Titan Machinery Intrinsic Value Calculation – Titan Machinery Reports GAAP EPS of $1.19 and Revenue of $569.6M

May 26, 2023

Trending News 🌥️

The company posted a GAAP earnings per share of $1.19 and total revenue of $569.6 million. The company is well-known for its quality products and outstanding customer service. It also offers a variety of financing options to help customers find the right solution for their needs.

In addition, efforts have been made to strengthen the company’s online presence, allowing customers to conveniently shop from anywhere. The company’s financial report was positive news for investors as it showed that the company’s efforts to optimize operations and improve efficiency are paying off. Titan Machinery ($NASDAQ:TITN) is well-positioned to benefit from the growth in the agricultural and construction industries and continues to be a leader in its industry.

Earnings

In the latest earning report of FY2023 Q4 as of January 31 2023, TITAN MACHINERY earned a total revenue of $582.98M USD and a net income of $18.11M USD. This marked an impressive 14.9% growth in total revenue in comparison to the same period the previous year. However, net income decreased by 19.3% compared to the same period in the previous year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Titan Machinery. More…

| Total Revenues | Net Income | Net Margin |

| 2.21k | 101.87 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Titan Machinery. More…

| Operations | Investing | Financing |

| 10.82 | -134.06 | 21.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Titan Machinery. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.19k | 652.39 | 22.52 |

Key Ratios Snapshot

Some of the financial key ratios for Titan Machinery are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.2% | 76.6% | 6.4% |

