Gartner Upgraded to ‘Strong Buy’ as Business Conditions Improve and Productivity Rises

December 1, 2023

☀️Trending News

Gartner ($NYSE:IT), Inc. has been upgraded to a “Strong Buy” in the Q3 report from Wall Street analysts. This rating upgrade is due to the recent stabilization of the business environment and an improvement in productivity. Gartner is a global technology research and advisory firm providing insights, analysis, and advice on business decisions. The company is focused on helping businesses identify emerging trends, technologies, and services that will enable them to become more successful. Gartner’s products and services range from research and insights, consulting, and events to IT and hardware comparisons. The recent rating upgrade is attributed to the fact that the business environment has stabilized and productivity has improved. Gartner has leveraged its extensive resources and knowledge base to provide needed information and services to their clients. As a result, Gartner’s customer base has expanded significantly.

Additionally, the company has been able to increase their profits and reduce their debt, further solidifying their position as the top global research and advisory firm. Overall, Gartner’s Q3 rating has been upgraded to a “Strong Buy” due to the stabilization of the business environment and an improvement in productivity. With their extensive resources and knowledge base, Gartner has been able to provide invaluable services to their customers while increasing their profits and reducing their debt. This has enabled them to remain one of the top global research and advisory firms.

Price History

On Thursday, Gartner Inc. was upgraded to a ‘Strong Buy’ rating by analysts, citing improved business conditions and rising productivity. GARTNER stock opened at $430.6 and closed at $434.8, representing an increase of 1.1% from its previous closing price of $430.1. Analysts noted that Gartner’s cost-cutting strategies have allowed it to remain competitive and generate higher profits even in a challenging economic environment. In light of these developments, investors have expressed confidence in the company’s long-term growth prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gartner. More…

| Total Revenues | Net Income | Net Margin |

| 5.83k | 930.65 | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gartner. More…

| Operations | Investing | Financing |

| 1.13k | 34.12 | -448.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gartner. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.24k | 6.68k | 7.27 |

Key Ratios Snapshot

Some of the financial key ratios for Gartner are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.6% | 35.6% | 22.0% |

