AIG Sells Shares of Verra Mobility Co.

June 12, 2023

☀️Trending News

American International Group Inc. (AIG) recently announced the sale of a portion of their shares of Verra Mobility ($NASDAQ:VRRM) Co. Verra Mobility is a global technology and services provider that is focused on helping government and commercial organizations make roads safer and smarter. This company provides solutions for traffic safety, electronic tolling, violations management, and connected vehicle services.

Additionally, they provide government-based systems that enable agencies to manage their roadways more safely and efficiently. Verra Mobility Co. also offers residential and commercial parking solutions which enable their customers to streamline the process of parking enforcement. This company has developed an array of products and services that are used in cities, towns, airports, universities, and even residential areas. These products and services allow for better management of parking availability and enforcement, as well as better customer service. By selling shares of Verra Mobility Co., AIG looks to further increase their already large presence in the industry. This move is expected to provide them with increased access to the increasingly competitive global market, and will also give them access to new opportunities for growth. With the sale of their shares, AIG further solidifies their position as one of the most influential companies in the industry.

Share Price

On Friday, AIG announced that it has sold all of its shares of VERRA MOBILITY stock. The company’s stock opened at $18.6 and closed at $18.8, a 0.6% increase from its previous closing price. This news came as a surprise to investors, as the recent trading of VERRA MOBILITY stock had not seen any significant fluctuation in price.

This sale of shares by AIG may be indicative of a shift in the company’s investments, or could signal other changes in the near future. Nevertheless, the stock market seemed to take this news in stride, and the stock’s closing price reflected only a minimal increase. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Verra Mobility. More…

| Total Revenues | Net Income | Net Margin |

| 763.12 | 87.01 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Verra Mobility. More…

| Operations | Investing | Financing |

| 232.31 | -56.31 | -202.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Verra Mobility. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.71k | 1.47k | 1.58 |

Key Ratios Snapshot

Some of the financial key ratios for Verra Mobility are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.8% | 20.8% | 26.3% |

