Qilu Expressway Reports Lower Earnings for Full Year 2022 with EPS of CN¥0.39

April 1, 2023

Trending News 🌧️

Qilu Expressway ($SEHK:01576), a transportation infrastructure company listed on the Shanghai Stock Exchange, reported a lower Earnings Per Share (EPS) of CN¥0.39 for the Full Year of 2022, which is lower than the EPS of CN¥0.43 during Fiscal Year 2021. It is engaged in the construction, management, and operation of expressways and other related services. The company also provides logistics services, such as express delivery, warehousing and distribution services.

In addition, it is involved in other businesses, including rail transportation, finance, property management, and tourism. Given these results, investors are concerned about the future prospects of Qilu Expressway. With lower EPS for FY 2022 and higher operating expenses in comparison to the previous year, Qilu Expressway is in need of a turnaround strategy to improve its financial performance. The company must work to reduce its operating expenses while increasing revenue in order to ensure its long-term success.

Price History

On Monday, QILU EXPRESSWAY stock opened at HK$2.3 and closed at HK$2.3, up by 0.9% from last closing price of 2.3. This comes after the company released its annual financial results for the year ending 2022, reporting a lower earnings per share of CN¥0.39. Despite the decrease in earnings, QILU EXPRESSWAY’s stock price was still able to rise due to positive investor sentiment. The company’s management team has attributed the decline in earnings to higher expenses associated with increased investments in research and development.

Going forward, QILU EXPRESSWAY is looking to strengthen their core business to further drive growth in the coming years and increase shareholder value. The company is also focusing on cost containment measures to ensure that earnings are maximized. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Qilu Expressway. More…

| Total Revenues | Net Income | Net Margin |

| 2.07k | 850.63 | 40.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Qilu Expressway. More…

| Operations | Investing | Financing |

| 1.21k | -1.65k | 1.22k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Qilu Expressway. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.93k | 3.7k | 2.62 |

Key Ratios Snapshot

Some of the financial key ratios for Qilu Expressway are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.4% | 27.9% | 60.0% |

