TTEC Holdings Has Room To Grow To Reach Its Potential.

February 12, 2023

Trending News 🌥️

TTEC ($NASDAQ:TTEC) Holdings is a customer experience technology and services company that offers end-to-end solutions for businesses. With its portfolio of solutions, it serves a wide range of clients in many different industries across the globe. Despite this impressive growth, TTEC Holdings still has room to grow to become a highly profitable investment. The company provides a variety of services, including everything from customer engagement and customer journey optimization to digital transformation and analytics. It also offers strategic consulting, training, and managed services that focus on helping businesses provide better customer experiences.

In addition, it has partnerships with leading software providers, helping it offer even more comprehensive solutions. TTEC Holdings focuses on leveraging both its technology and human capital to help its clients create unforgettable customer experiences. Its experienced professionals know how to provide the level of service and support that customers expect when interacting with a business. This, combined with its technological capabilities, provides a powerful combination of tools for businesses to take advantage of. The company is also well-positioned to benefit from the growth in the customer service industry. As customers become more demanding and technology advances, the need for reliable customer service solutions is greater than ever before. TTEC Holdings is well-positioned to fill this need with its wide range of solutions and experienced professionals. As businesses become increasingly reliant on customer service solutions, the demand for TTEC Holdings’ solutions is sure to increase. This will open up new opportunities for the company and create new avenues for growth and profitability.

Stock Price

TTEC HOLDINGS opened on Thursday at $51.2, but closed the day at $49.8, representing a 2.5% decrease from the previous closing price of $51.1. This potential lies in the company’s robust portfolio of products and services that include customer experience, consulting, technology and operations services for some of the world’s most iconic brands.

In addition, the company’s technology-enabled solutions focus on identifying and leveraging customer insights to drive customer loyalty and revenue growth. TTEC HOLDINGS is also well-positioned to capitalize on the current digital transformation trend, as more and more companies are investing in technology to improve customer experience and operations. Through their expertise in digital transformation, TTEC HOLDINGS can provide their clients with the necessary tools to stay ahead of their competition. Moreover, TTEC HOLDINGS is highly profitable and has shown steady growth over the years. These robust financials demonstrate that TTEC HOLDINGS is well-positioned to capitalize on future opportunities. What’s more, the company is well-positioned to capitalize on the tailwinds of the current macroeconomic environment, as companies are likely to outsource more services due to cost savings and efficiency. Overall, TTEC HOLDINGS represents a great investment opportunity with a lot of potential for growth. With its robust portfolio of services and strong financials, the company is well-positioned to capitalize on future opportunities and drive long-term growth for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ttec Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.4k | 109.64 | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ttec Holdings. More…

| Operations | Investing | Financing |

| 195.05 | -226.32 | 68.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ttec Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.16k | 1.58k | 10.76 |

Key Ratios Snapshot

Some of the financial key ratios for Ttec Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.4% | 15.9% | 7.6% |

