Parsons Corporation Stock Fair Value Calculator – HighTower Advisors LLC Decreases Stake in Parsons Co. by 14.9% in Q4

June 12, 2023

🌥️Trending News

Parsons Corporation ($NYSE:PSN) is a diversified technology, engineering, and construction services provider with strong capabilities in the defense, intelligence, and critical infrastructure sectors. The recent 13F filing with the Securities and Exchange Commission (SEC) indicates that HighTower Advisors LLC has decreased its stake in Parsons Co. by 14.9%. However, despite the decreased investor interest, Parsons Co. continues to be a leader in providing cutting-edge services and solutions to its government and commercial clients around the world.

Analysis – Parsons Corporation Stock Fair Value Calculator

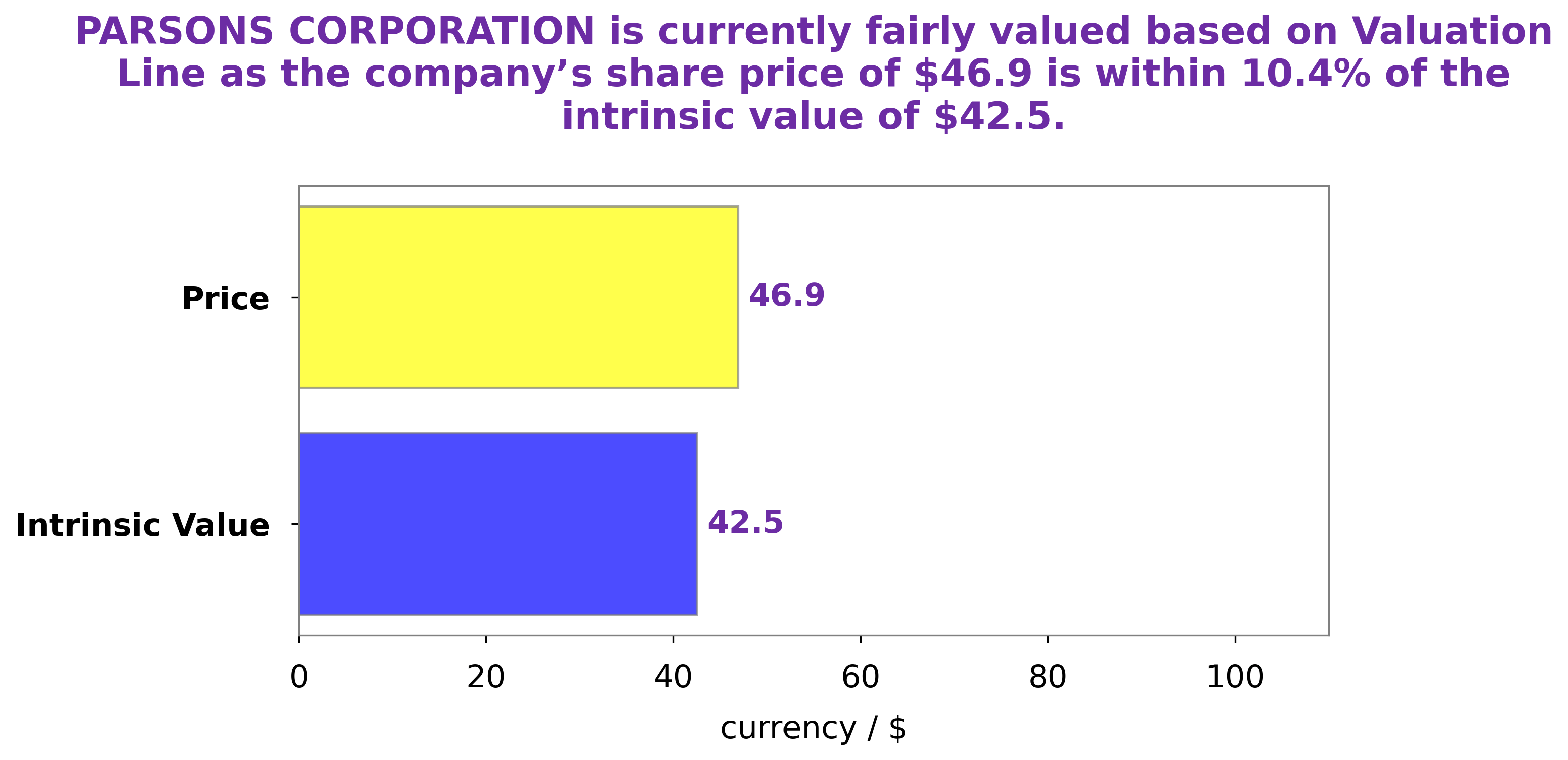

At GoodWhale, we’ve been analyzing the financials of PARSONS CORPORATION and have found that the intrinsic value of its share is around $42.5, calculated by our proprietary Valuation Line. With this in mind, investors can make an informed decision on whether to buy or hold their existing shares. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Parsons Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 4.42k | 101.55 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Parsons Corporation. More…

| Operations | Investing | Financing |

| 254.25 | -424.8 | 106.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Parsons Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.26k | 2.13k | 19.52 |

Key Ratios Snapshot

Some of the financial key ratios for Parsons Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | 52.5% | 4.7% |

| FCF Margin | ROE | ROA |

| 5.0% | 6.3% | 3.0% |

Peers

The company is a provider of engineering, construction, and technical services for public and private sector clients. Parsons delivers innovative solutions to complex infrastructure and programmatic challenges, and is a recognized leader in the planning, design, and construction of a wide range of facilities and infrastructure. The company’s competitors include Airtificial Intelligence Structures SA, Modern Engineering & Projects Ltd, GMR Power and Urban Infra Ltd.

– Airtificial Intelligence Structures SA ($OTCPK:AITLF)

Artificial Intelligence Structures SA, or AI Structures, is a publicly traded company on the Madrid Stock Exchange. As of 2022, AI Structures has a market capitalization of €69.19 million and a return on equity of -7.34%. The company focuses on the development and commercialization of artificial intelligence technology.

– Modern Engineering & Projects Ltd ($BSE:539762)

Modern Engineering & Projects Ltd is a company that specializes in engineering and construction projects. The company has a market cap of 73.54M as of 2022 and a Return on Equity of -2211.89%. Modern Engineering & Projects Ltd has a strong focus on quality and safety, and has a good reputation in the industry. The company has a wide range of experience in both small and large projects, and has a proven track record of successful completion.

– GMR Power and Urban Infra Ltd ($BSE:543490)

GMR Power and Urban Infra Ltd has a market cap of 15.21B as of 2022, a Return on Equity of -54.42%. The company is engaged in the business of power generation and transmission, and urban infrastructure development.

Summary

Parsons Corporation is a publicly traded technology-driven engineering services provider focused on delivering mission-critical projects across a range of industries. This is significant as it suggests that this investment firm does not have faith in the company’s performance and may be expecting a decrease in share prices in the near future. Investors should monitor Parsons Corporation carefully to assess the impact of these developments before making any decisions about buying or selling its stock.

Recent Posts