Leidos Holdings Intrinsic Value – Leidos Holdings Wins Contract to Construct Unmanned Aerial System for USMC

April 20, 2023

Trending News ☀️

The company has recently been awarded a contract to construct a prototype of an unmanned aerial system (UAS) for the U.S. Marine Corps. The system will be able to transport payloads, such as cameras and sensors, over long distances. The UAS is expected to be a cost-effective solution for the Marine Corps, allowing them to collect data from various locations quickly and efficiently. Furthermore, this type of system could also provide military personnel with better situational awareness when deployed on the battlefield.

Leidos ($NYSE:LDOS) is no stranger to working with the military, having also produced UASs for the U.S. Air Force and Navy. This type of project could potentially lead to more contracts in the future and boost Leidos’ reputation as a reliable provider of defense solutions. With their expertise and experience in the field, Leidos is well-positioned to provide more innovative solutions for the U.S. military in the future.

Market Price

On Tuesday, LEIDOS HOLDINGS, a leading science and technology solutions provider, announced that it had won a contract to construct an unmanned aerial system (UAS) for the U.S. Marine Corps (USMC). The successful bid has been a boost to the stock of LEIDOS HOLDINGS, as their shares opened at $93.1 on Tuesday and closed at the same price. This successful bid reflects the trust that the USMC has in LEIDOS HOLDINGS’ capabilities, making the company a trusted partner for military-related contracts. LEIDOS HOLDINGS’ commitment to providing innovative solutions for its customers is one of the reasons why it is so successful. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Leidos Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 14.4k | 685 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Leidos Holdings. More…

| Operations | Investing | Financing |

| 986 | -313 | -865 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Leidos Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.07k | 8.72k | 31.38 |

Key Ratios Snapshot

Some of the financial key ratios for Leidos Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 9.7% | 7.5% |

