Quadrature Capital Ltd Invests in Leidos Holdings, for 2023

March 14, 2023

Trending News 🌥️

Quadrature Capital Ltd has recently announced an investment in Leidos Holdings ($NYSE:LDOS), Inc. for the year 2023. This move marks a shift of momentum for the company and signifies their commitment to the future of the industry. Leidos Holdings, Inc. is a leading engineering, science and technology solutions provider that focuses on global security and resilience. The company boasts an impressive portfolio of innovative products and services. Through this investment, Quadrature Capital Ltd is ready to help Leidos Holdings, Inc. reach its full potential and become a leader in the industry. They have a strong track record of delivering mission-critical solutions to government, commercial and international customers.

Their portfolio includes aerospace, defense, healthcare, logistics and IT services as well as data analytics, artificial intelligence and machine learning, cyber security and robotics. With Quadrature Capital Ltd’s help, Leidos Holdings, Inc. will be able to continue to expand its reach and capabilities in these areas. Quadrature Capital Ltd is eager to help Leidos Holdings, Inc. expand its capabilities in the engineering, science and technology sectors as well as assist in developing new and innovative products and services that will better serve their customers. Meanwhile, Leidos Holdings, Inc. will gain access to new resources for research and development that can help it remain competitive in the ever-changing landscape of engineering, science and technology solutions. With this investment, both Quadrature Capital Ltd and Leidos Holdings, Inc. are poised to make a positive impact on the industry.

Share Price

On Monday, Leidos Holdings stock opened at $92.0 and closed at $92.2, a decrease of 0.3% from its closing price of $92.5 the previous day. This decline was minor, and the overall market outlook for Leidos Holdings remains largely positive. Investors in Quadrature Capital Ltd’s decision to invest in Leidos Holdings should remain confident in the potential for the company’s long-term growth going into the new year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Leidos Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 14.4k | 685 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Leidos Holdings. More…

| Operations | Investing | Financing |

| 986 | -313 | -865 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Leidos Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.07k | 8.72k | 31.38 |

Key Ratios Snapshot

Some of the financial key ratios for Leidos Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 9.7% | 7.5% |

