Dimensional Fund Advisors LP Increases Stake in N-able to Support SME Digital Transformation

June 14, 2023

☀️Trending News

N-able ($NYSE:NABL), Inc. is a leader in software and cloud solutions designed to help small and medium-sized enterprises (SMEs) manage and optimize their businesses. With their suite of modern digital solutions, N-able helps SMEs streamline their operations, reduce complexity, and maximize the value of their technology investments. The additional funds will be used to further develop and expand N-able’s suite of solutions, which includes cloud-based customer relationship management (CRM) tools, automation, cloud services, and more. These resources will enable SMEs to better compete in today’s digital economy, as well as reap the rewards of digital transformation.

N-able’s solutions are designed to help SMEs simplify their operations, boost productivity, and promote effective collaboration between teams. The company is committed to providing SMEs with the tools they need to switch to a digital-first approach and thrive in a rapidly changing business environment. With Dimensional Fund Advisors LP’s investment, N-able has the resources to continue innovating and helping SMEs unlock the full potential of their technology investments.

Market Price

On Friday, N-ABLE saw a slight increase in its stock price when Dimensional Fund Advisors LP (DFA) increased its stake in the company. The stock opened at $14.4 and closed at $14.5, up by 0.3% from the previous closing price of 14.4. DFA’s increased stake in the company is seen as a show of confidence and support of N-ABLE’s digital transformation strategy to help Small and Medium Enterprises (SMEs).

N-ABLE has been making great strides in their digital transformation initiatives, and DFA’s investment is seen as a strategic move to help them achieve their goals. With this investment, N-ABLE will be able to increase their focus on providing innovative solutions to SMEs to help them manage their digital transformation with greater ease. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for N-able. More…

| Total Revenues | Net Income | Net Margin |

| 380.73 | 15.14 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for N-able. More…

| Operations | Investing | Financing |

| 68.91 | -31.98 | -11.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for N-able. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.09k | 436.38 | 3.6 |

Key Ratios Snapshot

Some of the financial key ratios for N-able are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.2% | 9.0% | 13.8% |

