Concentrix Corporation Stock Fair Value – Concentrix Merger to Unlock Shareholder Value Through Synergies

May 26, 2023

Trending News ☀️

Concentrix Corporation ($NASDAQ:CNXC) is a global leader in providing customer engagement services and technology-enabled business process outsourcing solutions. Recently, The company has announced its plans to merge with another company that will create new possibilities for both companies to unlock additional value for their shareholders. The merger will combine Concentrix’s extensive customer service experience and technology-enabled business process outsourcing with the other company’s unique capabilities. This combination of capabilities will enable the two companies to achieve greater scale, optimize resources and create more efficient solutions to meet the needs of their customers. The merger is expected to create cost savings and operational efficiencies through a range of synergies. These include the deployment of shared technology platforms, the development and utilization of best practices, and the sharing of resources across a larger organization.

In addition, the merger could generate improved customer service experiences, greater product innovations, and optimized processes for both companies. Ultimately, the combined company will have the potential to unlock tremendous shareholder value through increased revenue and profitability. With the merger, Concentrix will be able to capitalize on new opportunities to expand its customer base and grow revenues. Furthermore, the company will also be well-positioned to benefit from cost savings resulting from the merger.

Price History

On Thursday, CONCENTRIX CORPORATION announced a merger that is anticipated to unlock shareholder value through synergies. In anticipation of the merger, CONCENTRIX CORPORATION stock opened at $93.6 and closed at $90.0, down by 4.4% from its previous closing price of 94.1. This drop in share price is likely due to investors taking a short-term view of the merger, and not taking into consideration the longer-term benefits. The merger between CONCENTRIX CORPORATION and its partner aims to combine the respective strengths of the two companies in order to create a more competitive business. This includes a stronger portfolio and services encompassing both companies’ offerings, creating increased efficiencies and cost savings. The merged entity will also benefit from economies of scale, with combined resources allowing for greater efficiency in both operations and marketing efforts.

The newly formed entity is expected to reap the rewards of increased shareholder value in the long run, as the synergies created through the merger are expected to increase profitability. CONCENTRIX CORPORATION hopes that once the combination is complete, the shareholders will begin to see returns on investment and greater shareholder value. Ultimately, CONCENTRIX CORPORATION believes that this merger will result in positive long-term outcomes for both shareholders and customers alike. With the anticipated cost savings and increased efficiencies, the newly merged entity is poised to be a stronger and more competitive company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Concentrix Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 6.42k | 414.2 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Concentrix Corporation. More…

| Operations | Investing | Financing |

| 600.72 | -1.84k | 1.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Concentrix Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.62k | 3.82k | 54.7 |

Key Ratios Snapshot

Some of the financial key ratios for Concentrix Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 29.6% | 10.5% |

