Credit Suisse AG Invests $4.64 Million in Concentrix Corporation.

March 4, 2023

Trending News ☀️

Concentrix Corporation ($NASDAQ:CNXC) recently announced that Credit Suisse AG had invested $4.64 million in the company’s stocks. This is a significant step for Concentrix, as it has propelled the company to the ranks of some of the most successful organizations in the world. The investment from Credit Suisse is an affirmation of the value Concentrix brings to the market, and will no doubt result in the company seeing continued future growth. It demonstrates that Credit Suisse believes that Concentrix has the potential to continue to develop, expand and be successful. This investment will no doubt provide Concentrix with the resources it needs to continue its growth and to build on its current successes.

The investment from Credit Suisse is testament to the quality of Concentrix’s business model and performance, and will ensure that the company can remain competitive in an ever-changing marketplace. This investment will no doubt be instrumental in helping Concentrix to achieve its long-term goals and objectives. Overall, the investment from Credit Suisse AG in Concentrix Corporation is an exciting development for the company and its future prospects. With this new injection of resources, Concentrix is in a strong position to continue its growth and remain a leader in its sector.

Stock Price

On Wednesday, Concentrix Corporation‘s stock opened at $136.7 and closed at $136.0, representing a 0.6% drop from its previous closing price at $136.8. Although the stock dipped slightly, analysts have high hopes for Concentrix Corporation’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Concentrix Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 6.32k | 435.05 | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Concentrix Corporation. More…

| Operations | Investing | Financing |

| 547.09 | -78.65 | -401.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Concentrix Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.67k | 3.97k | 52.76 |

Key Ratios Snapshot

Some of the financial key ratios for Concentrix Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 29.6% | 10.7% |

