DXC Technology Reports Non-GAAP EPS Miss and Revenue Miss

May 19, 2023

Trending News 🌧️

DXC ($NYSE:DXC) Technology recently reported their Non-GAAP earnings per share (EPS) of $1.02, falling short of expectations by $0.02, and their total revenue of $3.59B falling short of the forecast by $30M. DXC Technology is a publicly-traded American company that provides IT services to businesses around the world. This news has impacted the stock, which has seen a drop in the last few days as investors react negatively to the EPS miss and revenue miss. Despite the company’s long-term performance, investors have been wary of the unmet expectations in the short-term. Some analysts are concerned about DXC’s ability to meet future expectations as well.

However, others have argued that the company’s long-term performance is still strong and should remain that way in the future. Overall, DXC Technology’s recent non-GAAP EPS miss and revenue miss have caused a drop in stock prices and left investors uncertain about the company’s future performance. It remains to be seen whether this will impact the company’s long-term prospects.

Price History

The company’s stock opened at $23.8 and closed at the same price, with a slight 0.3% increase from its closing price the day before. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dxc Technology. More…

| Total Revenues | Net Income | Net Margin |

| 14.85k | 718 | 5.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dxc Technology. More…

| Operations | Investing | Financing |

| 1.27k | -452 | -1.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dxc Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.25k | 13.3k | 20.32 |

Key Ratios Snapshot

Some of the financial key ratios for Dxc Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.5% | -35.9% | 8.5% |

