MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE Receives Green Light For Swiss IPO With Conditional Approval.

February 11, 2023

Trending News ☀️

MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE ($SHSE:603713) is a leading chemical supply chain provider that has just received conditional approval for its Swiss IPO. The company provides a wide range of products, from basic industrial chemicals to more advanced specialty chemicals, for a variety of industries.

In addition, they have successfully integrated digital technologies into their business operations, providing customers with improved efficiency and service. The Swiss IPO will provide MILKYWAY with the necessary capital to continue expanding its product offering and further invest in digital technologies such as artificial intelligence, machine learning, and blockchain.

Additionally, the IPO will enable MILKYWAY to expand its global presence and customer base, as well as build strategic alliances with other leading chemical supply chain providers. It will provide them with the capital needed to grow and develop their business, allowing them to become a major player in the global chemical supply chain market. With their commitment to sustainability and quality, MILKYWAY is well-positioned to take advantage of this opportunity and provide customers with top-tier service.

Market Price

So far, media coverage of the company’s stock has been mostly positive. On the day of its launch, the MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE stock opened at CNY121.2 and closed at CNY121.0, down by 0.8% from the prior closing price of 121.9. The conditional approval allows MILKYWAY to move forward with its plans for a public listing. The company will now focus on meeting conditions set by the Swiss Exchange in order to proceed with the IPO. Such conditions may include, among other things, providing detailed financial data and other information about the company’s business operations. The IPO will provide MILKYWAY with access to capital that it can use to fund growth and further expand its portfolio of chemical supply chain services.

Additionally, the listing on the Swiss Stock Exchange will give MILKYWAY a platform to increase its visibility and attract new investors and customers. The success of MILKYWAY’s IPO will be closely watched by investors and industry observers, as it could set a precedent for companies in the chemical supply chain service sector. For now, it appears that the company has taken a step in the right direction with its conditional approval from the Swiss Exchange. It remains to be seen if MILKYWAY can meet the exchange’s conditions and successfully launch its public offering. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Milkyway Chemical Supply. More…

| Total Revenues | Net Income | Net Margin |

| 11.79k | 606.83 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Milkyway Chemical Supply. More…

| Operations | Investing | Financing |

| 227.55 | -994.5 | 1.33k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Milkyway Chemical Supply. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.03k | 5.28k | 20.89 |

Key Ratios Snapshot

Some of the financial key ratios for Milkyway Chemical Supply are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 71.1% | 51.1% | 7.2% |

