N-ABLE Sees Decline in Short Interest of 9.0%

January 15, 2023

Trending News ☀️

N-ABLE ($NYSE:NABL) is a publicly traded company that focuses on providing technology solutions to help organizations excel in their respective industries. It has experienced tremendous growth since its inception and is now listed on the New York Stock Exchange. Recently, N-ABLE has seen a decline in short interest of 9.0%. Short interest is a measure of the amount of a company’s stock that investors are shorting, or betting against. Shorting is a way for investors to make money if the stock price of a company goes down. When short interest in a company declines, it usually suggests that investors are becoming more bullish on the company’s prospects. The decline in N-ABLE’s short interest could be a sign that investors are beginning to have more faith in the company’s future performance. N-ABLE has been investing heavily in research and development, and they have also been expanding their offerings to reach more customers.

This could be why investors are starting to become more confident in the company’s future prospects. The decline in short interest could also be a sign that traders are becoming less bearish on N-ABLE’s stock. Traders often use shorting as a way to hedge their positions, so if they start to believe that the stock will go up, they may close their positions and take their profits. In any case, the decline in N-ABLE’s short interest is certainly good news for the company and its stockholders. It suggests that investors are becoming more optimistic about the company’s future and that traders are taking fewer positions against N-ABLE’s stock. This could lead to increased demand for the stock and higher prices in the future.

Price History

N-ABLE recently experienced a 9.0% decline in short interest, which is an indicator of how much investors are betting against the company. Since its emergence, media exposure of N-ABLE has mainly been positive. On Monday, the stock opened at $10.2 and closed at $10.0, representing a 0.1% decrease from the previous closing price of 10.0. Although this decrease is minimal, it raises some questions about the company’s ability to maintain a positive outlook. Short interest of 9.0% could indicate that investors are less optimistic about the company’s future performance, which could lead to more downward pressure on the stock price. This could be due to a few factors such as a lack of new products or services, or disappointing earnings reports.

However, investors should take into consideration that short interest may also decrease if the company is doing better than expected and optimism builds amongst investors. In order to make a sound investment decision, investors should consider the amount of short interest in N-ABLE and compare it to other companies in the same sector. It is also important to look at other indicators such as earnings reports, analyst ratings, and market sentiment. Furthermore, investors should do their own research and evaluate the company’s fundamentals before making any investment decisions. If done properly, investors can make informed decisions about whether or not to invest in N-ABLE. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for N-able. More…

| Total Revenues | Net Income | Net Margin |

| 365.52 | 11.78 | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for N-able. More…

| Operations | Investing | Financing |

| 72.2 | -35.01 | -9.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for N-able. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.03k | 437.32 | 3.29 |

Key Ratios Snapshot

Some of the financial key ratios for N-able are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.9% | 21.1% | 11.3% |