| FCF Margin | ROE | ROA |

| 5.3% | 17.0% | 4.3% |

Analysis

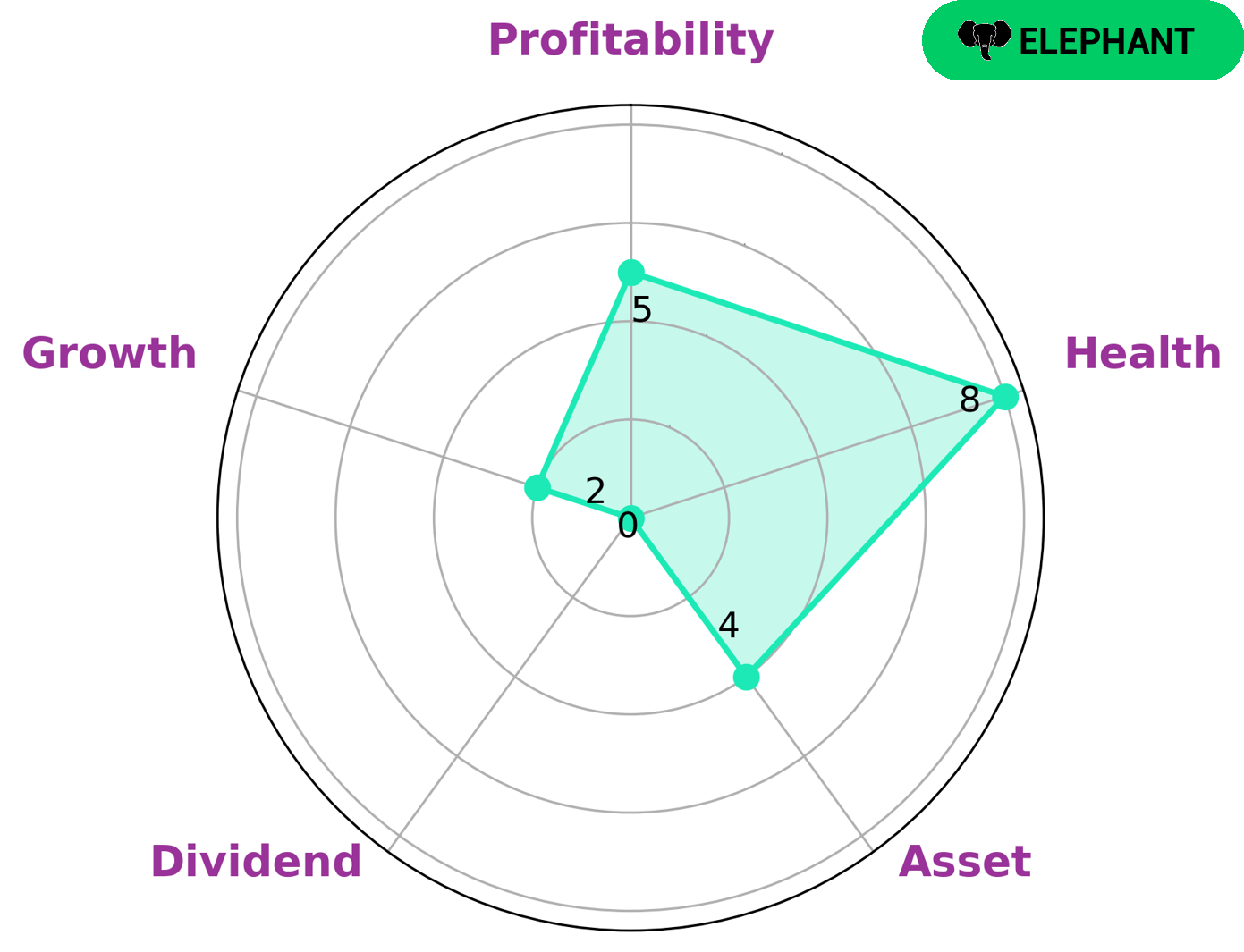

GoodWhale has conducted an in-depth analysis of DXC TECHNOLOGY‘s wellbeing. We found that the company has a high health score of 8/10 with regard to its cashflows and debt, indicating it is capable of safely riding out any crisis without the risk of bankruptcy. The Star Chart analysis also revealed that DXC TECHNOLOGY is strong in terms of asset, profitability, and weak in dividend and growth. Based on this information, we have classified DXC TECHNOLOGY as an ‘elephant’, a type of company that we conclude is rich in assets after deducting off liabilities. Given its strong cash flow and asset base, we believe that DXC TECHNOLOGY would be of great interest to investors who are seeking long-term, stable performance and who are prepared to accept lower dividend payouts. Furthermore, DXC TECHNOLOGY’s current financial situation may make it an attractive target to institutional investors who are looking for more resilient investments during market downturns. More…

Peers

The company’s competitors include Broadridge Financial Solutions Inc, Ework Group AB, and RTS Technology Holdings Bhd.

– Broadridge Financial Solutions Inc ($NYSE:BR)

As of 2022, Broadridge Financial Solutions Inc has a market cap of 21.78B and a Return on Equity of 25.4%. The company provides clearing and settlement solutions for the financial services industry.

– Ework Group AB ($LTS:0MCB)

Ework Group is a Swedish company that provides staffing and consulting services. The company was founded in 1999 and is headquartered in Stockholm. As of 2022, the company has a market cap of 1.98B and a ROE of 56.2%. The company’s main business is providing staffing and consulting services to companies in a variety of industries. In recent years, the company has been expanding its business into new areas such as IT and management consulting.

– RTS Technology Holdings Bhd ($KLSE:03039)

RTS Technology Holdings Bhd is a technology company that provides solutions for the retail industry. It has a market cap of 20.53M as of 2022 and a return on equity of 15.84%. The company offers a range of products and services, including point-of-sale systems, inventory management, customer relationship management, and e-commerce solutions. It also provides services such as system integration, project management, and training.

Summary

The company reported non-GAAP earnings per share (EPS) of $1.02 which missed the market’s expectations by $0.02. Revenue of $3.59B also fell short by $30M. This is a major concern for investors as DXC Technology had not posted such weak numbers in a while.

The market has responded negatively to this news, with the stock experiencing a steep drop shortly after the report was released. Investors should be cautious when considering investing in DXC Technology, and it is important to consider the financial risks associated with the company.

Recent Posts