| FCF Margin | ROE | ROA |

| 6.5% | 15.8% | 6.3% |

Analysis

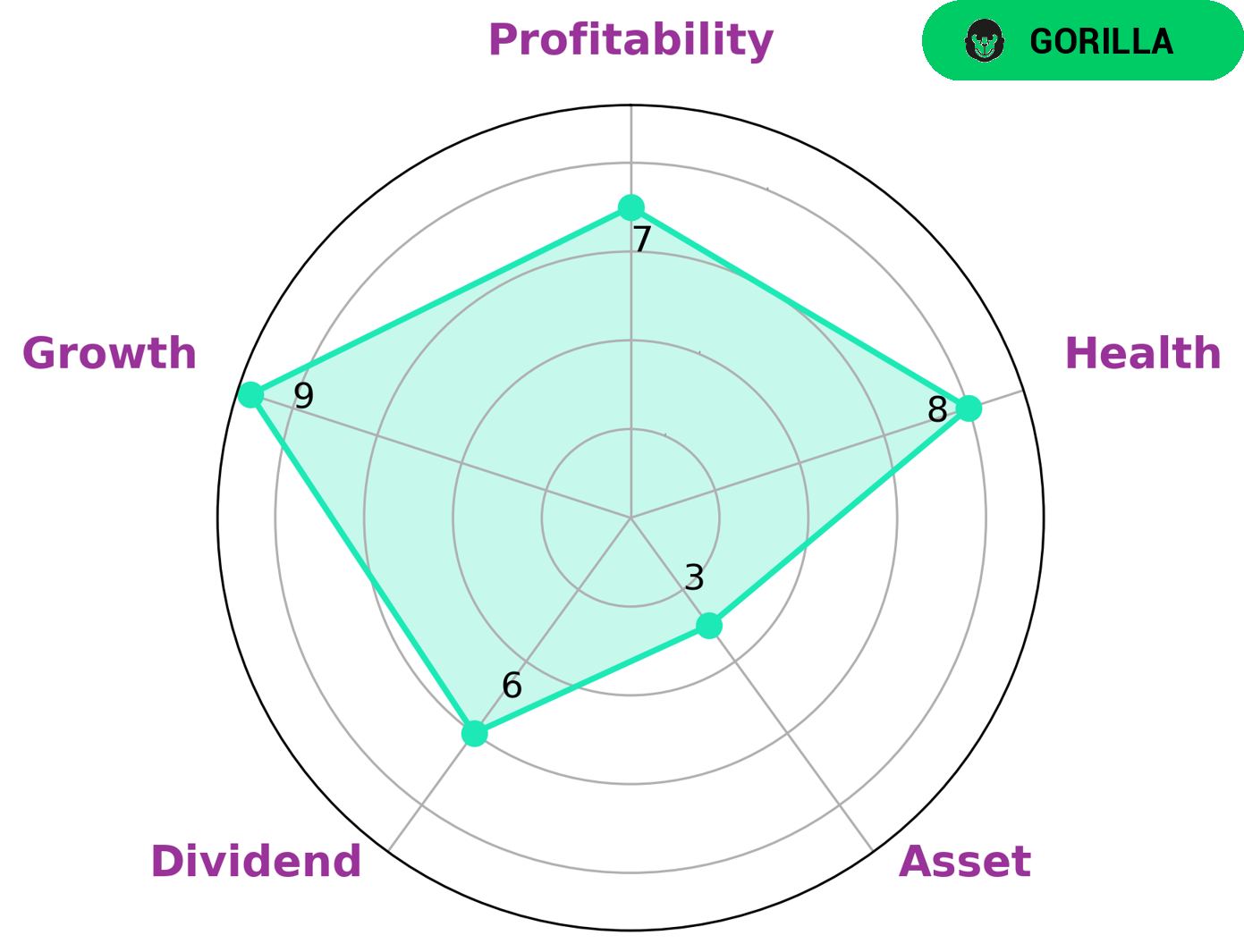

GoodWhale has conducted a comprehensive analysis of CONCENTRIX CORPORATION and has classified it as a “gorilla” – a company that has achieved stable and high revenue/earnings growth due to its strong competitive advantage. Based on the Star Chart available, CONCENTRIX CORPORATION has a high health score of 8/10, indicating that the company is in a strong financial position and is able to ride out any kind of crisis without the risk of bankruptcy. Furthermore, it is strong in terms of growth and profitability, has a medium dividend score, and a weak score in terms of assets. These factors are likely to make CONCENTRIX CORPORATION an attractive investment for a broad range of investors, from long-term, value-focused investors to those who are looking for a shorter-term, higher-risk play. Whatever their investment strategy, investors should evaluate CONCENTRIX CORPORATION on its own merits, as it could prove to be an attractive option. More…

Peers

The company has a strong presence in the US, Europe, and Asia-Pacific regions. Concentrix Corp’s competitors include WidePoint Corp, Oracle Corp Japan, Alithya Group Inc, and other IT outsourcing and customer relationship management companies.

– WidePoint Corp ($NYSEAM:WYY)

As of 2022, WidePoint Corporation’s market capitalization is $22.18 million. The company’s return on equity is -30.85%. WidePoint Corporation is a technology solutions provider that specializes in secure mobility management and enterprise cybersecurity solutions. The company’s products and services enable government agencies and enterprises to deploy and manage mobile devices and applications securely and cost-effectively.

– Oracle Corp Japan ($TSE:4716)

Oracle Corporation Japan is a Japanese subsidiary of Oracle Corporation. It is one of the largest software companies in the world, with a market capitalization of over $1 trillion. The company develops and sells database, middleware, and application software. Oracle Corporation Japan has a return on equity of 37.48%.

– Alithya Group Inc ($TSX:ALYA)

Alithya Group Inc is a global technology and management consulting firm. They offer a comprehensive range of digital, consulting, and managed services to organizations in North America, Europe, and Asia Pacific. They have a market cap of 232M as of 2022 and a Return on Equity of -4.33%. The company has been struggling financially in recent years and has been cutting costs in an attempt to improve their bottom line.

Summary

Credit Suisse AG recently invested $4.64 million in Concentrix Corporation, an American-based business process outsourcing company. The move has been welcomed by investors, as the current market sentiment for the stock is generally positive. Analysts suggest that the injection of funds from Credit Suisse could be seen as a vote of confidence in Concentrix’s prospects, with potential for growth in the future. The investment could spark further interest in the company, with more investors joining Credit Suisse to benefit from Concentrix’s potential future success.

It remains to be seen what effect the injection of funds will have on the company’s financials, though this is a positive sign for the stock. Investors should remain vigilant to any new developments from Concentrix and monitor their investments closely.

Recent Posts