Ttec Holdings Intrinsic Value Calculation – TTEC Digital Enhances Google CCAI Platform with Innovative Optics Technology

April 7, 2023

Trending News ☀️

TTEC HOLDINGS ($NASDAQ:TTEC), Inc. is a global provider of customer experience and digital transformation solutions for many of the world’s leading brands. The company offers a wide range of services to ensure their customers receive an exceptional customer experience through digital channels, including online chat, text, social media, and voice. Recently, TTEC Digital has unveiled an innovative optical solution for the Google Cloud Contact Center AI platform. This solution integrates optical recognition technology into existing customer service technology to allow customers to upload pictures of documents that they need help with, giving them a more personalized experience with the customer service process. The integration of optical recognition with Google’s Contact Center AI platform allows customers to quickly and easily upload pictures of important documents to receive assistance from customer service agents.

Additionally, this simplified process streamlines the amount of time it takes for customer service agents to assist customers, as well as increasing accuracy in providing accurate solutions for customers. With this enhanced capability, customer service agents will be able to provide faster and more accurate support to customers, helping to improve their overall customer experience. By providing a quicker and more accurate way of helping customers, customer service agents are now able to provide better solutions faster than ever before. This improved efficiency and accuracy will ultimately benefit customers as they will receive more meaningful responses from customer service agents in a timely manner.

Stock Price

On Wednesday, TTEC HOLDINGS announced the launch of its pioneering optics technology, which enhances Google CCAI Platform. This technology advances the use of artificial intelligence and machine learning, both of which are increasingly pivotal to the digital transformation of many industries. The launch of this technology propelled TTEC HOLDINGS stock on Wednesday, as it opened at $37.2 and closed at $36.7, down by 1.8% from its prior closing price of 37.4. This drop was likely due to the increased competition in the market, as other companies are rapidly embracing artificial intelligence technology to streamline their operations and improve their customer experience.

Nevertheless, TTEC HOLDINGS’s innovative optics technology will likely present lucrative opportunities for the company, as it is expected to further expand into new markets and continue improving its customer service capabilities. As such, investors should remain optimistic about the potential of TTEC HOLDINGS’s technological advancements, as they could lead to further growth in the stock price in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ttec Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.44k | 103.24 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ttec Holdings. More…

| Operations | Investing | Financing |

| 137.05 | -226.2 | 89.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ttec Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.15k | 1.52k | 11.86 |

Key Ratios Snapshot

Some of the financial key ratios for Ttec Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.1% | 13.3% | 7.4% |