| FCF Margin | ROE | ROA |

| 26.8% | 18.0% | 8.7% |

Analysis

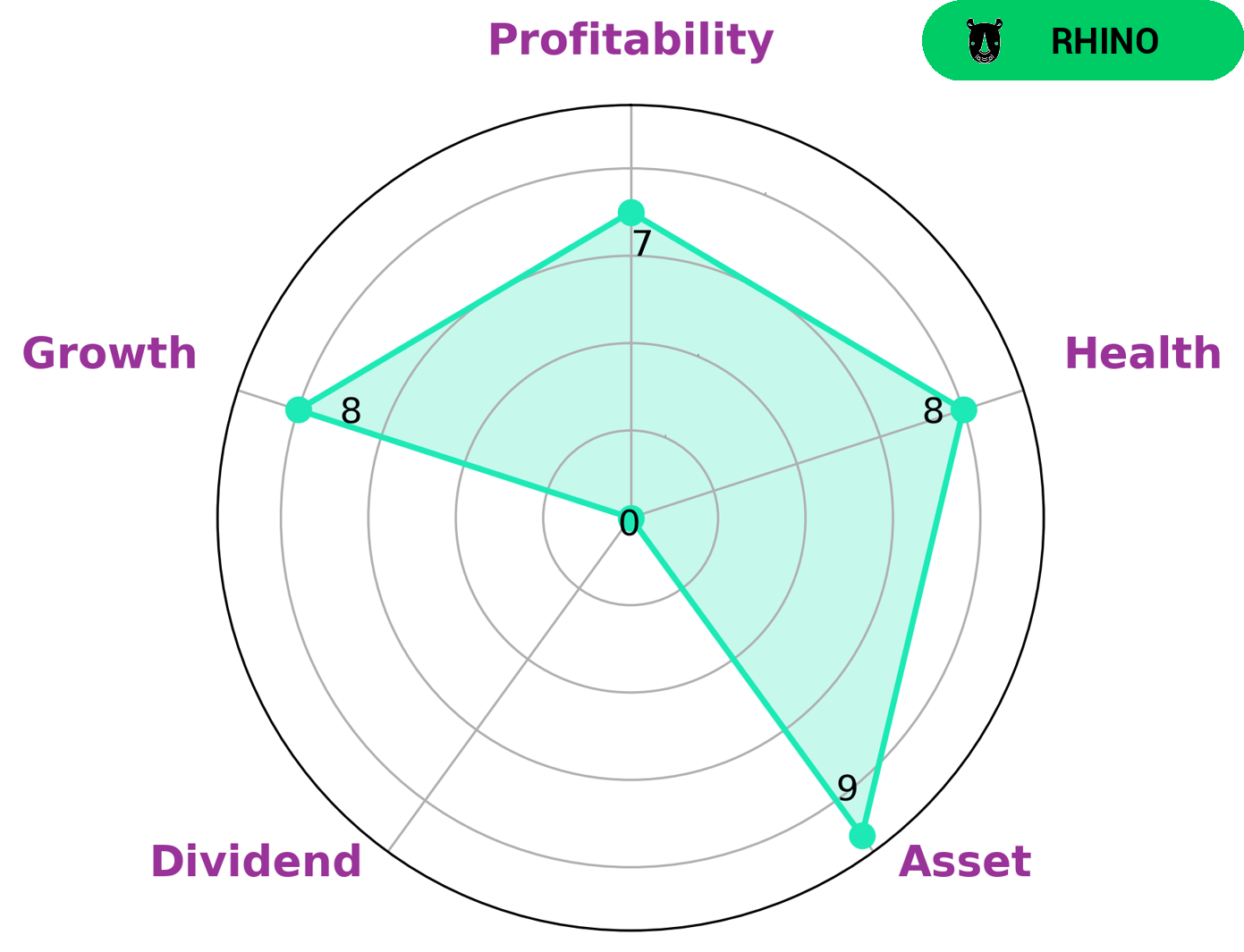

At GoodWhale, we recently conducted an analysis of QILU EXPRESSWAY‘s fundamentals. According to our Star Chart, QILU EXPRESSWAY is strong in asset, growth, and profitability, but relatively weak in dividends. We also evaluated the health score of QILU EXPRESSWAY and found that it scored 8/10 with regard to its cashflows and debt. This indicates that QILU EXPRESSWAY is capable to sustain future operations in times of crisis. Based on our analysis, we have classified QILU EXPRESSWAY as a ‘rhino’, which indicates that the company has achieved moderate revenue or earnings growth. Investors interested in this company may include those who are looking for a stable but moderate source of returns. More…

Peers

The competition between Qilu Expressway Company Ltd and its competitors, Yuexiu Transport Infrastructure Ltd, Dongguan Development (Holdings) Co Ltd, China Resources and Transportation Group Ltd, has become increasingly fierce as they all strive to gain a foothold in the transport infrastructure industry. With each company offering different services and capabilities, it has become an important battleground for them to gain the upper hand in the market.

– Yuexiu Transport Infrastructure Ltd ($SEHK:01052)

Yuexiu Transport Infrastructure Ltd is a Chinese infrastructure and construction company that specializes in the development and construction of transportation infrastructure, including roads, bridges, tunnels, airports, ports and railways. With a market cap of 6.81B as of 2022, the company is one of the leading infrastructure companies in China. In addition, the company has a Return on Equity (ROE) of 14.61%, indicating a higher efficiency in capital management and generating returns for shareholders.

– Dongguan Development (Holdings) Co Ltd ($SZSE:000828)

Dongguan Development (Holdings) Co Ltd is a Chinese holding company that specializes in financial services and investments. As of 2022, the company has a market capitalization of 9.5 billion, making it one of the larger companies in the region. Its return on equity (ROE) stands at 7.32%, indicating that the company is able to generate a healthy return on its assets. The company’s success is largely due to its diversified portfolio of investments and its ability to capitalize on opportunities in the financial services sector.

– China Resources and Transportation Group Ltd ($SEHK:00269)

China Resources and Transportation Group Ltd is a Chinese state-owned enterprise that provides integrated transportation services. The company’s market cap as of 2022 is 106.44M, which is indicative of its overall financial performance. Furthermore, the company has a return on equity of 21.09%, which demonstrates the ability of the company to generate profits from its shareholders’ investments. This suggests that CRT Group’s management is adept at utilizing its assets and capital to generate profits for its shareholders.

Summary

Investors should take note of Qilu Expressway‘s full year 2022 earnings report, which showed a decline in earnings per share (EPS) from CN¥0.43 to CN¥0.39 compared to the previous year. It is important to analyze the underlying reasons for this decline and its potential impact on future profits.

Additionally, investors should carefully consider the company’s longer-term prospects and risk factors when deciding whether to invest. These factors include the potential impact of macroeconomic conditions, government policies, and technological advancements on their operations. Overall, investors should be mindful of their investment decisions and take into account both short-term and long-term risks when investing in Qilu Expressway.

Recent Posts