Franklin Resources Boosts Stake in Broadridge Financial Solutions’ Shares

June 26, 2023

☀️Trending News

Franklin Resources Inc. recently increased its stake in Broadridge Financial Solutions ($NYSE:BR), Inc., a leading business services provider. It also offers services that help corporate issuers and their shareholders manage information, communications, and transactions. Broadridge Financial Solutions is headquartered in Lake Success, New York and is traded on the New York Stock Exchange under ticker symbol “BR”. Franklin Resources Inc.’s increased stake in Broadridge Financial Solutions reflects the company’s continued confidence in the firm’s ability to provide reliable services and solutions to its clients.

It is evident that the company is looking to benefit from Broadridge’s strong presence in the market and its reputation for offering innovative offerings. With Franklin Resources’ increased stake in Broadridge Financial Solutions, the firm is well-positioned to continue to provide high-quality services and solutions to its customers.

Market Price

On Friday, BROADRIDGE FINANCIAL SOLUTIONS stock opened at $148.5 and closed at $149.6, up by 1.0% from its previous closing price of 148.2. Investors can expect further growth in the stock as the company continues its commitment to providing efficient, innovative solutions to its customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BR. More…

| Total Revenues | Net Income | Net Margin |

| 5.94k | 554.6 | 9.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BR. More…

| Operations | Investing | Financing |

| 551.5 | -78.5 | -411.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.43k | 6.43k | 15.18 |

Key Ratios Snapshot

Some of the financial key ratios for BR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.7% | 13.3% | 13.8% |