| FCF Margin | ROE | ROA |

| 2.2% | 21.1% | 5.2% |

Analysis – Ttec Holdings Intrinsic Value Calculation

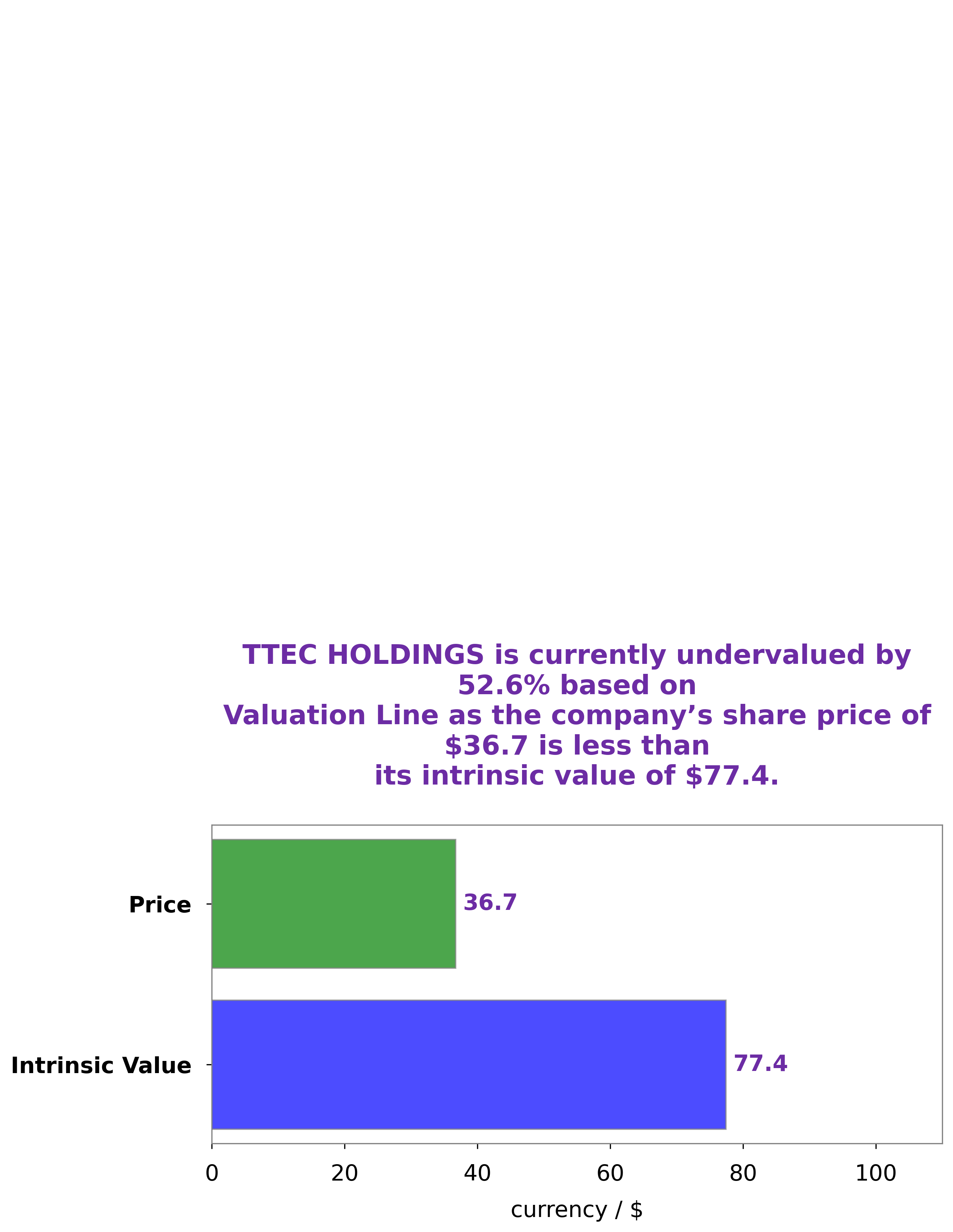

At GoodWhale, we conducted an analysis on the fundamentals of TTEC HOLDINGS. The intrinsic value of the stock was calculated to be around $77.4 by our proprietary Valuation Line. Currently, the stock is traded at $36.7, which is a 52.6% undervaluation. This presents an interesting opportunity for investors to purchase the stock at a discount. We believe that, with the right research and analysis, investors can take advantage of this undervaluation to make a significant return on their investment in the future. More…

Peers

The company offers a suite of digital customer engagement technologies and services that enable clients to manage customer interactions across multiple channels. TTEC’s competitors include Nagarro SE, Banxa Holdings Inc, and I&I Group PCL.

– Nagarro SE ($OTCPK:NGRRF)

Nagarro SE is a global provider of digital transformation solutions. The company has a market cap of 1.3B as of 2022 and a ROE of 37.18%. Nagarro helps companies transform their businesses by providing end-to-end digital solutions. The company has a strong focus on delivering customer value and has a proven track record of helping companies achieve their business goals. Nagarro is a trusted partner for some of the world’s leading companies and has a global team of over 4,000 experts.

– Banxa Holdings Inc ($TSXV:BNXA)

Banxa Holdings Inc is a Canadian company that provides online payment solutions for businesses. Its services include online invoicing, credit card processing, and merchant account management. The company has a market capitalization of 49.19 million as of 2022 and a return on equity of -46.42%. Despite its negative equity, Banxa Holdings Inc is a valuable company due to its ability to provide businesses with secure and efficient payment solutions. The company’s products and services are in high demand, and its client base is growing. Banxa Holdings Inc is a company to watch in the coming years.

– I&I Group PCL ($SET:IIG)

PCL is a leading investment company in Thailand with a market cap of 4.03B as of 2022. It has a strong focus on ROE with a return of 13.91%. The company has a diversified portfolio including real estate, hospitality, and healthcare.

Summary

TTEC Holdings (TTEC) is a provider of customer experience technology and services. The company’s stock has been on an upward trend lately, as they recently announced the launch of their optics for the Google Cloud Contact Center AI platform. This is expected to strengthen TTEC’s position in the customer experience space, leading to increased investor interest. Analysts believe the company will benefit from their improved product offerings, as well as their digital investments.

Additionally, TTEC has been actively investing in their technology solutions, which have enabled them to better meet the growing demands of their clients. With these developments, analysts are optimistic about TTEC’s growth potential and recommend the stock for long-term investments.

Recent Posts