Thoughtworks Holding Reports $0.03 Non-GAAP EPS Miss, Revenue Beats by $2.94M

May 10, 2023

Trending News 🌧️

Thoughtworks Holding ($NASDAQ:TWKS) recently reported their Non-GAAP EPS of $0.03, which was lower than the expected $0.04. Revenue was better than expected, coming in at $307.06M, a beat of $2.94M from the estimated $304.12M. Thoughtworks Holding is an information technology and services company headquartered in London, United Kingdom. It provides software engineering, agile transformation, and product design services to clients across the globe.

Thoughtworks Holding has many notable investments, including investments in start-ups such as Avaamo, CloudZero, and CodeFresh. Thoughtworks Holding is committed to providing innovative and cutting-edge services to its customers, while also promoting corporate responsibility initiatives. With its commitment to remaining at the forefront of technology, Thoughtworks Holding will continue to be an important player in the industry.

Earnings

THOUGHTWORKS HOLDING recently reported their FY2022 Q4 earnings ending December 31 2022, with total revenue reaching $310.74M USD and net income of $16.11M USD. Compared to the previous year, this reflects an 8.3% increase in total revenue and a 145.9% decrease in net income. However, the non-GAAP EPS missed the forecast of $0.03 USD and this has affected the company’s net income significantly. Overall, THOUGHTWORKS HOLDING has reported a positive result in terms of revenue growth, but their non-GAAP EPS miss has taken a toll on their net income for Q4.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Thoughtworks Holding. More…

| Total Revenues | Net Income | Net Margin |

| 1.3k | -105.39 | -7.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Thoughtworks Holding. More…

| Operations | Investing | Financing |

| 89.39 | -93.94 | -175.12 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Thoughtworks Holding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.46k | 683.63 | 2.47 |

Key Ratios Snapshot

Some of the financial key ratios for Thoughtworks Holding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.8% | – | -4.0% |

| FCF Margin | ROE | ROA |

| 5.0% | -4.3% | -2.2% |

Stock Price

Following the announcement, THOUGHTWORKS HOLDING stock opened at $7.1 and closed at $7.8, up by 1.4% from last closing price of 7.6. Despite the miss on earnings, investors were encouraged by the revenue beat and the overall positive performance of the company. Live Quote…