| FCF Margin | ROE | ROA |

| 6.0% | 16.2% | 5.2% |

Analysis

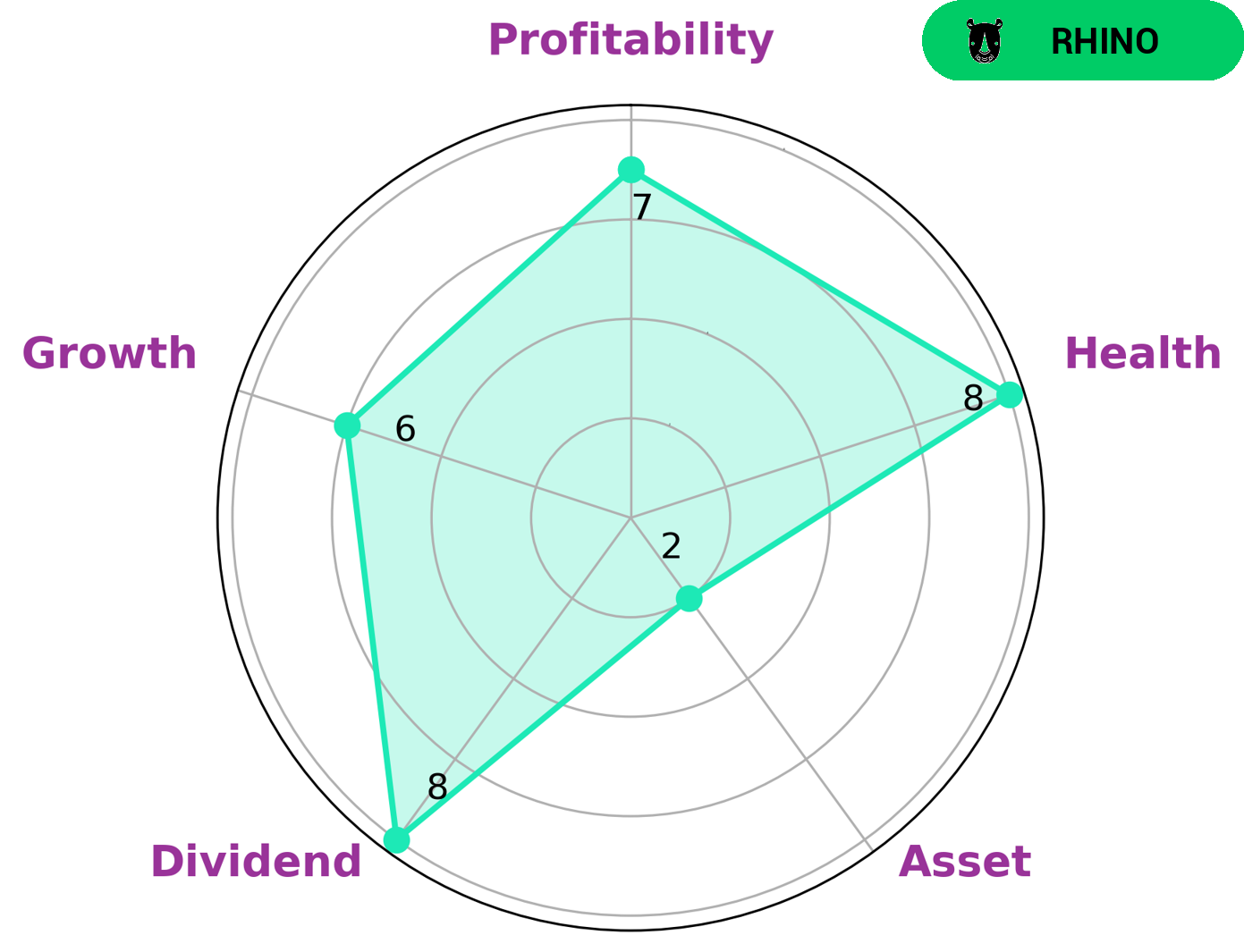

GoodWhale recently conducted an in-depth analysis of LEIDOS HOLDINGS‘s financials. According to our Star Chart, LEIDOS HOLDINGS is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Since LEIDOS HOLDINGS has a high health score of 8/10 considering its cashflows and debt, it is capable to pay off debt and fund future operations. It is also strong in dividend and profitability, medium in growth and weak in asset. Given these characteristics, investors who are looking for a steady and reliable source of income may be interested in such company. Those investors that are aiming for high capital gains may not be as interested. More…

Peers

Leidos Holdings Inc is an American technology company that provides products and services for the national security, health, and engineering sectors. The company operates in three segments: National Security Solutions, Health Solutions, and Engineering Solutions. Leidos Holdings Inc’s competitors include Vama Industries Ltd, STS Evermedia Corp, and Societe Pour L’Informatique Industrielle.

– Vama Industries Ltd ($BSE:512175)

Vama Industries Ltd is an Indian company that manufactures automotive components and parts. It has a market cap of 370.93M as of 2022 and a Return on Equity of 3.33%. The company was founded in 1963 and is headquartered in Mumbai, India. Vama Industries Ltd manufactures a variety of automotive components and parts, including engine parts, suspension parts, and electrical parts.

– STS Evermedia Corp ($OTCPK:SEVM)

Societe Pour L’Informatique Industrielle is a France-based company that provides software solutions and services for industrial applications. The Company operates in three segments: Software Solutions, Services and Maintenance, and Hardware. The Software Solutions segment offers software products, including design and development tools, manufacturing execution systems, and industrial connectivity solutions. The Services and Maintenance segment provides services, such as consulting, training, and support, as well as maintenance and support services for software products. The Hardware segment offers hardware products, such as programmable logic controllers, human machine interfaces, and industrial PCs.

Summary

Leidos Holdings, Inc. is a diversified technology and engineering company that provides innovative solutions in national security, health, and infrastructure. Quadrature Capital Ltd has recently invested in the company for 2023. Analysts have mostly viewed the move positively. Recent financials suggest that Leidos is well-positioned to benefit from increased demand in its core markets. The company has seen consistent revenue growth in the past years and a healthy gross margin rate. It has also kept its debt burden low, resulting in a strong cash balance.

Additionally, Leidos has been actively investing in research and development to stay ahead of the curve. Going forward, the company is likely to continue benefiting from favorable market conditions, especially in the defense sector, providing investors with an attractive opportunity for long-term returns.

Recent Posts