| FCF Margin | ROE | ROA |

| 17.5% | 139.0% | 11.1% |

Analysis

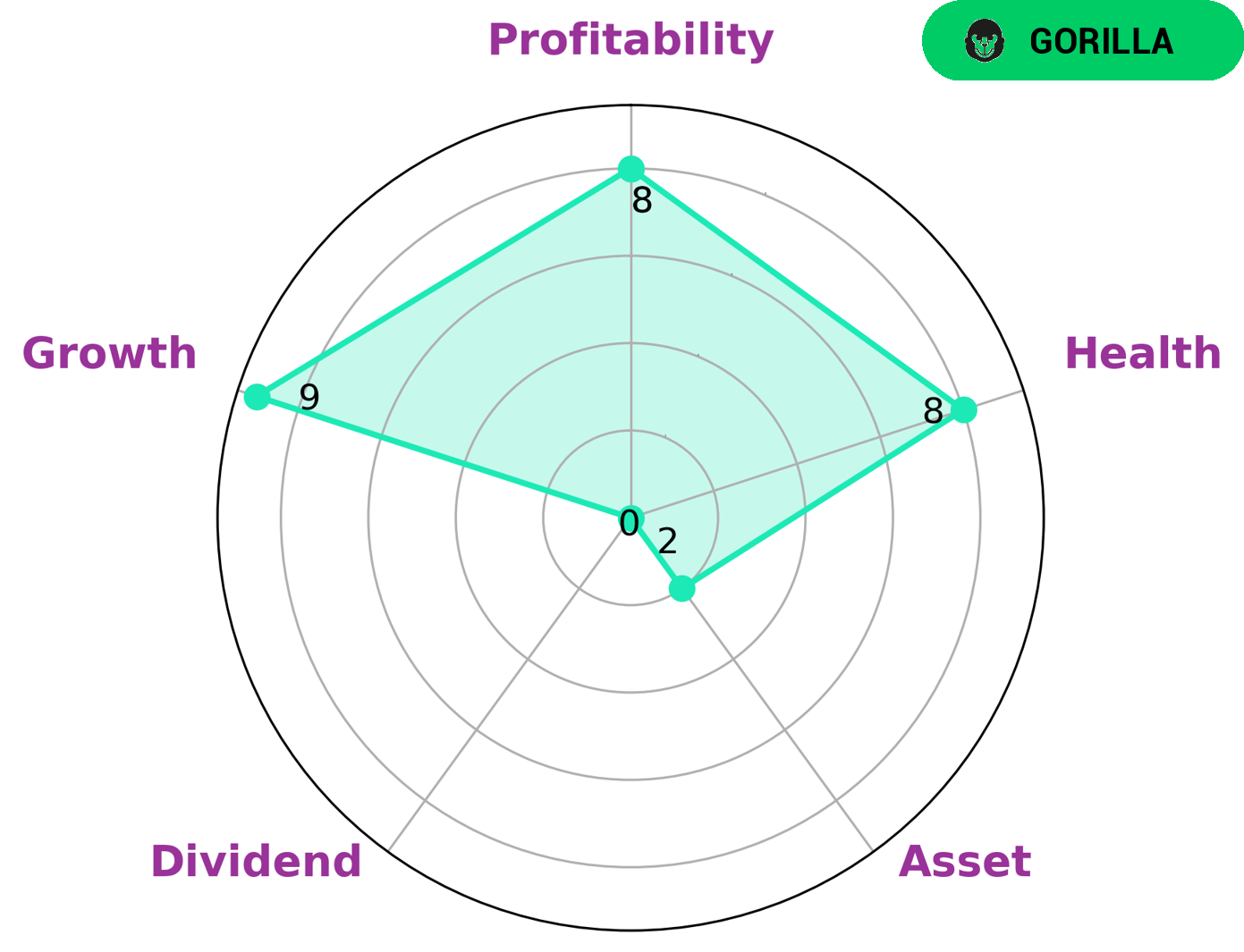

As GoodWhale, we have conducted a thorough analysis of GARTNER’s fundamentals. According to our Star Chart, GARTNER has a high health score of 8/10, considering its cashflows and debt, meaning it is capable to sustain its future operations even in times of crisis. Furthermore, GARTNER scores high in growth and profitability, while remaining weak in asset and dividend categories. Taking everything into account, we classify GARTNER as a ‘gorilla’ type of company – one that is likely to achieve stable and high revenue or earning growth due to its strong competitive advantage. Given these impressive fundamentals, we believe GARTNER could be an attractive option for investors looking for long-term growth and diversification of their portfolios. GARTNER’s competitive advantage and strong financial position makes it an ideal option for those focused on long-term capital appreciation who can stomach the inherent risk of stock market investing. Gartner_Upgraded_to_Strong_Buy_as_Business_Conditions_Improve_and_Productivity_Rises”>More…

Peers

The competition among Gartner Inc, Shenzhen Farben Information Technology Co Ltd, Beijing Philisense Technology Co Ltd, and Beijing E-techstar Co Ltd is heating up as the global market for information technology research and advisory services continues to grow. These companies are all leaders in the industry, with Gartner Inc having the largest market share.

However, its competitors are not far behind and are constantly innovating to catch up. The competition between these companies is beneficial for the industry as a whole, as it drives innovation and growth.

– Shenzhen Farben Information Technology Co Ltd ($SZSE:300925)

Shenzhen Farben Information Technology Co Ltd is a leading provider of information technology services in China. The company has a market cap of 4.66B as of 2022 and a return on equity of 7.31%. Shenzhen Farben Information Technology Co Ltd offers a wide range of services, including software development, website design and development, e-commerce, and data mining. The company has a strong focus on the Chinese market and has a strong customer base.

– Beijing Philisense Technology Co Ltd ($SZSE:300287)

Beijing Philisense Technology Co Ltd is a Beijing-based company that specializes in the production of sensors and other related technology. The company has a market cap of 5.41B as of 2022 and a Return on Equity of -12.14%. Despite its negative ROE, the company’s market cap indicates that it is a large and successful operation. Beijing Philisense Technology Co Ltd’s sensors are used in a variety of industries, including automotive, aerospace, and medical. The company’s products are known for their accuracy and reliability.

– Beijing E-techstar Co Ltd ($SZSE:300513)

Beijing E-techstar Co Ltd is a Chinese holding company. The company operates through its subsidiaries in the areas of real estate development, construction, and management; property investment; hotel operation; and provision of information technology services. As of 2022, the company had a market capitalization of 3.58 billion US dollars and a return on equity of -3.95%.

Summary

The new rating reflects Gartner‘s optimism in the market’s potential and suggests that investors should take advantage of the current period to make sound investments. Gartner also noted that with continued advances in technology and further economic recovery, there are many opportunities in the market for investors to capitalize on. As such, investors should carefully consider their options and weigh the risks before making any investment decisions.

Recent Posts