Transurban Group Reaches All-Time High Earnings Before CEO Departure.

February 9, 2023

Trending News ☀️

The Transurban Group ($ASX:TCL) (ASX:TCL) is a well-known infrastructure and transport company based in Australia. The Group has achieved a significant milestone by reaching an all-time high in earnings. This success has been largely due to the leadership of its outgoing Chief Executive Officer, Scott Charlton. During his tenure, the Group increased its presence in Australia and expanded internationally, while also carrying out major investments in the development of new infrastructure.

Charlton’s leadership saw Transurban become one of the most successful transport companies in Australia. Under Charlton’s guidance, Transurban managed to negotiate large toll road concessions with governments and successfully implemented state-of-the-art technology such as electronic toll collection systems. Moriarty has a wealth of experience in the transport and infrastructure industry, and is looking forward to the challenge of continuing to build on Transurban’s strong performance.

Stock Price

Transurban Group made headlines on Wednesday when its stock opened at AU$13.9 and closed at AU$14.1, up by 0.8% from its previous closing price of AU$14.0. This marked the company’s highest ever earnings before the departure of its Chief Executive Officer (CEO). The strong stock price performance was a testament to the success of Transurban Group’s operations and investments. This increase in revenue was achieved by a combination of new customers, increased usage rates, and the introduction of dynamic pricing. Transurban Group has also made significant investments in its operations across Australia. This investment has been well received by investors as it indicates confidence in the company’s long-term outlook.

The company’s success was also reflected in its financial results, with its earnings before interest, taxes, depreciation and amortization (EBITDA) reaching an all-time high. The strong growth in the company’s earnings before its CEO’s departure, combined with its investments in toll roads, demonstrates the confidence of investors in the company’s future prospects. Transurban Group’s stock performance on Wednesday is a testament to its success and profitability, and investors have expressed optimism over its future despite the departure of its CEO. With continued investments and expansion of its toll road network, it looks like Transurban Group is on track for yet another successful year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transurban Group. More…

| Total Revenues | Net Income | Net Margin |

| 4.14k | 163 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transurban Group. More…

| Operations | Investing | Financing |

| 1.36k | -315 | -1.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transurban Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 38.28k | 24.02k | 4.39 |

Key Ratios Snapshot

Some of the financial key ratios for Transurban Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | -4.5% | 19.6% |