| FCF Margin | ROE | ROA |

| 23.2% | 53.5% | 7.3% |

Analysis

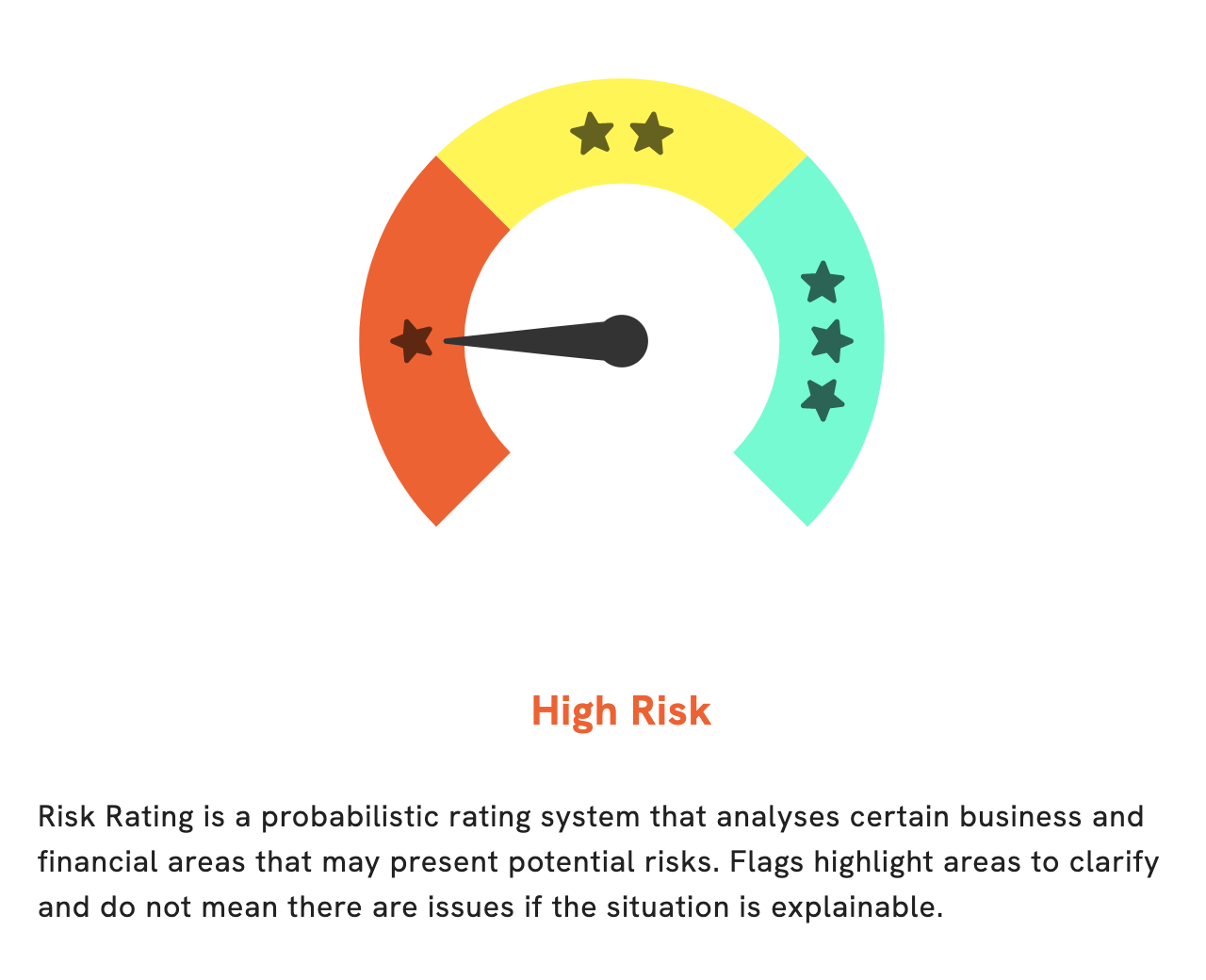

As part of GoodWhale’s service, we analyze the fundamentals of VERRA MOBILITY. Our risk rating shows that it is a high risk investment, both from a financial and business perspective. Our analysis has revealed two risk warnings in the company’s income sheet and balance sheet, which are only visible to registered users. If you’re considering investing in VERRA MOBILITY, it’s important to understand these risks and make an informed decision. We recommend that you become a registered user of GoodWhale to take advantage of our detailed analysis and research. More…

Peers

The competition between Verra Mobility Corp and its competitors is fierce. Each company is striving to be the best in the industry and to provide the best products and services to their customers. Fluor Corp, Shenzhen Genvict Technologies Co Ltd, and ComfortDelGro Corp Ltd are all major players in the transportation industry and are constantly innovating to provide the best possible products and services to their customers.

– Fluor Corp ($NYSE:FLR)

Fluor Corp is a engineering and construction company with a market cap of 4.51B as of 2022. The company has a ROE of 11.56%. Fluor Corp provides engineering, procurement, construction, and project management services to government and commercial clients worldwide.

– Shenzhen Genvict Technologies Co Ltd ($SZSE:002869)

Shenzhen Genvict Technologies Co Ltd is a leading provider of Internet of Things (IoT) solutions. The company has a market cap of 4.06B as of 2022 and a ROE of -3.9%. The company provides IoT solutions for a wide range of industries, including smart cities, transportation, energy, and healthcare. The company’s products and solutions are used by government agencies, enterprises, and consumers in over 100 countries.

– ComfortDelGro Corp Ltd ($SGX:C52)

ComfortDelGro Corp Ltd is a Singapore-based land transport company. The Company’s segments include Buses, Taxi, Rail, Automotive Engineering Services, and Others. It offers a range of services, including bus chartering, bus advertising, bus assembly, and spare parts trading. The Company’s businesses include bus operations in Singapore, taxi operations in Singapore, UK, China and Vietnam, railway operations in Singapore and Australia, automotive engineering services and car rental and leasing operations. ComfortDelGro Corp Ltd has a market cap of 2.86B as of 2022, a Return on Equity of 5.96%. The company’s market capitalization is 2.86B, and its ROE is 5.96%.

Summary

American International Group Inc. recently sold its shares in Verra Mobility Corporation (formerly known as American Traffic Solutions Inc.), a leading provider of connected transportation services that enable the safe and efficient movement of people and goods worldwide. Analysts believe that this move could be beneficial for Verra Mobility’s stock price, as it signals a strong endorsement from AIG. Analysts are generally positive about Verra Mobility’s prospects, citing the company’s strong competitive position in the connected transportation sector and its impressive track record of delivering innovative solutions.

In addition, the company’s expanding customer base, impressive revenue growth, and healthy balance sheet should provide a strong foundation for further growth. For investors looking for a promising long-term investment opportunity in the connected transportation sector, Verra Mobility could be an appealing option.

Recent Posts