| FCF Margin | ROE | ROA |

| 12.7% | 4.3% | 2.5% |

VI Analysis

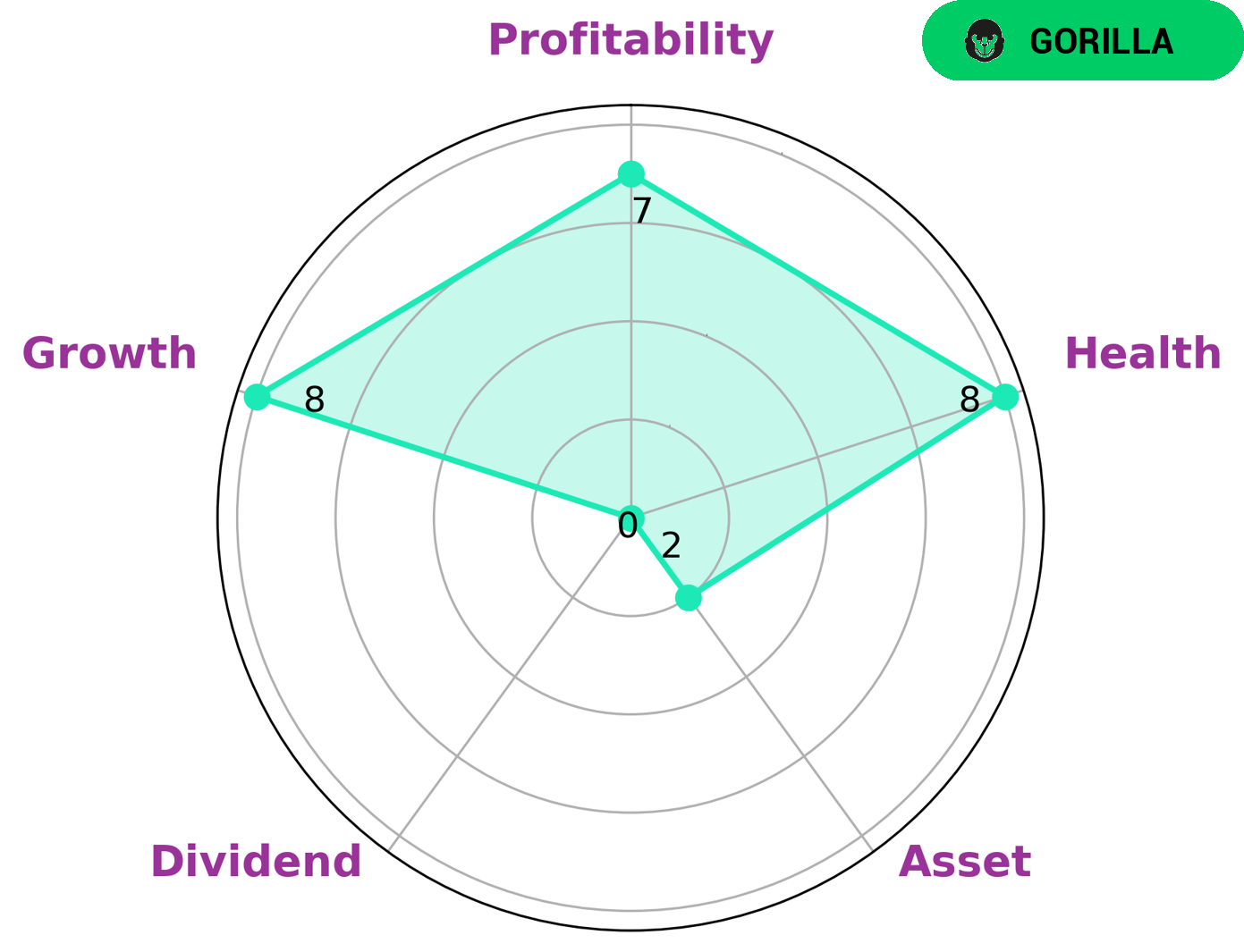

The VI app provides a simple analysis of N-ABLE, indicating that it has a high health score of 8/10 with regard to its cashflows and debt, which makes it capable of riding out any crisis without the risk of bankruptcy. N-ABLE is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for long-term growth should be interested in N-ABLE due to its strong fundamentals and financial stability. N-ABLE is very strong in terms of growth and profitability, but weak when it comes to assets and dividends. This means that N-ABLE could be a great option for investors who are looking for long-term growth opportunities, but not necessarily expecting immediate returns. Investors should also keep in mind that although N-ABLE has strong fundamentals, investing in any company always involves some risk. More…

VI Peers

In the market for customer relations management (CRM) software, N-able Inc faces stiff competition from Coveo Solutions Inc, BigBear.ai Holdings Inc, and Pushpay Holdings Ltd. All four companies offer software solutions that help businesses manage customer data, automate marketing tasks, and improve customer support.

– Coveo Solutions Inc ($TSX:CVO)

Coveo Solutions Inc is a software company that specializes in search and analytics. The company has a market cap of 561.87M as of 2022 and a return on equity of 59.41%. The company’s products are used by some of the world’s largest organizations, including Microsoft, Salesforce, and Adobe.

– BigBear.ai Holdings Inc ($NYSE:BBAI)

BigBear.ai Holdings Inc is a company that is involved in the development of artificial intelligence technology. The company has a market capitalization of 140.15 million as of 2022. The company’s return on equity is -405.49%.

– Pushpay Holdings Ltd ($NZSE:PPH)

With a market cap of $1.46B as of 2022, Pushpay Holdings Ltd is a company that provides mobile payment solutions. Its Return on Equity (ROE) is 18.56%.

Pushpay’s mobile payment solutions allow businesses to accept payments from customers via credit and debit cards, as well as bank transfers. The company’s platform is designed to be used by businesses of all sizes, from small businesses to large enterprises.

Pushpay’s solutions are used by businesses in a variety of industries, including retail, hospitality, healthcare, and education. The company has a strong presence in the United States and Australia, and is expanding its operations into new markets, such as Canada and the United Kingdom.

Summary

Investors in N-ABLE have seen a recent decline in short interest of 9.0%. This suggests that investors may be feeling more confident in the company’s prospects, as less investors are betting against it. This could be indicative of a bullish outlook, as media exposure to the company has been largely positive. Therefore, it may be worth considering investing in N-ABLE as a potential growth opportunity.

Recent Posts