N-able Releases First ESG Report, Demonstrates Commitment to Innovation in IT Services

May 5, 2023

Trending News ☀️

N-able ($NYSE:NABL), Inc., a global software company specializing in IT services for remote monitoring and management, data protection as-a-service, and other IT solutions, has released its first Environmental, Social and Governance (ESG) Report. This demonstrates the company’s commitment to innovation in its services and products, as well as its dedication to creating a positive impact on society and the environment. Its comprehensive platform enables service providers to automate tasks, manage IT service delivery, and more. The ESG Report is the first of its kind, providing a comprehensive look into the company’s commitments to sustainability, social responsibility, and corporate governance.

In the report, N-ABLE outlines the measures it has taken to reduce its emissions and water consumption, increase employee engagement and diversity, and practice ethical corporate governance. The report also provides an overview of the company’s commitment to philanthropy, with donations and support of causes such as education, technology research, and natural disaster relief. Through its dedication to environmental, social and corporate responsibility, N-ABLE continues to set the example for other software companies to follow.

Price History

Following the release of the report, N-ABLE stock opened at $12.4 and closed at $12.4, up by 0.2% from its closing price of 12.4 the previous day. The ESG report outlines N-ABLE’s dedication to sustainability, transparency, and ethical practices in their delivery of services. The report also includes details of their use of technology to provide services in a cost-effective and efficient way, as well as how they strive to provide the highest quality products for their clientele.

Furthermore, N-ABLE is committed to upholding their corporate social responsibility and understanding the environmental impact of their operations. N-ABLE’s ESG report provides assurance that the company is taking proactive steps to ensure the long-term success and growth of their IT services while also protecting the environment and contributing to society. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for N-able. More…

| Total Revenues | Net Income | Net Margin |

| 371.77 | 16.71 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for N-able. More…

| Operations | Investing | Financing |

| 71.41 | -30.21 | -10.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for N-able. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 436.79 | 3.55 |

Key Ratios Snapshot

Some of the financial key ratios for N-able are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.2% | 9.0% | 13.3% |