Analysis

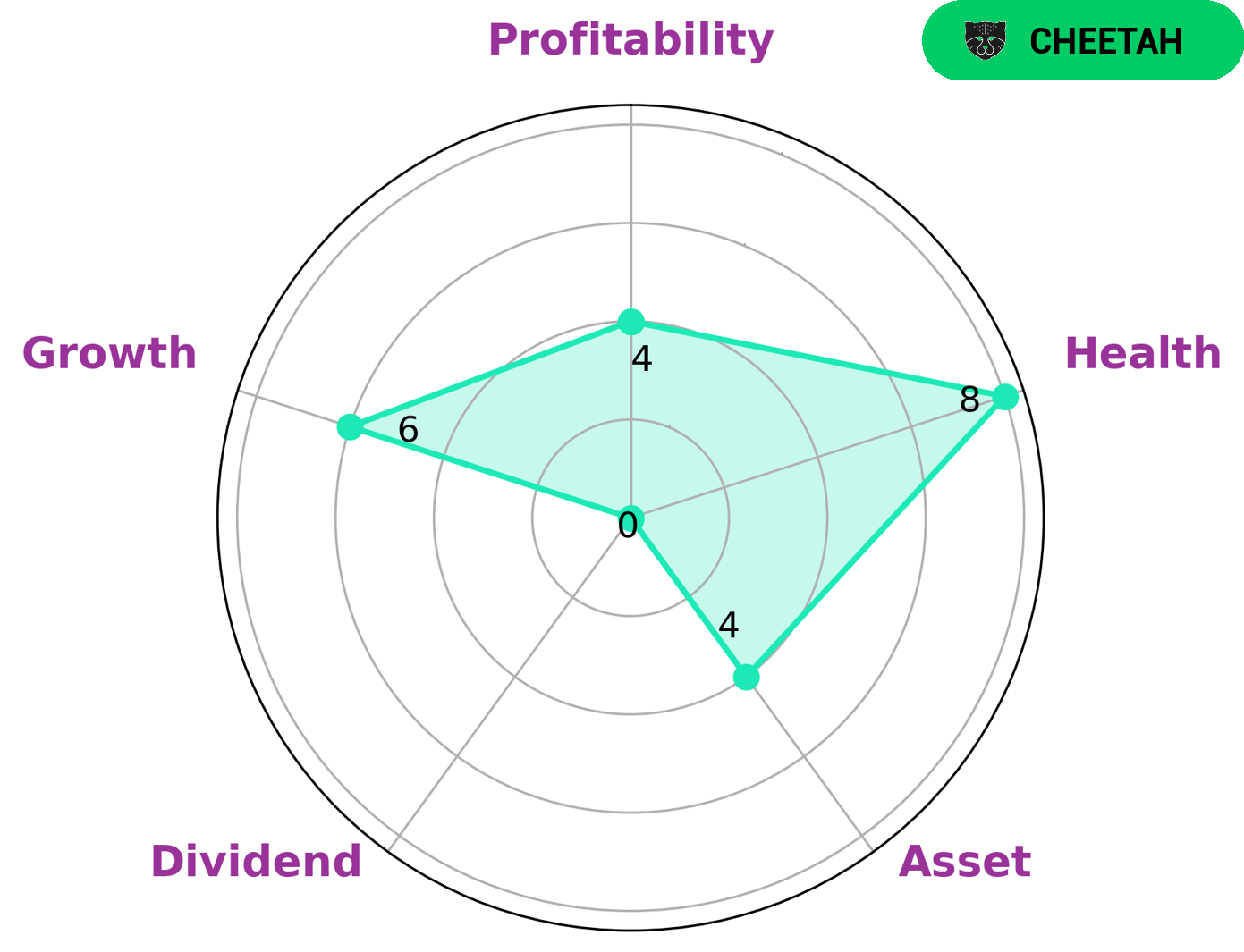

At GoodWhale, we have conducted an analysis of THOUGHTWORKS HOLDING‘s wellbeing. Our Star Chart indicates that THOUGHTWORKS HOLDING has a high health score of 8/10 with regard to its cashflows and debt, further confirming that it is capable to safely ride out any crisis without the risk of bankruptcy. When we look at the other aspects of THOUGHTWORKS HOLDING’s wellbeing, we find that it is strong in asset, medium in growth, profitability and weak in dividend. Based on these results, we can classify THOUGHTWORKS HOLDING as a ‘cheetah’, a type of company we conclude that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the profile of THOUGHTWORKS HOLDING, we can surmise that investors who are looking for higher returns and are willing to take the associated risks would be interested in investing in this company. Risk-averse investors may prefer to look elsewhere. More…

Peers

The competition between Thoughtworks Holding Inc and its competitors, China Crescent Enterprises Inc, Ealixir Inc, and Zhengzhou Jiean Hi-tech Co Ltd, is fierce and ever-evolving. All four companies are vying for market share, pushing each other to innovate and perfect their offerings in order to stay ahead of the competition. With a wide range of services and products on offer, the competition between these companies is sure to be intense.

– China Crescent Enterprises Inc ($OTCPK:CCTR)

Crescent Enterprises Inc is a global conglomerate that operates in multiple industries including engineering, construction, energy, trading, and services. The company’s market cap as of 2022 is 297.74k, indicating the size of the company and its value in the market. Crescent Enterprises Inc also has a Return on Equity of -5.3%, which means its shareholders have not been able to get a good return on their investments in the company. This indicates that the company has not been able to generate sufficient profits to cover its debts and investors have seen a negative return on their investments.

– Ealixir Inc ($OTCPK:EAXR)

Ealixir Inc is a technology-driven company that specializes in providing innovative solutions to the healthcare sector. The company has a market cap of 324.74M as of 2022, indicating it has a strong presence in the industry. Ealixir Inc’s Return on Equity (ROE) stands at 86.89%, indicating that it generates significant returns for its shareholders. This high ROE is indicative of the company’s strong performance and its ability to efficiently utilize its resources to generate revenue. The company’s strong financials, combined with its innovative offerings, make it an attractive investment for potential investors.

– Zhengzhou Jiean Hi-tech Co Ltd ($SZSE:300845)

Zhengzhou Jiean Hi-tech Co Ltd is a Chinese company that specializes in the research and development, production, and sale of optical communication products and other related products. The company has a market capitalization of 2.09 billion as of the year 2022, indicating that it is a large, successful enterprise. In addition, the company has a Return on Equity of 3.34%, suggesting that the company is making a healthy profit and generating positive returns for its shareholders. This shows that the company is well managed and is likely to continue to grow in the future.

Summary

Revenue of $307.06M was higher than expected and represented an increase from the same quarter last year. The company’s non-GAAP earnings-per-share of $0.03 was lower than the analyst consensus, but cost management and higher revenue helped the company post stronger overall financial results. Investors may want to pay attention to Thoughtworks Holding’s financial results to get a better understanding of its progress and prospects.

Recent Posts