Fd Technologies Intrinsic Stock Value – FD Technologies Partners with Amazon Web Services to Launch Cloud-Native KDB Insights Service

June 3, 2023

☀️Trending News

On Thursday, FD ($LSE:FDP) Technologies announced a new partnership with Amazon Web Services to launch their cloud-native KDB Insights service. FD Technologies is a leading provider of data analysis and visualization software, offering solutions for businesses of all sizes and across industries. This partnership with Amazon Web Services adds the ability to run the KDB Insights software on the cloud, allowing for a more accessible and cost-effective way to use the product. KDB Insights is a robust data analytics solution that enables users to quickly and easily analyze, explore, and visualize their data. With its ability to process large amounts of data and provide insights in a matter of seconds, KDB Insights makes it easier for companies to analyze data and make informed decisions.

Additionally, the cloud-native version of the software makes it easier for companies to scale their operations based on their changing needs. The cloud-native KDB Insights service will be available on AWS Marketplace, making it easier for customers to purchase and use the software. The combination of FD Technologies’ in-depth expertise in data analysis and Amazon Web Services’ cloud infrastructure will allow users to get the most out of their data. With this new offering, customers can quickly access actionable insights and have peace of mind knowing that their data is secure.

Price History

This cloud-based service is designed to enable customers to quickly and easily query and analyze data in real-time. Since its launch, FD Technologies has seen its stock price increase by 4.4%, from its last closing price of £18.0 to £18.8. This increase in stock value could be attributed to the company’s strategic move to partner with the tech giant, AWS. The Cloud-Native KDB Insights Service will provide an easy to use, cost-effective solution for customers to quickly query and analyze data.

Customers will benefit from the scalability, resilience, and security of the cloud-based platform. The launch of this new service shows FD Technologies’ commitment to providing customers with the highest quality solutions in the data management sector. With the help of AWS, the company is able to offer customers a comprehensive cloud-based solution that is tailored to their specific needs. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fd Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 296.04 | -4.01 | -1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fd Technologies. More…

| Operations | Investing | Financing |

| 27.03 | -18.08 | -22.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fd Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 374.24 | 173.37 | 7.16 |

Key Ratios Snapshot

Some of the financial key ratios for Fd Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | -64.1% | 1.2% |

