber Technologies is an example of how innovation can disrupt entire industries. Although the IPO may have been a bust, it has opened up a variety of opportunities for those looking to make a living in the transportation space. With its continued focus on innovation, Uber Technologies is sure to remain a leader in the industry for years to come.

Stock Price

Uber Technologies has been making headlines recently in the news as their initial public offering (IPO) has been a wild ride. At the time of writing, sentiment towards Uber Technologies is mostly positive, as their IPO opened at $33.7 on Tuesday and closed at $34.9, up by 3.0% from its previous closing price of 33.9. This has marked a historic milestone for the company and its investors, who have been eagerly awaiting the public debut of Uber Technologies. The company itself has been working hard over the past few years to revolutionize the way people move by uniting drivers with passengers through its ride-hailing platform. The IPO also represents a significant turning point for Uber Technologies, as the company has been subject to numerous regulatory changes and controversies in recent years. This includes the company’s decision to remove its self-driving car project and focus on its core services.

Despite this, Uber Technologies continues to remain popular with its users, offering a convenient and reliable way to get around town. The company has also managed to build a large network of drivers who are willing to provide above-average service in order to make a living. Overall, Uber Technologies’ IPO has been a wild ride, but one that has been met with mostly positive news sentiment and a strong stock performance. While the company still faces many challenges ahead, it is clear that Uber Technologies is here to stay and will continue to unite people with above-average driving through its ride-hailing platform. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Uber Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 29.05k | -8.84k | -9.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Uber Technologies. More…

| Operations | Investing | Financing |

| 779 | -2.14k | 518 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Uber Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 31.11k | 23.71k | 3.37 |

Key Ratios Snapshot

Some of the financial key ratios for Uber Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.6% | – | -29.5% |

