PARK24 Stock Price Drops 0.5%

January 30, 2023

Trending News 🌥️

PARK24 ($TSE:4666) Co., Ltd. is a publicly traded company on the Tokyo Stock Exchange and is known for its leading car navigation and mobile lifestyle services. Recently, however, the stock price of PARK24 has taken a slight dip, decreasing by 0.5%. The drop in PARK24’s stock price has raised some concern among investors. The company’s performance has been strong in recent months and the drop in the price of its stock has come as a surprise to many. Analysts suggest that the drop in the stock price may be due to the recent market volatility, which has been caused by a number of factors, including rising inflation and the continuing US-China trade war.

Despite the minor drop in the stock price, PARK24’s performance in the past year has been very impressive. Although the stock price of PARK24 has decreased by 0.5%, it is still considered to be a strong investment option and is expected to recover shortly. The company’s long-term prospects remain strong and its diverse product portfolio and innovative services have resulted in consistent growth over the years. Overall, despite the minor dip in its stock price, PARK24 remains a strong investment option and is expected to continue to generate steady returns over the long term.

Market Price

On Thursday, the stock of PARK24 opened at JP¥2056.0, dropped by 0.5%, and closed at JP¥2121.0. Despite the drop in stock price, it was still an increase of 1.7% from the last closing price of JP¥2085.0. The 0.5% drop in stock price of PARK24 may have been due to a variety of factors. The market sentiment may have shifted due to external events, and investors may have adopted a more cautious attitude towards PARK24’s stock. The company’s performance may have also been a factor that led to the drop in stock price.

Despite this decrease in stock price, investors may find it encouraging to note that PARK24’s stock is still up from its last closing price. This could be seen as an indication of the company’s future growth potential and its ability to generate returns for its shareholders. Overall, the 0.5% drop in stock price of PARK24 on Thursday could be a normal market fluctuation or a sign of changing investor sentiment. Whatever the reason, investors should assess the current market sentiment and take into account their own risk tolerance before making any decisions regarding PARK24’s stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Park24. More…

| Total Revenues | Net Income | Net Margin |

| 278.1k | 3.35k | 1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Park24. More…

| Operations | Investing | Financing |

| 26.28k | -13.26k | -18.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Park24. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 316.52k | 274.67k | 245.4 |

Key Ratios Snapshot

Some of the financial key ratios for Park24 are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.1% | -14.4% | 5.1% |