| FCF Margin | ROE | ROA |

| 7.2% | 15.3% | 6.3% |

Analysis – Concentrix Corporation Stock Fair Value

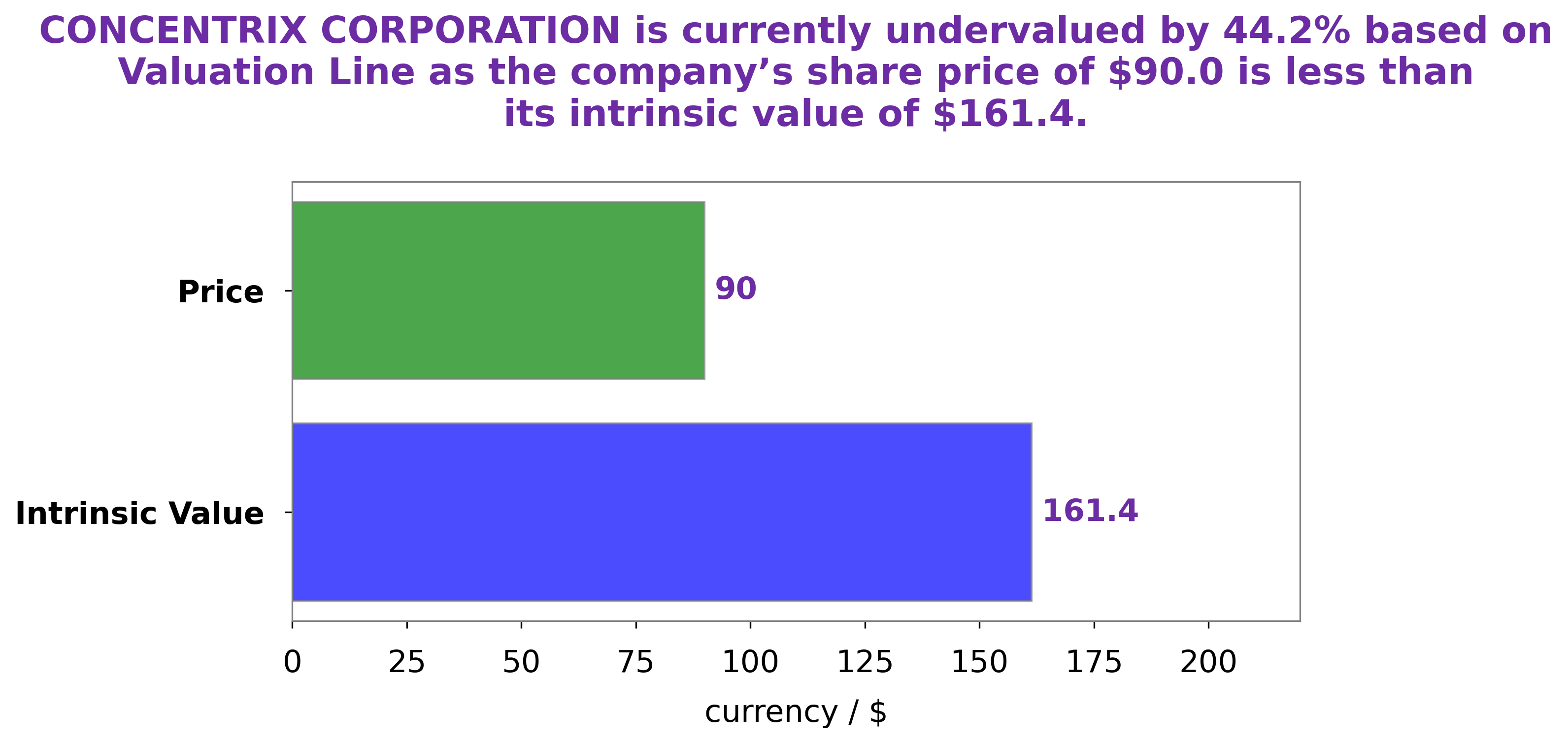

At GoodWhale, we have been analyzing CONCENTRIX CORPORATION’s financials. After careful consideration, we have concluded that the intrinsic value of CONCENTRIX CORPORATION’s share is around $161.4, calculated by our proprietary Valuation Line. This means that the stock is currently being traded at $90.0, resulting in a 44.2% undervaluation. This presents a great opportunity for investors to purchase the stock at an attractive price. More…

Peers

The company has a strong presence in the US, Europe, and Asia-Pacific regions. Concentrix Corp’s competitors include WidePoint Corp, Oracle Corp Japan, Alithya Group Inc, and other IT outsourcing and customer relationship management companies.

– WidePoint Corp ($NYSEAM:WYY)

As of 2022, WidePoint Corporation’s market capitalization is $22.18 million. The company’s return on equity is -30.85%. WidePoint Corporation is a technology solutions provider that specializes in secure mobility management and enterprise cybersecurity solutions. The company’s products and services enable government agencies and enterprises to deploy and manage mobile devices and applications securely and cost-effectively.

– Oracle Corp Japan ($TSE:4716)

Oracle Corporation Japan is a Japanese subsidiary of Oracle Corporation. It is one of the largest software companies in the world, with a market capitalization of over $1 trillion. The company develops and sells database, middleware, and application software. Oracle Corporation Japan has a return on equity of 37.48%.

– Alithya Group Inc ($TSX:ALYA)

Alithya Group Inc is a global technology and management consulting firm. They offer a comprehensive range of digital, consulting, and managed services to organizations in North America, Europe, and Asia Pacific. They have a market cap of 232M as of 2022 and a Return on Equity of -4.33%. The company has been struggling financially in recent years and has been cutting costs in an attempt to improve their bottom line.

Summary

Concentrix Corporation is a technology and services company that provides outsourced customer engagement and business-process solutions. Recently, it has announced a merger with another company, and it is widely speculated that this merger could unlock shareholder value. Investors should consider the potential for Concentrix to improve its operations and margins with the enhanced efficiency of the combined entities.

Furthermore, with the increased scale, Concentrix may be able to leverage its customer base and cost structure to expand its reach further and capture higher market share. While the stock price initially moved down the day of the announcement, investors should monitor how the merger affects the company’s financials and share price in the future.

Recent Posts