| FCF Margin | ROE | ROA |

| 1.7% | -82.9% | -17.2% |

Analysis

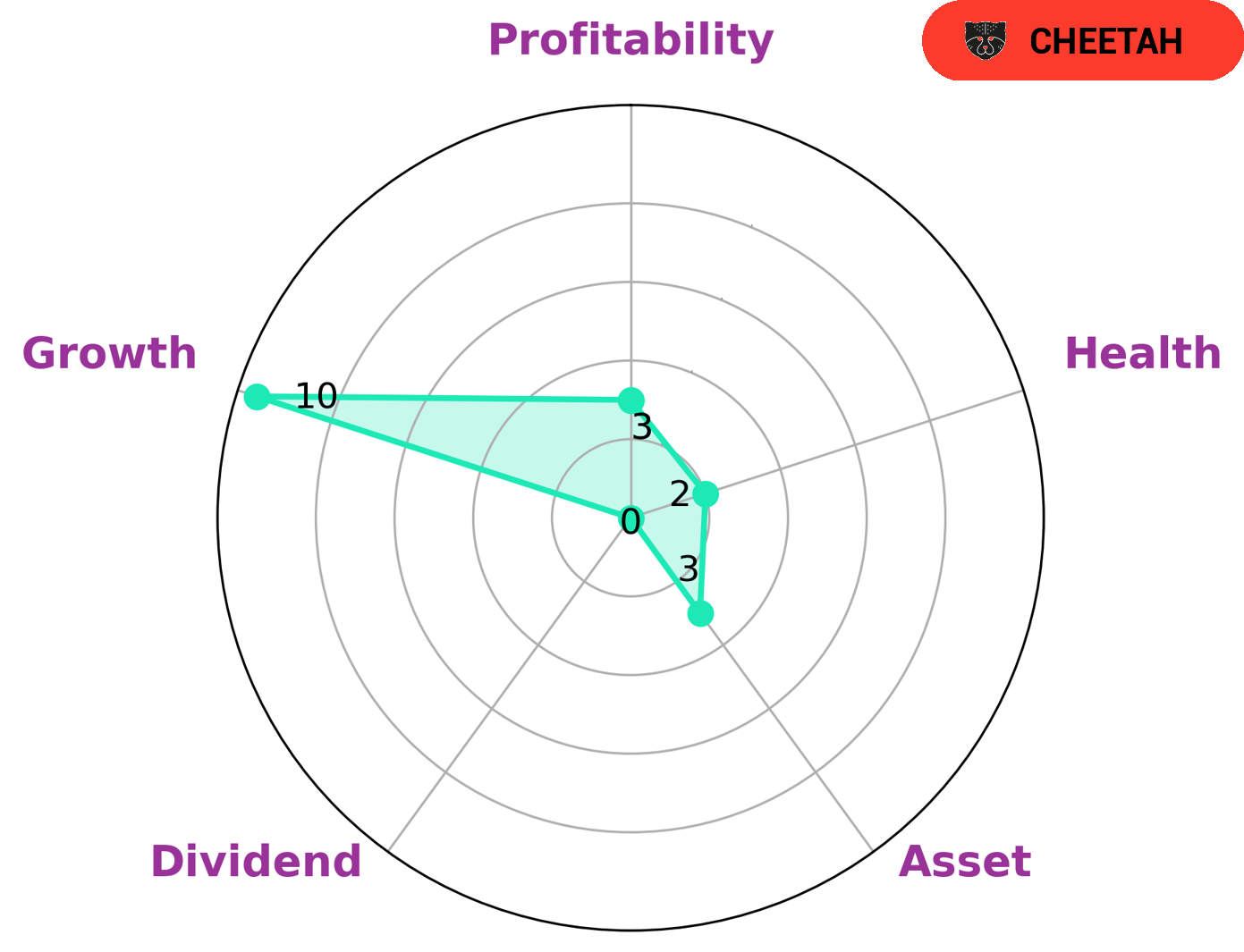

Uber Technologies has recently been analyzed by GoodWhale and the results show that it is classified as a ‘cheetah’ type of company. This means that it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. This type of company may be attractive to investors who are looking for potential high returns, but they must also be aware of the associated risks. Uber Technologies is strong in terms of growth, but weak in terms of assets, dividends, and profitability. In terms of health score, Uber Technologies has a low score of 2/10, which means that it is less likely to be able to sustain future operations during times of crisis. Investors must take this into consideration before investing in the company. Overall, Uber Technologies may be an attractive investment option for investors looking for high returns, but they must consider the associated risks and the company’s ability to sustain operations during times of crisis. They should also assess their own risk tolerance and financial goals before making any decisions. More…

Peers

As the world progresses, new technologies are constantly emerging and reshaping the way we live. One of the most recent and influential technological advancements is the rise of ride-sharing apps, such as Uber Technologies Inc. These apps have changed the way we travel, and have had a profound impact on the taxi industry. While Uber has become the most well-known and successful ride-sharing app, it faces stiff competition from other companies, such as Trend Innovations Holding Inc, Waitr Holdings Inc, and Where Food Comes From Inc.

– Trend Innovations Holding Inc ($OTCPK:TREN)

Innovative Holding Inc is a publicly traded holding company with a focus on technology investments. The company’s market cap as of 2022 was 58.02M and its ROE was 81.69%. Innovative Holding Inc’s portfolio includes investments in companies such as AppDirect, Cloud Elements, and Icertis. These companies provide software that helps businesses manage their operations, customers, and suppliers.

– Waitr Holdings Inc ($NASDAQ:WTRH)

Waitr Holdings Inc is a food delivery service company. It operates in the United States and has a market cap of 26.59M as of 2022. The company has a Return on Equity of -127.21%.

Waitr Holdings Inc was founded in 2013 and is headquartered in Lake Charles, Louisiana. The company operates in the restaurant industry and provides food delivery services to its customers. It delivers food from local restaurants to its customers through its app. The company has a fleet of drivers who pick up and deliver food to its customers.

– Where Food Comes From Inc ($NASDAQ:WFCF)

Food Comes From Inc. is a company that helps farmers and food producers to connect with consumers and sell their products. The company has a market cap of 70.04M as of 2022 and a Return on Equity of 17.04%. The company has a strong focus on sustainability and works to promote sustainable practices among its farmers and food producers. The company also works to educate consumers about where their food comes from and the importance of supporting sustainable agriculture.

Summary

Investing in Uber Technologies has been a wild ride since its IPO in May 2019. Initial news sentiment was mostly positive, and the stock price rose the same day. Since then, the stock has seen dramatic fluctuations, with peaks and valleys that have tested investor patience. Despite the volatility, analysts believe Uber is a long-term investment that offers the potential of substantial returns.

As such, many investors have chosen to hold onto their shares, while taking advantage of dips to buy more. With its strong brand presence, innovative technology, and diversified revenue streams, Uber Technologies is an attractive option for investors looking for a long-term bet.

Recent Posts