| FCF Margin | ROE | ROA |

| 3.8% | 21.9% | 2.8% |

VI Analysis

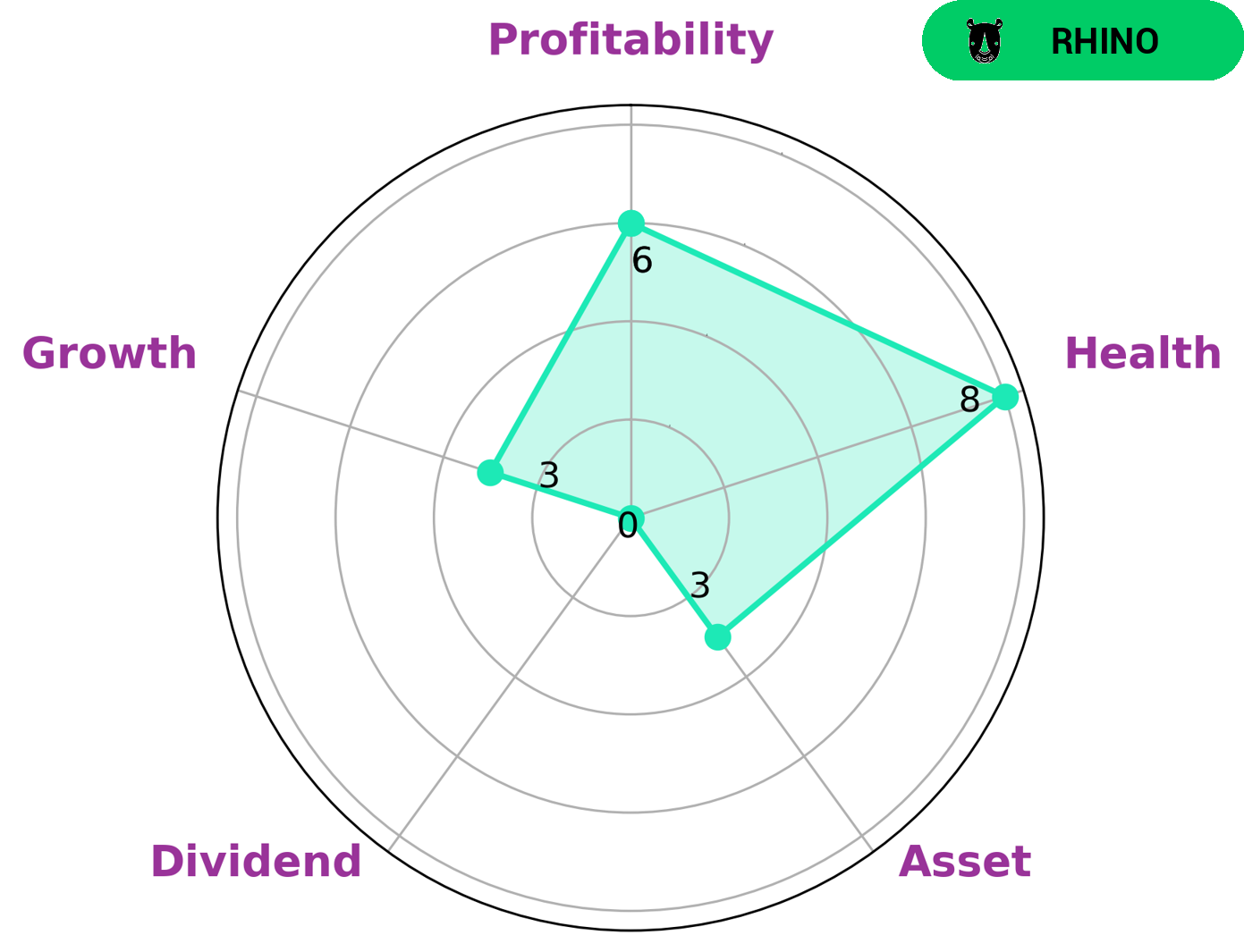

Company fundamentals are a key indicator of a company’s long-term potential and can be used to determine the type of investor who may be interested in it. The VI app simplifies this process by categorizing companies into different types, such as the ‘rhino’. In this case, PARK24 is classified as a ‘rhino’, which denotes moderate revenue or earnings growth. The company also has a high health score of 8/10, indicating that it is capable of paying off debt and funding future operations. This could be a good indication for potential investors who are looking to invest in a company with strong cash flows and debt management. Furthermore, PARK24 has strong liquidity, medium profitability, and weak asset, dividend and growth scores. Overall, these metrics provide an indication of PARK24’s financial performance and long-term potential, allowing investors to make informed decisions about whether to invest in the company or not. With its moderate revenue growth and strong health score, PARK24 may be an attractive investment for investors looking for mid-term returns. More…

VI Peers

It faces stiff competition from Synergetic Auto Performance PCL, Zhejiang Expressway Co Ltd, and Parkd Ltd, all of which are renowned for their innovative automotive technology and products.

– Synergetic Auto Performance PCL ($SET:ASAP)

Synergetic Auto Performance PCL is a global leader in the production of high-performance automotive components. The company’s market cap of 2.45B as of 2023 reflects its position as a leading manufacturer in the industry, with an impressive return on equity of 16.41%. Synergetic Auto Performance PCL produces a wide variety of automotive components, including pistons, cylinder heads, turbochargers, fuel injectors, and other engine components. These components are designed to enhance the performance of vehicles and are used by leading carmakers around the world. The company is committed to providing high-quality products and services that meet the needs of its customers.

– Zhejiang Expressway Co Ltd ($SEHK:00576)

Zhejiang Expressway Co Ltd is a Chinese highway and bridge construction and management company that operates toll roads, bridges, and tunnels. Founded in 1996, the company has grown to become one of the leading expressway operators in the country. As of 2023, the company has a market capitalization of 30.27 billion dollars, reflecting its growing presence in the industry. Additionally, the company has achieved an impressive Return on Equity of 19.8%, indicating that it has been successful in its investments and has a strong business model.

– Parkd Ltd ($ASX:PKD)

Parkd Ltd is a company that provides transportation services and technology solutions. The company has a market cap of 2.14M as of 2023, and a negative Return on Equity of -88.92%. This suggests that the company has been unable to generate profits from its investments, either due to high costs incurred or inefficient management. The market cap of 2.14M indicates that the company is relatively small compared to other companies in the industry.

Summary

Investing in PARK24 can be a risky proposition due to its volatile stock price. In the past few months, the stock has seen a 0.5% drop in value, making it difficult to predict future performance. It is important to do thorough research on the company before investing and understand the risks associated with the stock. Investors should pay attention to the company’s financial reports, market trends, and other economic indicators, as these can provide insight into the future of PARK24 stock.

Additionally, investors should be aware of any news related to the company, such as changes in management or financial performance. Investing in PARK24 can be rewarding but carries a high degree of risk, so it is important to make informed decisions when investing.

Recent Posts