| FCF Margin | ROE | ROA |

| 4.6% | 21.9% | 5.3% |

Analysis

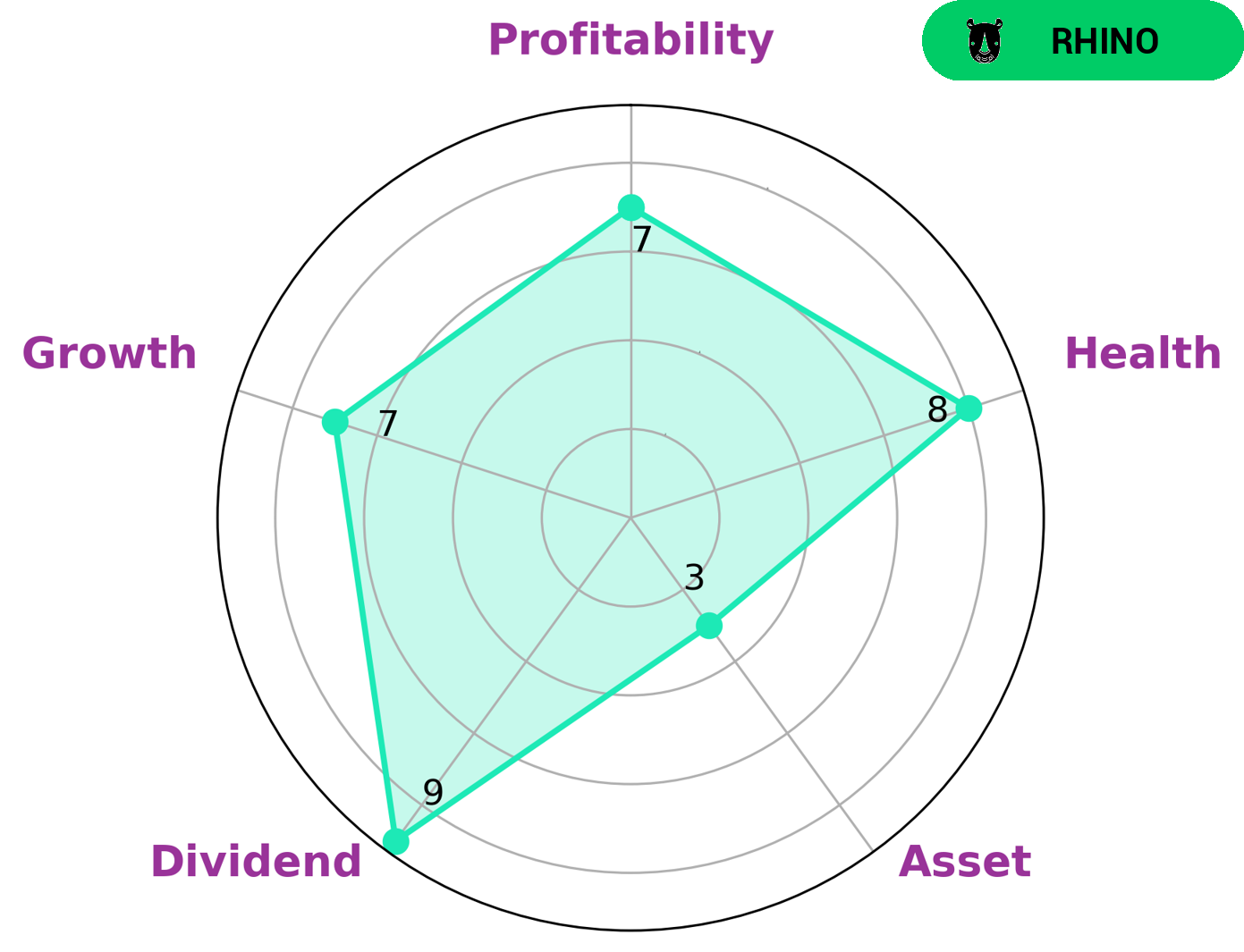

TTEC HOLDINGS is classified as a ‘rhino’ company, which indicates moderate growth in revenues or earnings. This type of company may be attractive to value investors, who look for stocks that are undervalued and offer potential for growth. Investors seeking a regular income can also benefit from TTEC HOLDINGS’ strong dividend yields. Investors looking for growth may be attracted to its moderate growth, as well as its good profitability. On the other hand, the company is weak in terms of assets, which means investors should not expect any asset value appreciation over time. Nevertheless, TTEC HOLDINGS has a high health score of 8/10, which means it is well positioned to handle times of crisis and sustain future operations. For these reasons, TTEC HOLDINGS may be attractive to both value and growth investors. More…

Peers

The company offers a suite of digital customer engagement technologies and services that enable clients to manage customer interactions across multiple channels. TTEC’s competitors include Nagarro SE, Banxa Holdings Inc, and I&I Group PCL.

– Nagarro SE ($OTCPK:NGRRF)

Nagarro SE is a global provider of digital transformation solutions. The company has a market cap of 1.3B as of 2022 and a ROE of 37.18%. Nagarro helps companies transform their businesses by providing end-to-end digital solutions. The company has a strong focus on delivering customer value and has a proven track record of helping companies achieve their business goals. Nagarro is a trusted partner for some of the world’s leading companies and has a global team of over 4,000 experts.

– Banxa Holdings Inc ($TSXV:BNXA)

Banxa Holdings Inc is a Canadian company that provides online payment solutions for businesses. Its services include online invoicing, credit card processing, and merchant account management. The company has a market capitalization of 49.19 million as of 2022 and a return on equity of -46.42%. Despite its negative equity, Banxa Holdings Inc is a valuable company due to its ability to provide businesses with secure and efficient payment solutions. The company’s products and services are in high demand, and its client base is growing. Banxa Holdings Inc is a company to watch in the coming years.

– I&I Group PCL ($SET:IIG)

PCL is a leading investment company in Thailand with a market cap of 4.03B as of 2022. It has a strong focus on ROE with a return of 13.91%. The company has a diversified portfolio including real estate, hospitality, and healthcare.

Summary

TTEC Holdings is an attractive investment option for those looking for growth potential. The company’s fundamentals are strong, with revenue and earnings growth, solid cash flow, and a healthy balance sheet. The stock has been trading at a relatively low price-to-earnings ratio and is well-positioned to benefit from future trends in digital customer experience and workforce solutions. The company has a number of advantages, including its strong brand and extensive product portfolio, as well as its growing presence in the global market.

Furthermore, its expansion plans into digital channels, such as AI-driven customer service, could further improve the company’s competitiveness. With its current fundamentals in place, TTEC Holdings is expected to deliver strong results in the coming years.

Recent Posts