| FCF Margin | ROE | ROA |

| -1.0% | 14.9% | 5.9% |

Analysis

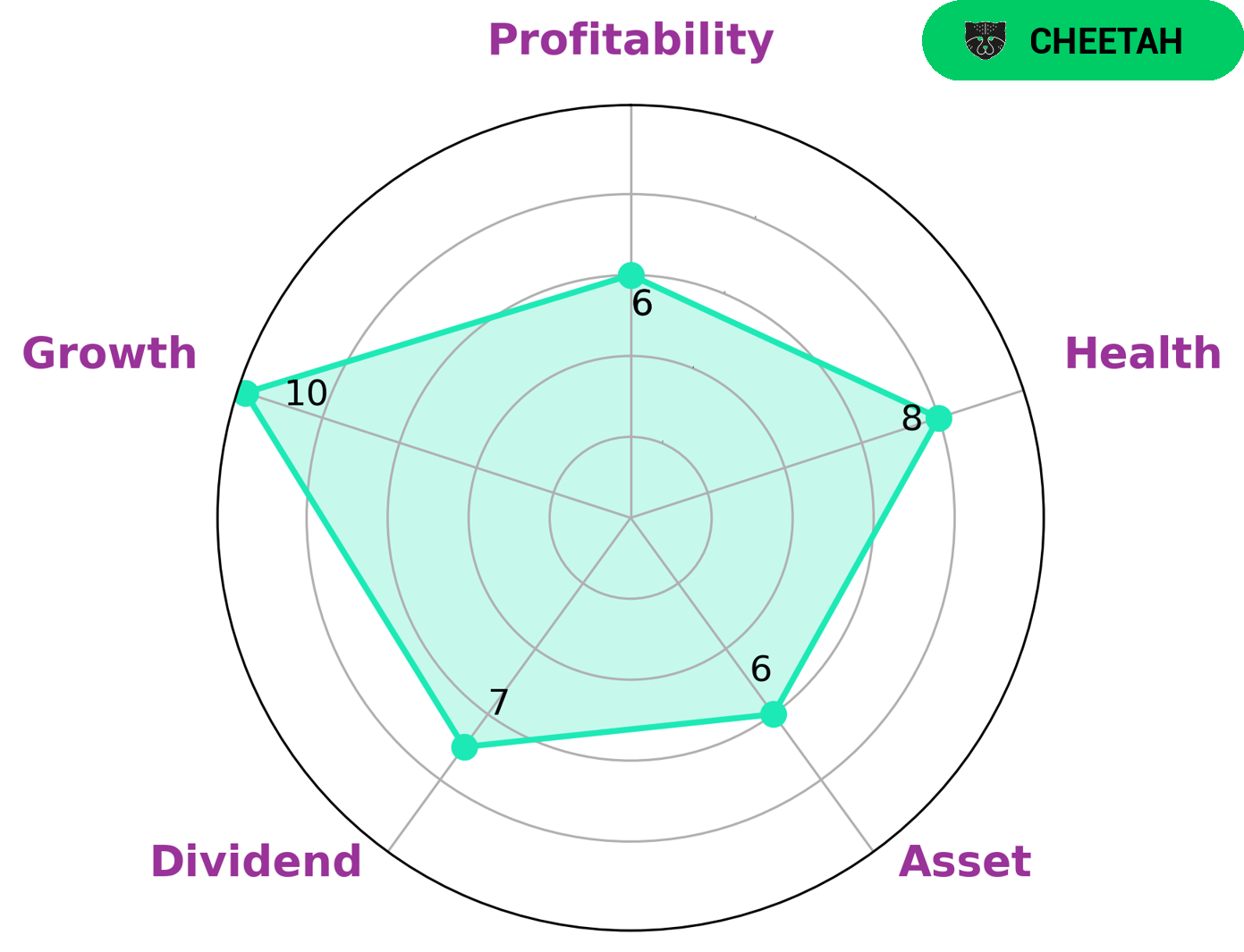

GoodWhale has conducted an analysis of MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE’s wellbeing and classified it as ‘cheetah’ on the Star Chart. This means that the company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Therefore, investors looking to reap short term returns may be interested in such a company. MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE has a relatively high health score of 8/10 based on cashflows, debt and its ability to pay off debt and fund future operations. They have been strong in dividend, growth and medium in asset, profitability. The company is looking to increase their presence in the market and make strategic acquisitions to become a leader in their industry. In terms of sustainability, MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE has taken steps to reduce their carbon footprint and move towards a more sustainable future. They have also initiated measures to ensure equitable compensation for their staff and ensure compliance with international standards. Overall, MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE has been successful in achieving high revenue and earnings growth with a relatively high health score. They have also taken steps to become more sustainable and continue to implement measures to ensure staff and compliance are at optimum levels. These factors may attract short-term investors seeking returns, while also having sustainability at the core of their business operations. More…

Peers

The competition among Milkyway Chemical Supply Chain Service Co Ltd and its competitors, Mahindra Logistics Ltd, Tracimexco – Supply Chains and Agency Services JSC, and Xinjiang Tianshun Supply Chain Co Ltd, is fierce. All of these companies strive to provide the best service, quality, and delivery times to their customers in order to gain market share. With the ever-evolving landscape of supply chain services, each of these companies is constantly innovating and looking for ways to better serve its customers.

– Mahindra Logistics Ltd ($BSE:540768)

Mahindra Logistics Ltd is an Indian logistics and supply chain management company. It provides services that include transportation, warehousing, freight forwarding and value-added services. The company has a market cap of 29.38 billion as of 2023, making it one of the largest logistics companies in India. The company’s Return on Equity (ROE) stands at 12.48%, indicating that it has been able to generate profits from its operations. Mahindra Logistics Ltd is committed to providing world-class logistics solutions that are tailored to meet customer needs. It is also focused on enhancing customer experience by providing a range of services that are cost-effective, timely and reliable.

– Tracimexco – Supply Chains and Agency Services JSC ($HNX:TRS)

Xinjiang Tianshun Supply Chain Co Ltd is a Chinese supply chain management company with a market capitalization of 2.78 billion as of 2023. The company has an impressive return on equity (ROE) of 6.85%. Xinjiang Tianshun Supply Chain Co Ltd specializes in providing total logistic solutions, including supply chain management, warehousing, transportation and distribution services. The company has established a nationwide network to provide integrated logistics services for customers in the apparel, electronics, food and beverage, pharmaceuticals, automotive and other industries. With a strong emphasis on innovation and customer service, the company is well-positioned to capitalize on the growing demand for supply chain services in China.

Summary

MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE has received conditional approval for a Swiss IPO, and so far the media coverage has been positive. Investing in MILKYWAY CHEMICAL SUPPLY CHAIN SERVICE is potentially a lucrative opportunity, as the company has a strong business base with a focus on sustainability and customer service. The IPO will provide investors with the chance to gain exposure to the company’s strategic activities, future prospects, and financial performance. Investors should consider the company’s track record and overall industry outlook prior to investing.

Recent Posts