Transurban Group Intrinsic Value Calculation – Citigroup Downgrades Transurban Group’s Rating to Neutral

April 19, 2023

Trending News 🌥️

Transurban Group ($ASX:TCL) is a toll road operator based in Australia, known for its network of urban toll roads and express lanes. On Monday, Citigroup published a research report downgrading Transurban Group’s shares from a buy rating to a neutral rating. The report cited market saturation, near-term earnings pressure, and the company’s inability to increase traffic in its existing networks as primary reasons for the downgrade. The report also noted that the company’s aggressive expansion plans have created a large debt burden and the potential for significant capital expenditure requirements in the future. The downgrade highlighted concerns over Transurban Group’s ability to deliver consistent earnings growth amidst a challenging environment. The company has been struggling to increase traffic on some of its major projects in Sydney and Melbourne, leading to weak revenue figures.

Additionally, the company has been investing heavily in acquisitions and projects, resulting in an increased debt load and additional capital expenditure requirements. The downgrade of Transurban Group’s shares is likely to have a negative impact on the company’s stock price. Analysts fear that the company may struggle to meet its growth targets due to increasing competition, increasing debt burdens and ongoing capital expenditure requirements. It remains to be seen how the stock will react to the downgrade in the coming months.

Market Price

Following the downgrade, TRANSURBAN GROUP stock opened at AU$14.6 and closed at AU$14.8, down by 0.2% from the last closing price of AU$14.8. The downgrade is likely to negatively impact the company’s stock performance in the near future. The downgrade reflects analysts’ concerns that the company’s performance is expected to remain weak for the foreseeable future and that further downgrades may be on the horizon. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transurban Group. More…

| Total Revenues | Net Income | Net Margin |

| 4.14k | 163 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transurban Group. More…

| Operations | Investing | Financing |

| 1.36k | -315 | -1.08k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transurban Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 38.28k | 24.02k | 4.39 |

Key Ratios Snapshot

Some of the financial key ratios for Transurban Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.3% | -4.5% | 19.6% |