| FCF Margin | ROE | ROA |

| 6.0% | 16.2% | 5.2% |

Analysis – Leidos Holdings Intrinsic Value

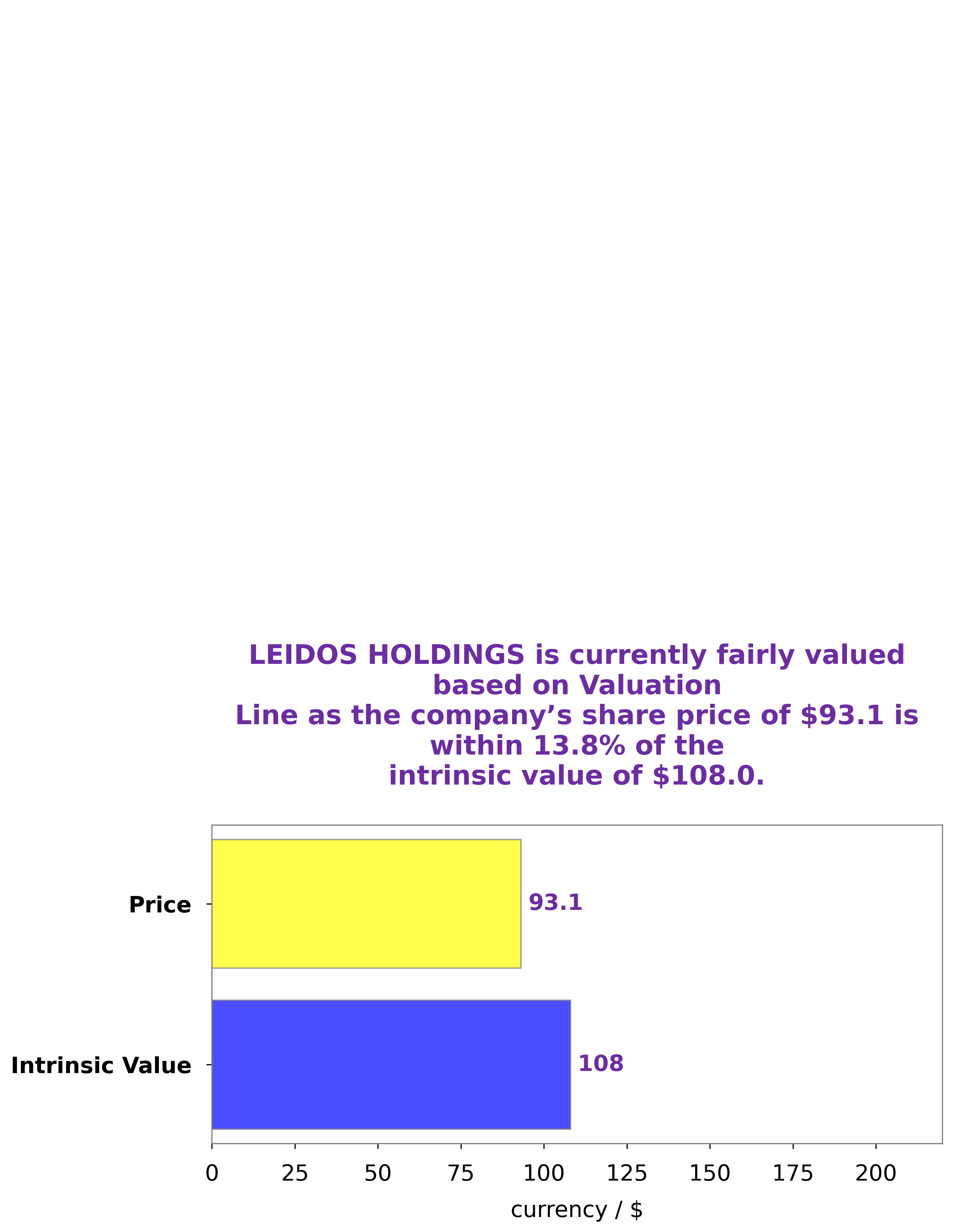

We at GoodWhale recently conducted an analysis of LEIDOS HOLDINGS to determine their wellbeing. After our research, we determined that the fair value of a LEIDOS HOLDINGS share is approximately $108.0. This calculation was made using our proprietary Valuation Line, which takes into account various factors including the company’s performance and future prospects. Currently, LEIDOS HOLDINGS’ shares are trading at $93.1, which is 13.8% lower than our calculated fair price. This indicates that the shares are currently undervalued and could be a great opportunity for potential investors. More…

Peers

Leidos Holdings Inc is an American technology company that provides products and services for the national security, health, and engineering sectors. The company operates in three segments: National Security Solutions, Health Solutions, and Engineering Solutions. Leidos Holdings Inc’s competitors include Vama Industries Ltd, STS Evermedia Corp, and Societe Pour L’Informatique Industrielle.

– Vama Industries Ltd ($BSE:512175)

Vama Industries Ltd is an Indian company that manufactures automotive components and parts. It has a market cap of 370.93M as of 2022 and a Return on Equity of 3.33%. The company was founded in 1963 and is headquartered in Mumbai, India. Vama Industries Ltd manufactures a variety of automotive components and parts, including engine parts, suspension parts, and electrical parts.

– STS Evermedia Corp ($OTCPK:SEVM)

Societe Pour L’Informatique Industrielle is a France-based company that provides software solutions and services for industrial applications. The Company operates in three segments: Software Solutions, Services and Maintenance, and Hardware. The Software Solutions segment offers software products, including design and development tools, manufacturing execution systems, and industrial connectivity solutions. The Services and Maintenance segment provides services, such as consulting, training, and support, as well as maintenance and support services for software products. The Hardware segment offers hardware products, such as programmable logic controllers, human machine interfaces, and industrial PCs.

Summary

Leidos Holdings is an American defense and technology company that specializes in engineering and information technology. The company recently won a contract with the United States Marine Corps to develop a prototype unmanned aerial system (UAS) capable of carrying a payload. This is a positive development for the company, as it stands to benefit from increased government spending in the defense sector. Investors should consider the potential for increased revenue and profits, as well as the potential for growth in the UAS industry. With this new contract, Leidos has the opportunity to expand its customer base and create innovative new technologies for military applications.

In addition, investors should monitor potential changes in government spending, as this can have an effect on the company’s performance and outlook.

Recent Posts