| FCF Margin | ROE | ROA |

| 14.0% | 3.6% | 1.3% |

Analysis

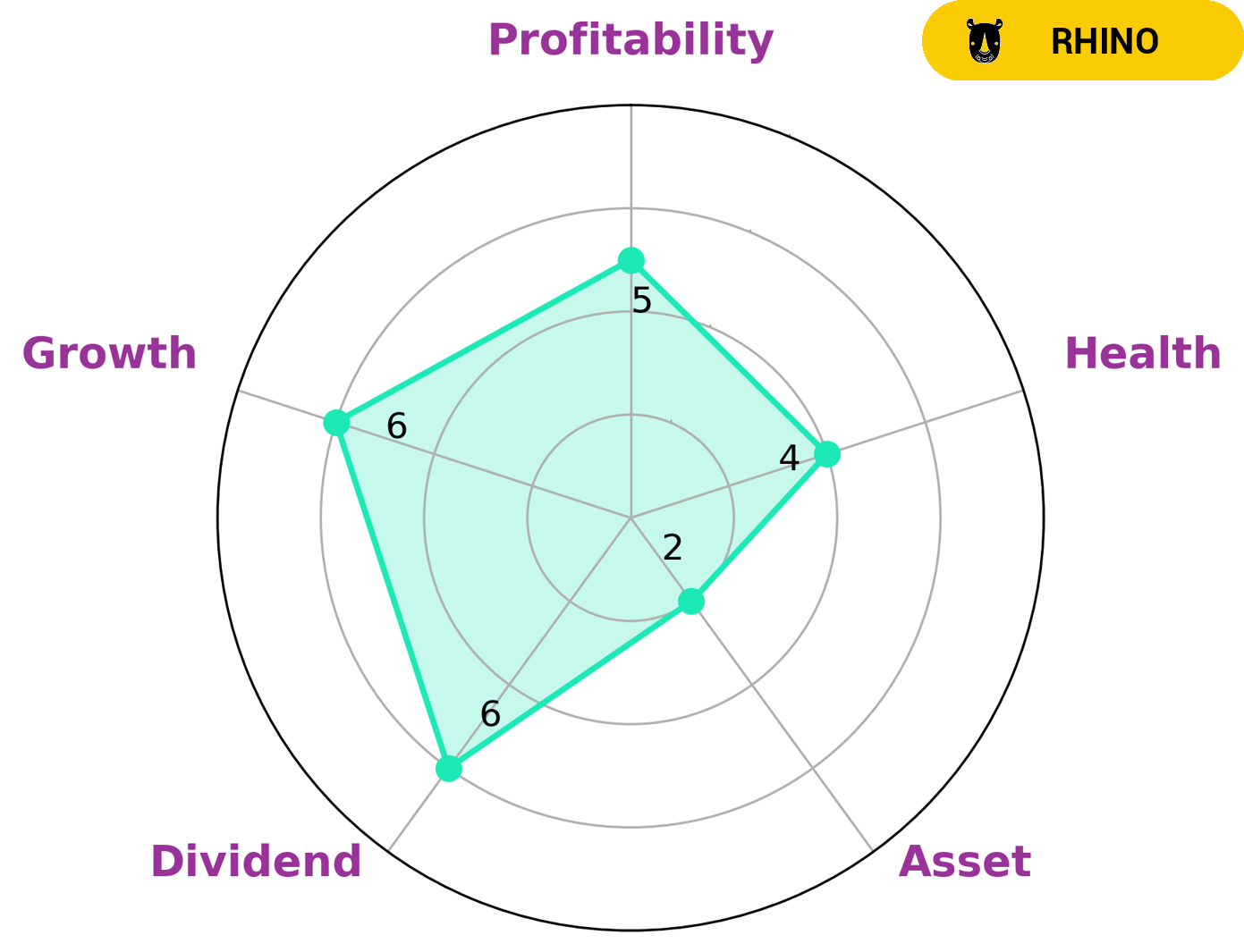

GoodWhale has undertaken an analysis of TRANSURBAN GROUP‘s fundamentals, finding it to be classified as a ‘rhino’. This type of company has achieved moderate revenue or earnings growth but might not be suitable for investors seeking high returns. TRANSURBAN GROUP has an intermediate health score of 4/10 with regard to cashflows and debt, indicating it could potentially ride out any crisis without the risk of bankruptcy. In terms of its fundamentals, TRANSURBAN GROUP is strong in dividend, medium in growth, profitability, and weak in asset. Investors interested in medium-term securities may be interested in investing into TRANSURBAN GROUP, as they could potentially benefit from the moderate revenue or earnings growth it is likely to provide over the long-term. Furthermore, the intermediate health score of 4/10 it has been given could provide investors with some security from major risks such as bankruptcy. However, investors should note that there is no guarantee of success when investing in any company and that the performance of TRANSURBAN GROUP could change over time. As such, investors should look into other factors such as market trends and competitive forces before committing to investing in TRANSURBAN GROUP. It is also important to conduct thorough research into the company’s finances and operations before investing to make sure that the investment is suitable for their individual circumstances. More…

Peers

Transurban Group competes with a number of companies in the toll road and highway management space, including Atlas Arteria Ltd, Vinci SA, and Jiangsu Expressway Co Ltd. The company has a strong market position and a good track record, but its competitors are also well-established and capable.

– Atlas Arteria Ltd ($ASX:ALX)

Atlas Arteria Ltd is a global investment platform with a focus on infrastructure. The company has a market cap of 9.56B as of 2022 and a Return on Equity of 5.32%. Atlas Arteria’s investment strategy is to target high quality, well-positioned infrastructure assets with long-term, stable cash flows. The company invests across the transportation, social, and utility sectors. Atlas Arteria is headquartered in Sydney, Australia.

– Vinci SA ($OTCPK:VCISY)

Vinci SA is a French construction and concessions company. The company’s market cap as of 2022 is 52.21B. The company’s return on equity is 16.12%. The company’s main businesses are construction, concessions, and energy. The company’s construction business includes the construction of roads, bridges, tunnels, airports, and railway lines. The company’s concessions business includes the operation of airports, motorways, and car parks. The company’s energy business includes the generation and distribution of electricity and gas.

– Jiangsu Expressway Co Ltd ($SHSE:600377)

Jiangsu Expressway Co Ltd is a Chinese expressway operator. The company operates a network of expressways in Jiangsu province, China. As of 2022, the company had a market capitalization of 34.72 billion yuan and a return on equity of 10.96%. The company’s expressway network includes the Nanjing-Qidong Expressway, the Nanjing-Jinghu Expressway, the Suzhou-Jiaxing-Hangzhou Expressway, and the Wuxi-Changxing Expressway.

Summary

Transurban Group, a toll road operator, has achieved an all-time high in earnings prior to the departure of their Chief Executive Officer. This is a positive sign for investors, as it illustrates the strength of the company’s financial performance. The results suggest that the company is well-positioned for future growth, and this could be a great opportunity for investors looking for long-term returns. Transurban Group has a diversified portfolio that includes airports, ports, railroads and toll roads, and its strong earnings have led to an increase in share price.

Additionally, the company’s dividend yield is attractive, which further bolsters its attractiveness to investors. With these attributes, Transurban Group appears to be an attractive investment opportunity.

Recent Posts