Parsons Corporation to Lead MoDOT’s Replacement of Chester Bridge

April 19, 2023

Trending News 🌥️

Parsons ($NYSE:PSN), a publicly traded engineering and construction company, specializes in delivering efficient and innovative solutions to government and private sector clients. Parsons’ design and construction team is uniquely suited for the Chester Bridge project, having completed several similar projects in the past. Their work includes successful completion of multiple bridges in the St. Louis area, as well as a variety of other infrastructure projects.

In addition, Parsons is renowned for their commitment to safety and quality. They are dedicated to delivering projects on time and on budget, making them an ideal partner for MoDOT. The Chester Bridge replacement project is a significant undertaking for MoDOT and Parsons. It will require a great deal of collaboration and coordination between numerous stakeholders. Parsons’ experience in the field and commitment to excellence will no doubt be a major asset throughout the duration of the project. The team at Parsons is already hard at work planning and coordinating the project, and they look forward to the successful completion of the project.

Share Price

The Parsons Corporation has been awarded a contract to lead the replacement of the Chester Bridge in Missouri by the Missouri Department of Transportation (MoDOT). This project is part of MoDOT’s year-long initiative to improve bridges and roadways throughout the state. The Parsons Corporation is being tasked with providing engineering and construction management services for the bridge replacement.

To mark this milestone, the Parsons Corporation’s stock opened at $46.3 on Tuesday and closed at $46.4, up by 0.4% from its previous closing price of 46.3. This is a reflection of the strong foundation and trust that the Parsons Corporation has built with both private and public sector clients, and is an indication of their success as an engineering and construction services provider. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Parsons Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 4.2k | 96.66 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Parsons Corporation. More…

| Operations | Investing | Financing |

| 237.53 | -417.47 | 100.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Parsons Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.2k | 2.1k | 19.52 |

Key Ratios Snapshot

Some of the financial key ratios for Parsons Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | 49.8% | 4.5% |