| FCF Margin | ROE | ROA |

| -1.2% | 17.0% | 7.5% |

Market Price

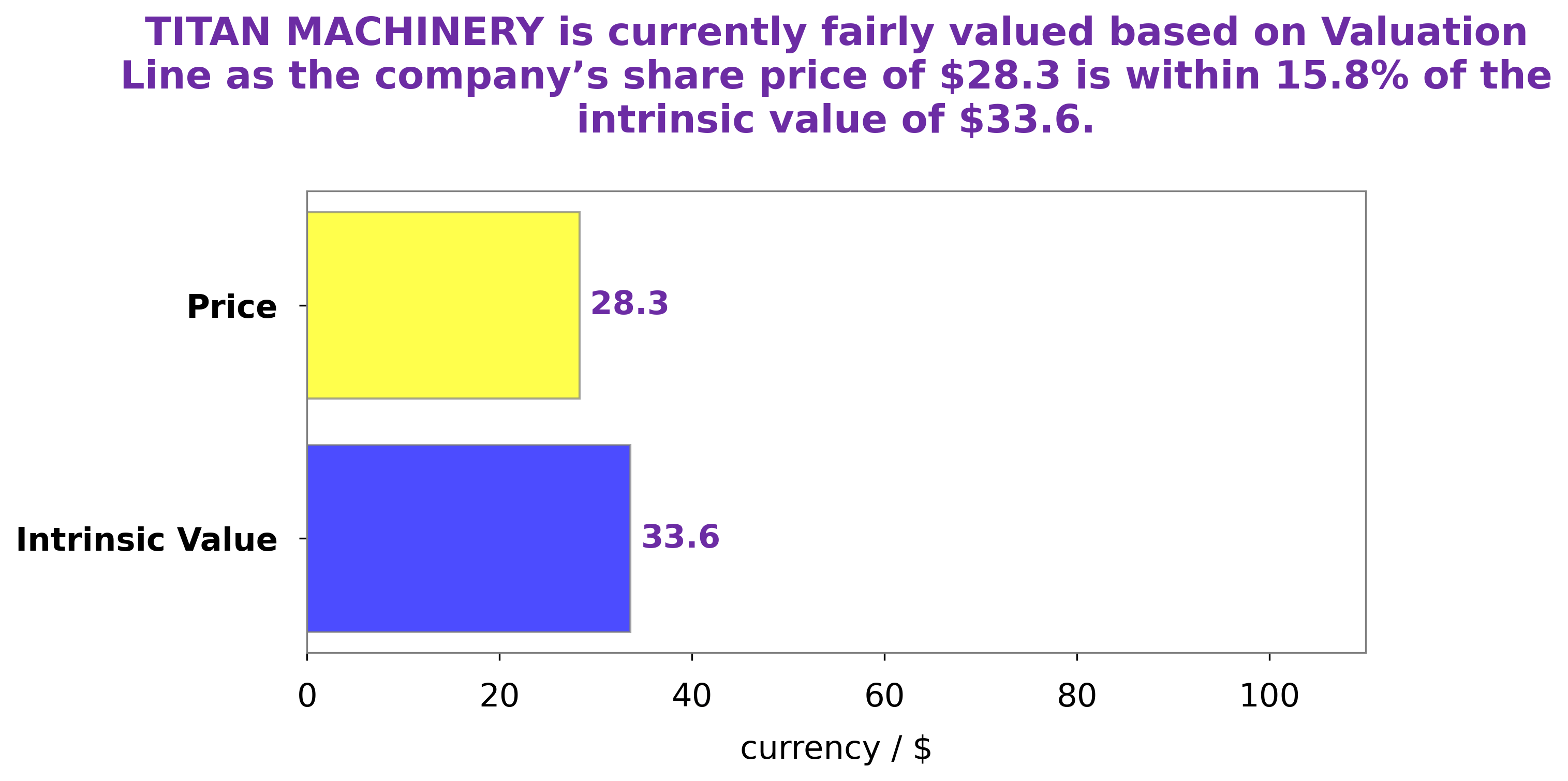

In response to the earnings announcement, TITAN MACHINERY‘s stock opened at $35.0 and closed at $28.3, plunge 18.6% from its prior closing price of 34.8. Despite the negative reaction, analysts are still bullish on the stock, noting its strong fundamentals and long-term outlook. Live Quote…

Analysis – Titan Machinery Intrinsic Value Calculation

At GoodWhale, we have conducted an analysis of the wellbeing of TITAN MACHINERY. Through our proprietary Valuation Line, we have arrived at a fair value for TITAN MACHINERY share to be around $33.6. This presents a great opportunity for investors to capitalize on and buy the stock at a significant discount. More…

Peers

Its main competitors are Narasaki Sangyo Co Ltd, Finning International Inc, and Ferronordic AB. These companies are all leaders in the heavy equipment industry, and they all compete for market share.

– Narasaki Sangyo Co Ltd ($TSE:8085)

Narasaki Sangyo Co Ltd is a Japanese company that manufactures and sells chemicals, plastics, and other industrial products. The company has a market cap of 8.44B as of 2022 and a Return on Equity of 8.36%. Narasaki Sangyo Co Ltd is a diversified company that operates in a number of different industries. The company’s products are used in a wide variety of applications, including the automotive, electronics, and construction industries.

– Finning International Inc ($TSX:FTT)

Finning International Inc is a world leader in the sale, service and rental of Caterpillar equipment for the construction, forestry, mining and energy sectors. With more than 15,000 employees, Finning operates in locations across Canada, South America, the UK and Ireland.

– Ferronordic AB ($LTS:0RVG)

Ferronordic AB is a Swedish company that sells, rents, and services construction equipment in the Nordic and Russian regions. The company has a market capitalization of 478.12 million as of 2022 and a return on equity of 19.37%. Ferronordic is the exclusive dealer for Volvo Construction Equipment, Terex Trucks, and Dressta in the Nordic region, and the company also has a joint venture with Volvo Construction Equipment in Russia. Ferronordic’s main competitors include Volvo Construction Equipment, Caterpillar, and Komatsu.

Summary

Titan Machinery recently reported their GAAP EPS of $1.19 and revenue of 569.6M. The stock price fell on the same day, making it a potential attractive investment opportunity for value investors. An analysis of Titan Machinery suggests that strong sales and revenue growth are likely to continue into the near future. While cost cutting initiatives could push up operating margin, the main challenge facing the company is competition.

Titan Machinery’s market share is being challenged by its competitors which could have an impact on revenues. Investors should also assess whether the company has strong cash flows, good management, and a competitive advantage to succeed in the long-term. As with any investment, investors must do their own research to determine if Titan Machinery is a good fit for their portfolio.

Recent Posts