| FCF Margin | ROE | ROA |

| 8.2% | 27.2% | 6.1% |

Analysis

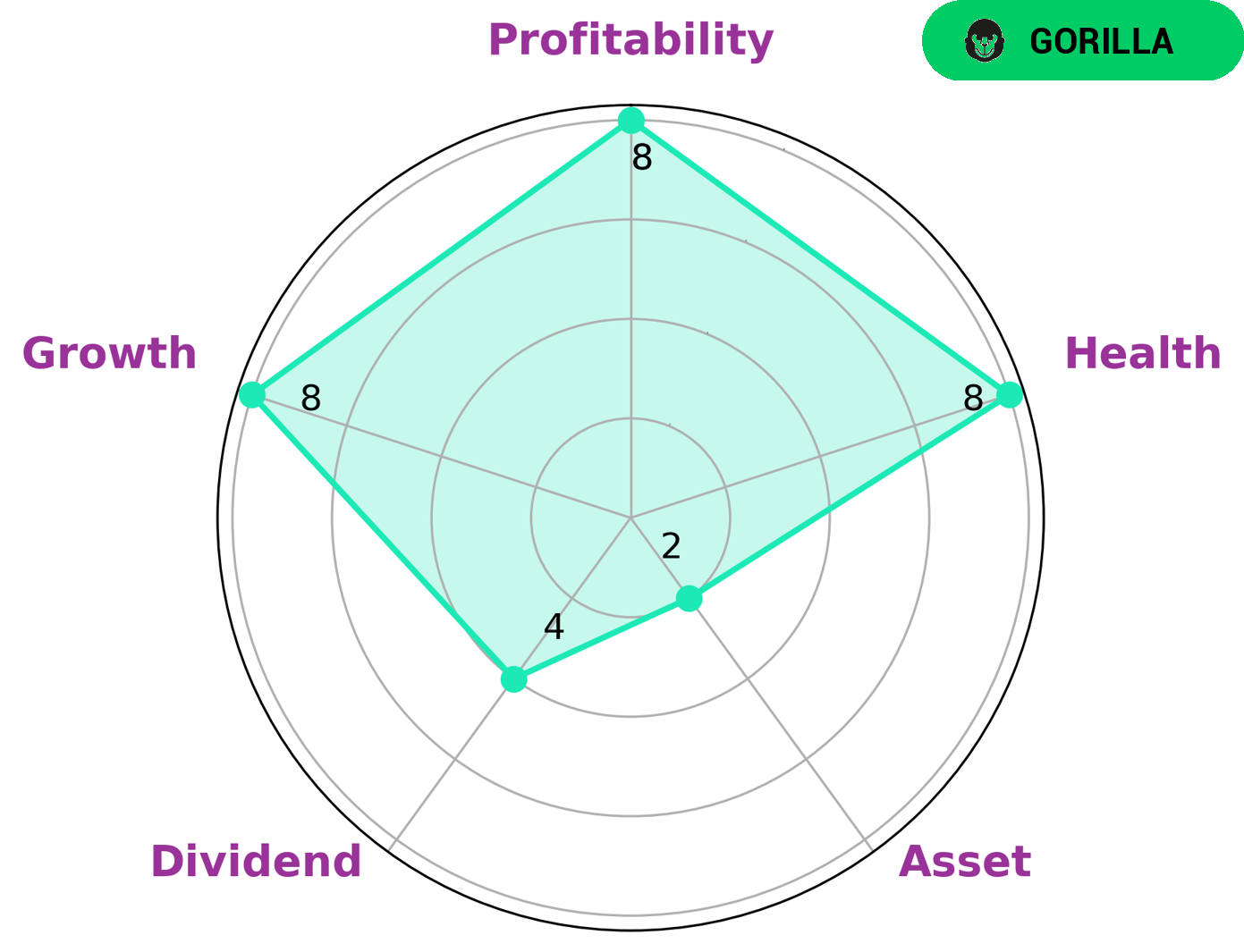

At GoodWhale, we believe in evaluating the fundamentals of BROADRIDGE FINANCIAL SOLUTIONS. Our Star Chart analysis shows that the company has a high health score of 8/10 when it comes to cashflows and debt, making it a safe option for riding out any crisis without the risk of bankruptcy. Based on this analysis, we classify BROADRIDGE FINANCIAL SOLUTIONS as a ‘gorilla’, meaning that they have achieved stable and high revenue or earning growth due to their strong competitive advantage. This makes BROADRIDGE FINANCIAL SOLUTIONS an attractive option for investors looking for growth. Specifically, the company is strong in growth, profitability, and medium in dividend, but weak in asset. Overall, BROADRIDGE FINANCIAL SOLUTIONS is a great option for investors looking for steady growth with minimal risks. More…

Peers

Broadridge Financial Solutions Inc. is a provider of investor communications and technology-driven solutions to banks, broker-dealers, asset and wealth managers, and corporations. Headquartered in New York, United States, Broadridge employs over 10,000 people in 18 countries.

Broadridge’s main competitors are RTS Technology Holdings Bhd, Fact Inc, and Information Services Group Inc.

– RTS Technology Holdings Bhd ($KLSE:03039)

RTS Technology Holdings Bhd has a market cap of 20.53M as of 2022, a Return on Equity of 15.84%. The company is an investment holding company. Through its subsidiaries, the Company is engaged in the provision of management services, as well as trading of electrical and electronic products.

– Fact Inc ($OTCPK:FCTI)

Fact Inc is a publicly traded company with a market capitalization of 552.17k as of 2022. The company has a return on equity of 98.84%. Fact Inc is engaged in the business of providing financial data and analytics solutions to clients in a variety of industries. The company’s products and services are used by clients to make informed decisions about investments, risk management, and other financial matters.

– Information Services Group Inc ($NASDAQ:III)

Information Services Group Inc is a publicly traded company that provides technology research and advisory services. The company has a market capitalization of 232.55 million as of 2022 and a return on equity of 19.28%. ISG was founded in 2006 and is headquartered in Stamford, Connecticut.

Summary

Franklin Resources Inc. has recently increased their position in shares of Broadridge Financial Solutions, Inc. This signals a positive outlook and potential for growth in the company. Analysts have noted that the financial services provider’s performance has been strong in recent quarters, with revenue and profits both increasing. Broadridge has also seen growth in its customer base and overall market share.

The stock is currently trading at a discount to its peers, making it a good value buy. Investors looking to take advantage of the potential growth in Broadridge should consider investing in the company’s stock.

Recent Posts