| FCF Margin | ROE | ROA |

| 13.6% | 5.0% | 2.9% |

Analysis

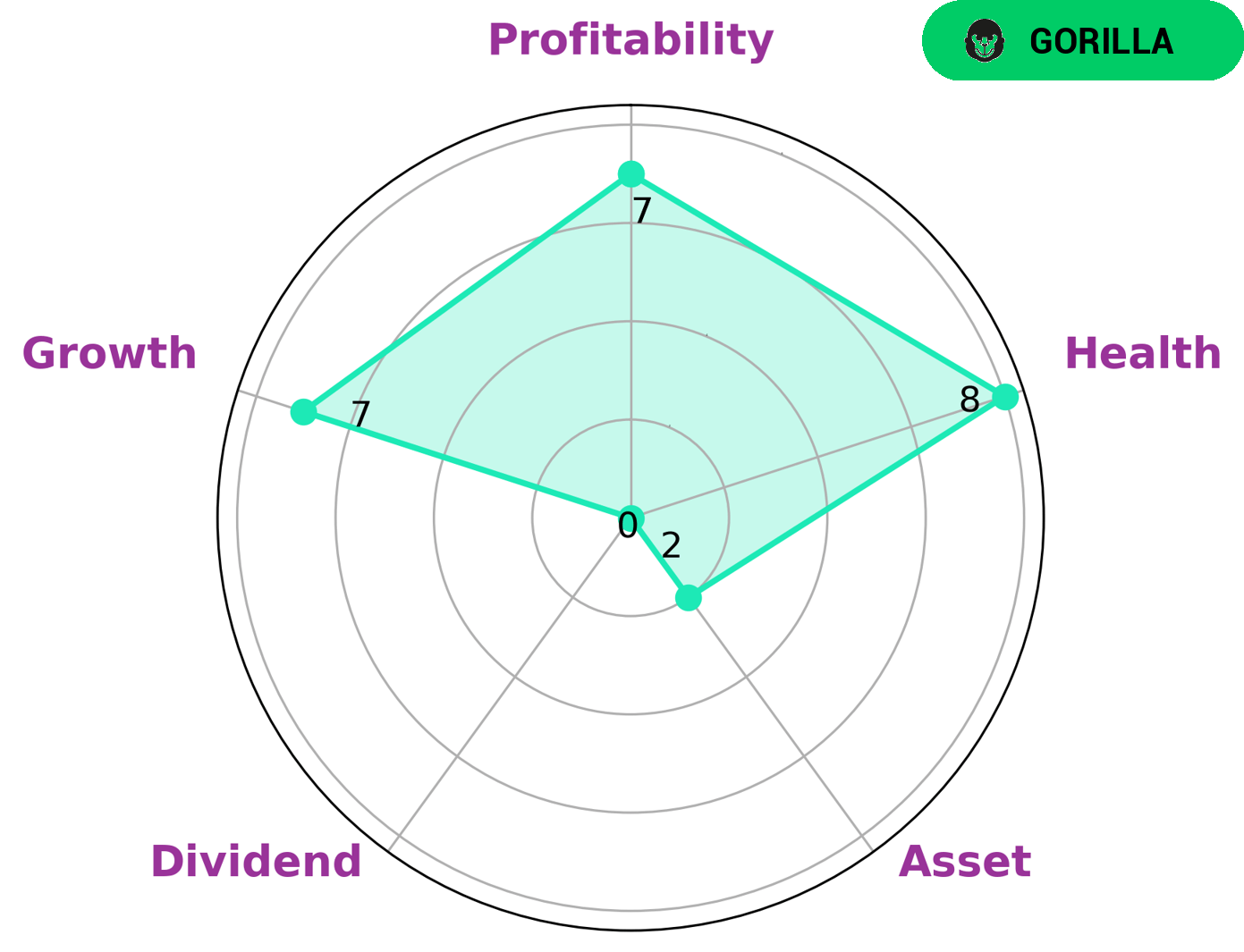

As GoodWhale, we analyzed N-ABLE‘s financials and found that the company is classified as a ‘gorilla’, meaning it has achieved stable and high revenue or earning growth due to its strong competitive advantage. This is demonstrated in its Star Chart, which shows strong growth, profitability, and weak asset and dividend performance. Additionally, N-ABLE has a high health score of 8/10, showing its ability to safely ride out any crisis without the risk of bankruptcy. This stability, combined with its strong competitive advantage, make N-ABLE a great investment for those looking for steady growth and profitability. Investors with a higher risk appetite may also be interested in N-ABLE, as it could be a great long-term investment with potential for large returns. More…

Peers

In the market for customer relations management (CRM) software, N-able Inc faces stiff competition from Coveo Solutions Inc, BigBear.ai Holdings Inc, and Pushpay Holdings Ltd. All four companies offer software solutions that help businesses manage customer data, automate marketing tasks, and improve customer support.

– Coveo Solutions Inc ($TSX:CVO)

Coveo Solutions Inc is a software company that specializes in search and analytics. The company has a market cap of 561.87M as of 2022 and a return on equity of 59.41%. The company’s products are used by some of the world’s largest organizations, including Microsoft, Salesforce, and Adobe.

– BigBear.ai Holdings Inc ($NYSE:BBAI)

BigBear.ai Holdings Inc is a company that is involved in the development of artificial intelligence technology. The company has a market capitalization of 140.15 million as of 2022. The company’s return on equity is -405.49%.

– Pushpay Holdings Ltd ($NZSE:PPH)

With a market cap of $1.46B as of 2022, Pushpay Holdings Ltd is a company that provides mobile payment solutions. Its Return on Equity (ROE) is 18.56%.

Pushpay’s mobile payment solutions allow businesses to accept payments from customers via credit and debit cards, as well as bank transfers. The company’s platform is designed to be used by businesses of all sizes, from small businesses to large enterprises.

Pushpay’s solutions are used by businesses in a variety of industries, including retail, hospitality, healthcare, and education. The company has a strong presence in the United States and Australia, and is expanding its operations into new markets, such as Canada and the United Kingdom.

Summary

N-ABLE, a global software company, has recently published its inaugural Environmental, Social and Governance (ESG) Report. This report provides insight into the company’s performance and guides investors when making decisions about their investments. Key highlights include commitment to climate action, social responsibility initiatives and corporate governance standards.

N-ABLE provides remote monitoring and management, data protection as-a-service, as well as support for core IT services to IT services providers. Investors can use this report to assess N-ABLE’s ability to create long-term value by understanding the company’s ESG practices and performance.

Recent Posts