| FCF Margin | ROE | ROA |

| 14.0% | 3.6% | 1.3% |

Analysis – Transurban Group Intrinsic Value Calculation

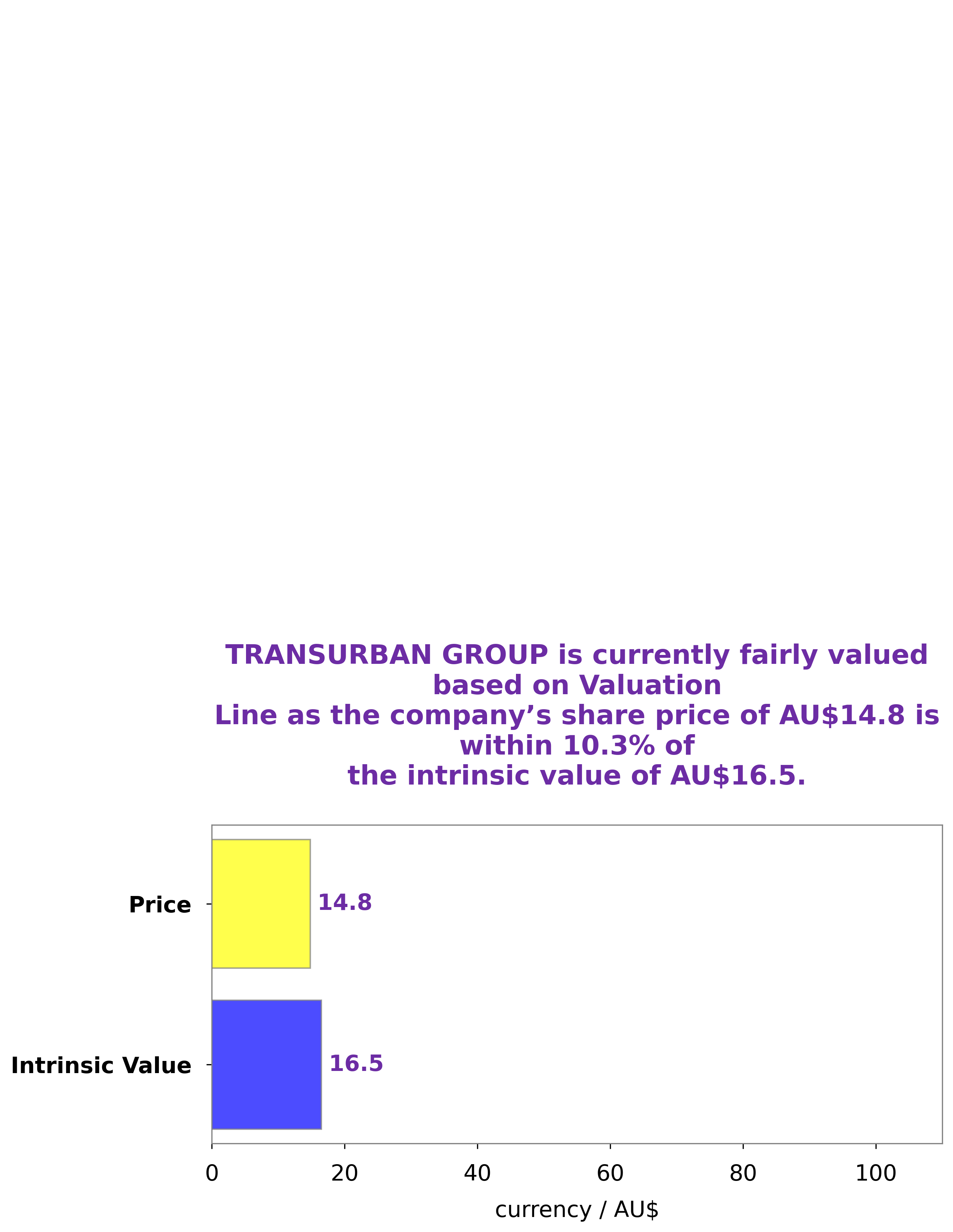

At GoodWhale, we have conducted an analysis of TRANSURBAN GROUP‘s fundamentals and found that the intrinsic value of their shares is around AU$16.5. This value was determined using our proprietary Valuation Line. Currently, TRANSURBAN GROUP stock is trading at AU$14.8, making it a fairly-priced but undervalued option by 10.0%. More…

Peers

Transurban Group competes with a number of companies in the toll road and highway management space, including Atlas Arteria Ltd, Vinci SA, and Jiangsu Expressway Co Ltd. The company has a strong market position and a good track record, but its competitors are also well-established and capable.

– Atlas Arteria Ltd ($ASX:ALX)

Atlas Arteria Ltd is a global investment platform with a focus on infrastructure. The company has a market cap of 9.56B as of 2022 and a Return on Equity of 5.32%. Atlas Arteria’s investment strategy is to target high quality, well-positioned infrastructure assets with long-term, stable cash flows. The company invests across the transportation, social, and utility sectors. Atlas Arteria is headquartered in Sydney, Australia.

– Vinci SA ($OTCPK:VCISY)

Vinci SA is a French construction and concessions company. The company’s market cap as of 2022 is 52.21B. The company’s return on equity is 16.12%. The company’s main businesses are construction, concessions, and energy. The company’s construction business includes the construction of roads, bridges, tunnels, airports, and railway lines. The company’s concessions business includes the operation of airports, motorways, and car parks. The company’s energy business includes the generation and distribution of electricity and gas.

– Jiangsu Expressway Co Ltd ($SHSE:600377)

Jiangsu Expressway Co Ltd is a Chinese expressway operator. The company operates a network of expressways in Jiangsu province, China. As of 2022, the company had a market capitalization of 34.72 billion yuan and a return on equity of 10.96%. The company’s expressway network includes the Nanjing-Qidong Expressway, the Nanjing-Jinghu Expressway, the Suzhou-Jiaxing-Hangzhou Expressway, and the Wuxi-Changxing Expressway.

Summary

Transurban Group, a toll road company, recently had its stock rating downgraded from “Buy” to “Neutral” by Citigroup in a recent research report. This likely indicates that the company’s short-term performance outlook is no longer as strong as it once was. Investors should be aware that this rating change could cause the stock to fluctuate in value significantly in the near future.

Furthermore, potential investors should conduct a careful analysis of the company’s financials and market position before deciding whether or not to invest. Though Transurban Group may not be the most attractive option right now, it could still be a viable choice depending on a thorough assessment of the risks involved.

Recent Posts