| FCF Margin | ROE | ROA |

| 12.1% | 5.1% | 3.0% |

Analysis

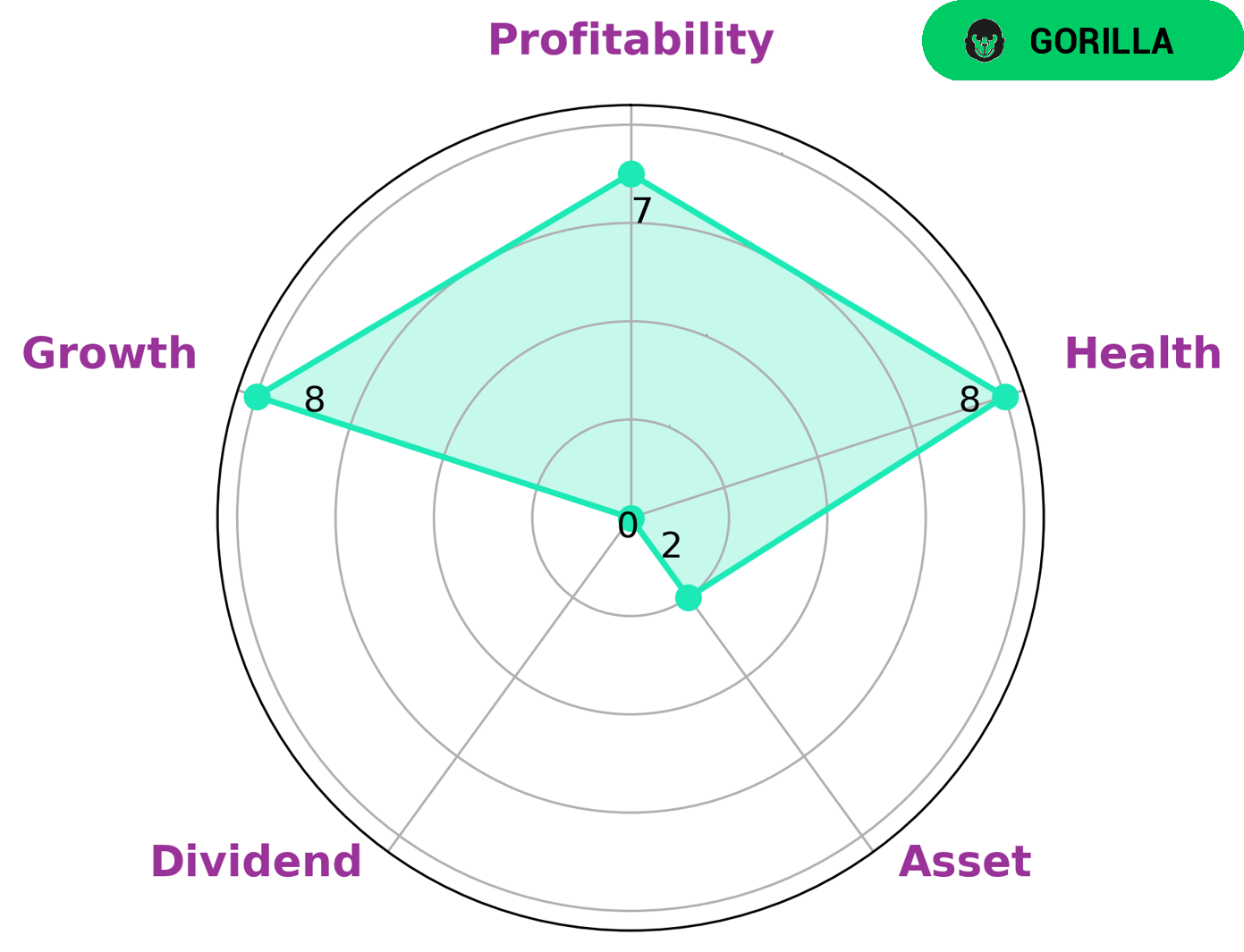

GoodWhale’s analysis of N-ABLE‘s financials showed that the company was classified as a ‘gorilla’, which we concluded was due to its strong competitive advantage leading to stable and high revenue or earnings growth. This type of company may be of interest to investors looking for a strong growth profile and the potential for impressive returns. Moreover, N-ABLE has an impressive health score of 8/10, indicating its cashflows and debt are in good shape and it is capable of riding out any crisis without the risk of bankruptcy. Additionally, N-ABLE is strong in growth and profitability, though weak in assets and dividend. More…

Peers

In the market for customer relations management (CRM) software, N-able Inc faces stiff competition from Coveo Solutions Inc, BigBear.ai Holdings Inc, and Pushpay Holdings Ltd. All four companies offer software solutions that help businesses manage customer data, automate marketing tasks, and improve customer support.

– Coveo Solutions Inc ($TSX:CVO)

Coveo Solutions Inc is a software company that specializes in search and analytics. The company has a market cap of 561.87M as of 2022 and a return on equity of 59.41%. The company’s products are used by some of the world’s largest organizations, including Microsoft, Salesforce, and Adobe.

– BigBear.ai Holdings Inc ($NYSE:BBAI)

BigBear.ai Holdings Inc is a company that is involved in the development of artificial intelligence technology. The company has a market capitalization of 140.15 million as of 2022. The company’s return on equity is -405.49%.

– Pushpay Holdings Ltd ($NZSE:PPH)

With a market cap of $1.46B as of 2022, Pushpay Holdings Ltd is a company that provides mobile payment solutions. Its Return on Equity (ROE) is 18.56%.

Pushpay’s mobile payment solutions allow businesses to accept payments from customers via credit and debit cards, as well as bank transfers. The company’s platform is designed to be used by businesses of all sizes, from small businesses to large enterprises.

Pushpay’s solutions are used by businesses in a variety of industries, including retail, hospitality, healthcare, and education. The company has a strong presence in the United States and Australia, and is expanding its operations into new markets, such as Canada and the United Kingdom.

Summary

Dimensional Fund Advisors LP has recently acquired an increased stake in N-ABLE, Inc., a company specializing in providing digital transformation solutions to small and medium-sized enterprises (SMEs). This move can be seen as an expression of confidence in the prospects of the company by the leading institutional investor. With the digital transformation market continuing to grow, it appears that Dimensional Fund Advisors has made a wise investment decision in regard to N-ABLE. It remains to be seen how this move will affect the business of N-ABLE, but the prospects of the company’s success are certainly increasing.

Recent Posts