| FCF Margin | ROE | ROA |

| 0.2% | 1.1% | 0.6% |

Analysis – Fd Technologies Intrinsic Stock Value

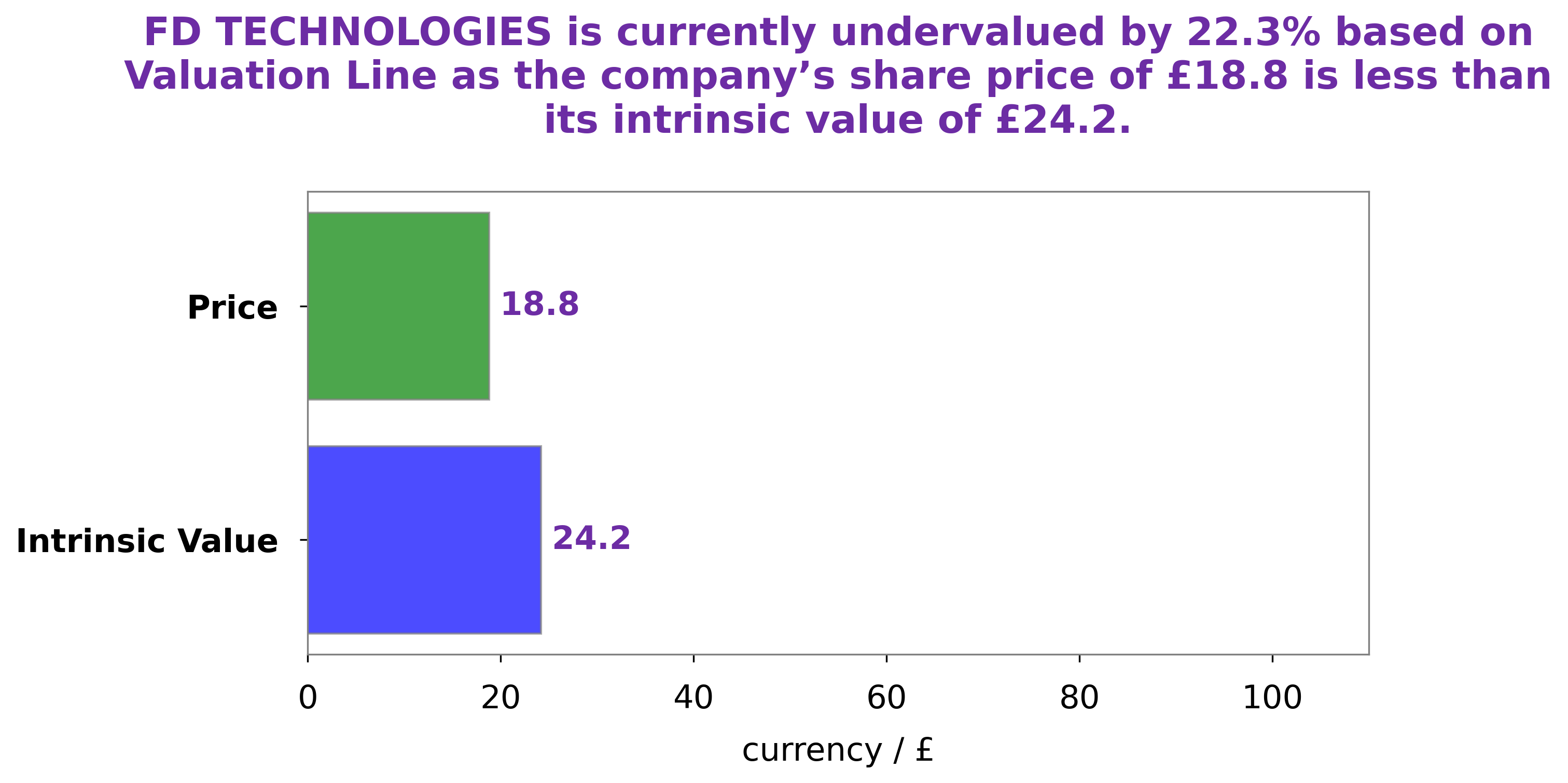

At GoodWhale, we have conducted an analysis of FD TECHNOLOGIES‘s fundamentals. Our proprietary Valuation Line has calculated the intrinsic value of FD TECHNOLOGIES share to be around £24.2. However, the current market price of FD TECHNOLOGIES stock is £18.8, which is undervalued by 22.2%. More…

Peers

The company’s products and services are used by major corporations and government agencies around the world. FD Technologies PLC is a publicly traded company on the London Stock Exchange (LSE: FD). The company’s major competitors are Appier Group Inc, Pci Technology Group Co Ltd, Merit Group PLC.

– Appier Group Inc ($TSE:4180)

Appier Group Inc is a global technology company that provides artificial intelligence (AI) services to businesses. The company has a market cap of $152.74 billion as of 2022 and a return on equity of -0.89%. Appier Group Inc provides a range of AI services including data analysis, predictive modelling, and decision-making support. The company’s AI services are used by businesses in a variety of industries including retail, healthcare, financial services, and manufacturing.

– Pci Technology Group Co Ltd ($SHSE:600728)

Pci Technology Group Co Ltd is a technology company that provides solutions for the banking and financial services industry. It has a market cap of 10.61B as of 2022 and a return on equity of 5.32%. The company offers a range of products and services including payment processing, fraud prevention, and compliance management. It serves customers in the United States, Europe, Asia, and Africa.

– Merit Group PLC ($LSE:MRIT)

Intermec Technologies PLC, together with its subsidiaries, designs, develops, manufactures, markets, and sells automatic identification and data collection products worldwide. The company has a market cap of $8.74 million and a return on equity of -2.36%. Intermec Technologies PLC was founded in 1966 and is based in London, United Kingdom.

Summary

FD Technologies has partnered with Amazon Web Services to launch kdb Insights as a cloud-native service on data, which sent their stock price up on the same day. Investors considering FD Technologies are likely attracted to the potential benefits of the new cloud-native service. It will potentially supplement the company’s current offerings and make them more competitive in the market.

Analysts are also likely to consider the impact of the new partnership on FD Technologies’ revenue and profitability. Moreover, investors should also factor in FD Technologies’ future prospects due to the potential growth opportunities of the new AWS partnership.

Recent Posts