| FCF Margin | ROE | ROA |

| 4.9% | 5.9% | 2.8% |

Analysis

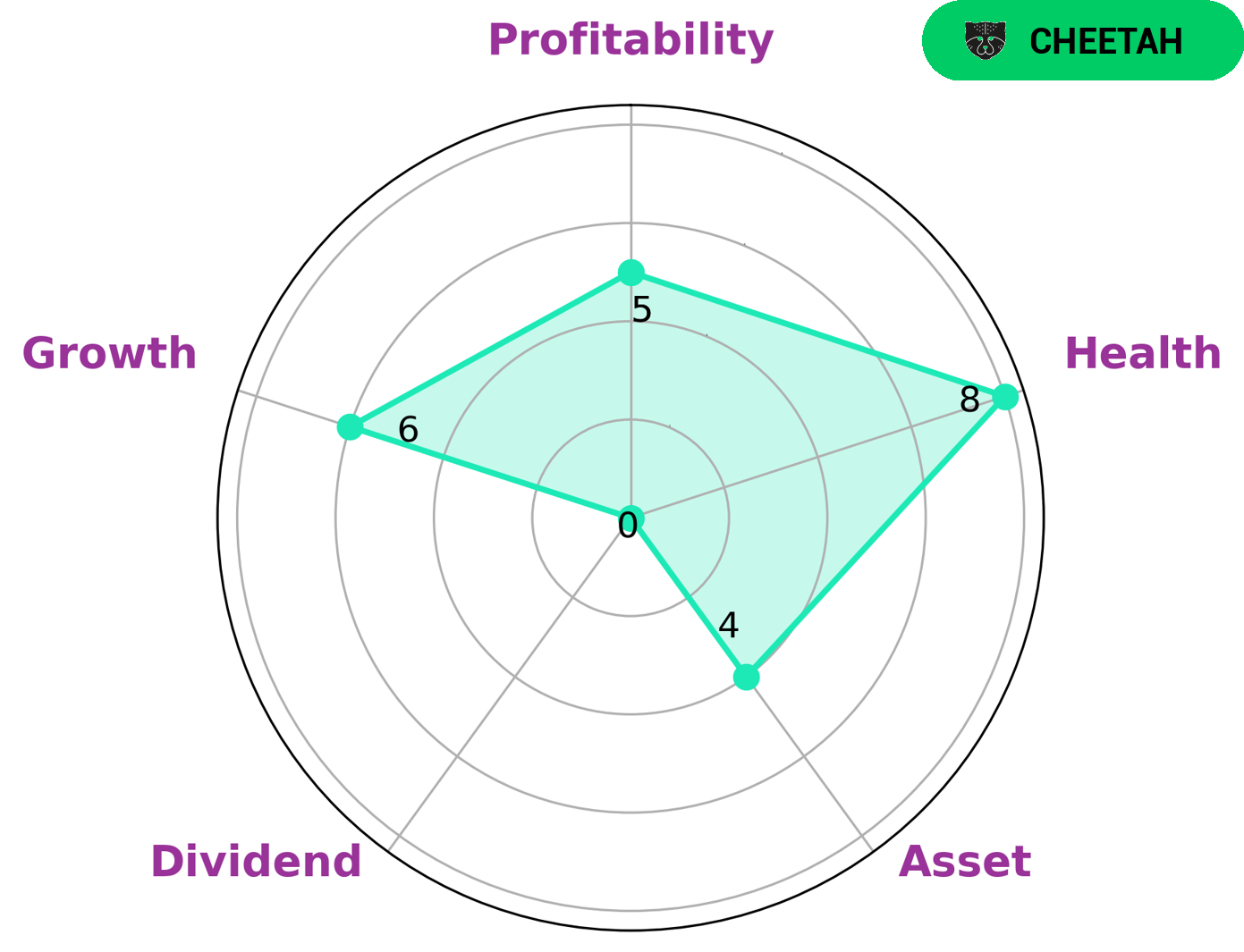

GoodWhale’s analysis of PARSONS CORPORATION‘s fundamentals suggests that the company is strong in asset, growth, profitability, and weak in dividend, according to our Star Chart. PARSONS CORPORATION’s health score is 8/10, which is higher than average, indicating that it is capable of paying off debt and funding future operations. Our findings also classify PARSONS CORPORATION as a ‘Cheetah’ type of company. That is to say, it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. These characteristics may make PARSONS CORPORATION a good investment for those investors who are looking for higher-growth opportunities with a bit of risk. Investors who are comfortable with such a risk-return combination may be interested in PARSONS CORPORATION as an investment option. More…

Peers

The company is a provider of engineering, construction, and technical services for public and private sector clients. Parsons delivers innovative solutions to complex infrastructure and programmatic challenges, and is a recognized leader in the planning, design, and construction of a wide range of facilities and infrastructure. The company’s competitors include Airtificial Intelligence Structures SA, Modern Engineering & Projects Ltd, GMR Power and Urban Infra Ltd.

– Airtificial Intelligence Structures SA ($OTCPK:AITLF)

Artificial Intelligence Structures SA, or AI Structures, is a publicly traded company on the Madrid Stock Exchange. As of 2022, AI Structures has a market capitalization of €69.19 million and a return on equity of -7.34%. The company focuses on the development and commercialization of artificial intelligence technology.

– Modern Engineering & Projects Ltd ($BSE:539762)

Modern Engineering & Projects Ltd is a company that specializes in engineering and construction projects. The company has a market cap of 73.54M as of 2022 and a Return on Equity of -2211.89%. Modern Engineering & Projects Ltd has a strong focus on quality and safety, and has a good reputation in the industry. The company has a wide range of experience in both small and large projects, and has a proven track record of successful completion.

– GMR Power and Urban Infra Ltd ($BSE:543490)

GMR Power and Urban Infra Ltd has a market cap of 15.21B as of 2022, a Return on Equity of -54.42%. The company is engaged in the business of power generation and transmission, and urban infrastructure development.

Summary

Parsons Corporation is an engineering and technology company specializing in a broad range of markets, including defense, intelligence, infrastructure, and energy. The company is an attractive investment opportunity given its strong financial standing, solid balance sheet, and past performance. Through its strong reputation, the company is well-positioned to take on larger projects, resulting in better returns for investors. The company has a well diversified portfolio of projects, ranging from bridge and highway construction to power plant design and construction.

Additionally, the company has also undertaken innovative projects in the fields of clean water technology and energy efficiency. Furthermore, its experienced management team has been successful in managing large-scale projects efficiently and on budget. Overall, Parsons Corporation is an appealing investment opportunity for those looking for long-term growth potential.

Recent Posts