Finning International (TSX:FTT) Crosses Above 200-Day Moving Average, Marks Milestone

January 28, 2023

Trending News 🌥️

Finning International ($TSX:FTT) Inc (TSX:FTT) has crossed above their 200-day moving average of $29.45, marking a milestone for the stock. Finning International is a world leading provider of heavy equipment, engines and related services for the mining, construction, forestry, power systems and industrial markets. The 200-day moving average is a widely followed indicator that measures the average price of a stock over a period of 200 days. This milestone is a sign of strength in the stock and indicates that the underlying trend is positive. Investors often use the 200-day moving average as a tool to determine whether a stock is in an uptrend or downtrend. This is likely due to its focus on customer service and product innovation. Finning International has been able to keep up with industry trends by investing in new technologies and expanding its reach.

It also provides a wide range of services, including financing and parts and service support. These services have helped to drive revenue growth and customer loyalty. The stock’s recent surge above the 200-day moving average is a sign of strength and indicates that the underlying trend is positive. As Finning International continues to invest in innovation and expand its reach, the company is likely to continue to grow and remain a leader in its industry. Investors may want to consider adding the stock to their portfolios as it continues to move above the 200-day moving average.

Share Price

So far, news sentiment about the crossing has been mostly positive, as it could signal a strong performance for the company in the coming months. At the start of trading on Monday, FINNING INTERNATIONAL stock opened at CA$36.8 and closed at CA$36.6, up by 0.1% from its previous closing price of 36.6. This was the first time since early February that the company’s stock had crossed above the 200-day moving average. The 200-day moving average is a widely used technical indicator of a stock’s health and performance. The average is calculated by taking the average of stock prices over the last 200 trading days.

If a stock’s price moves above the average, it can indicate that the company’s stock is performing better than it had been in the past. The crossing of FINNING INTERNATIONAL’s 200-day moving average is an encouraging sign for investors in the company. It suggests that the company’s stock may be in a period of sustained growth and could be poised to rise further in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Finning International. More…

| Total Revenues | Net Income | Net Margin |

| 8.57k | 471 | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Finning International. More…

| Operations | Investing | Financing |

| -216 | -228 | -20 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Finning International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.02k | 4.58k | 15.08 |

Key Ratios Snapshot

Some of the financial key ratios for Finning International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.4% | 18.0% | 8.2% |

| FCF Margin | ROE | ROA |

| -4.1% | 18.4% | 6.2% |

VI Analysis

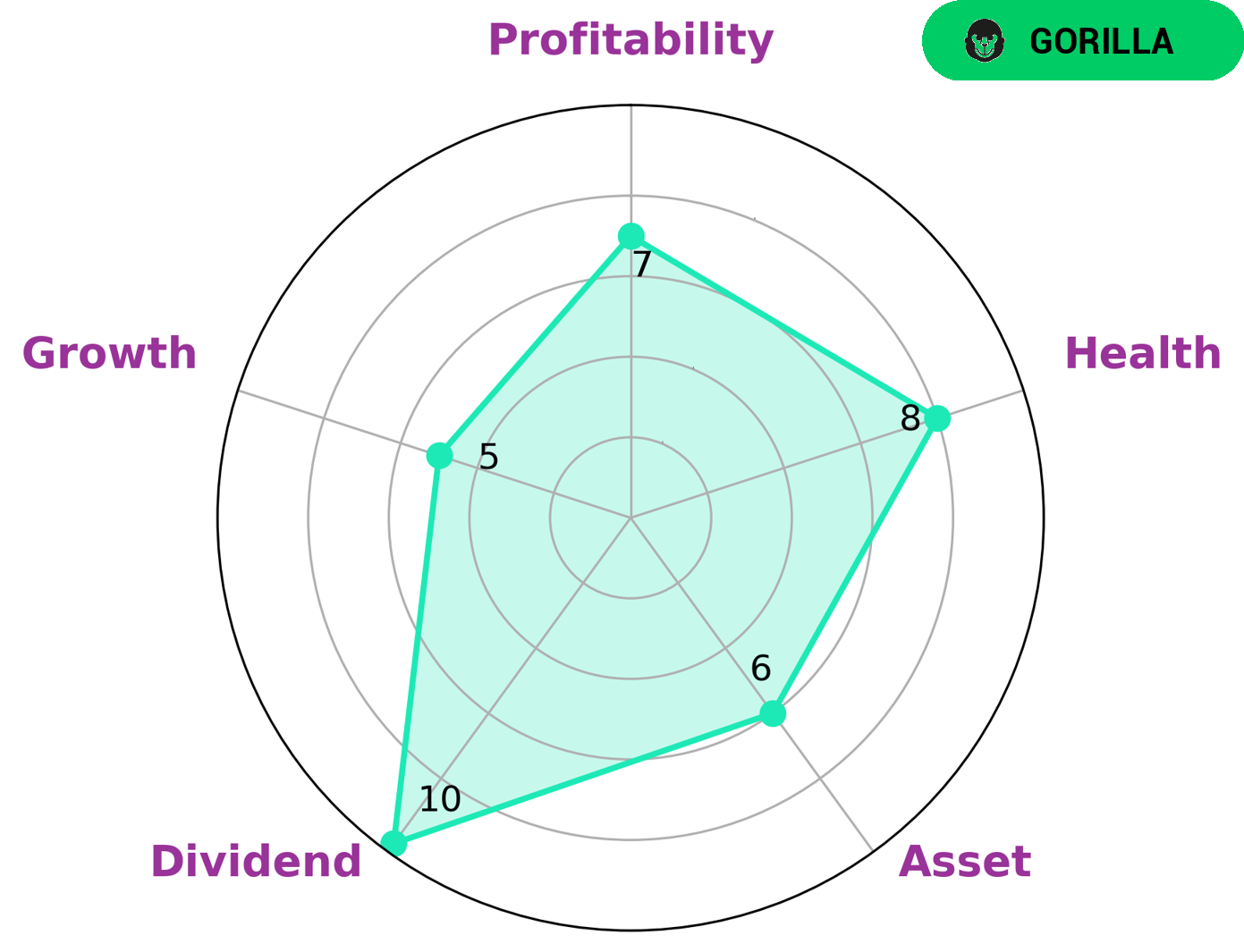

FINNING INTERNATIONAL is classified as a ‘gorilla’ company, which is characterized by its strong competitive advantage and stable and high revenue or earnings growth. Investors who may be interested in this company include those who are looking for steady dividend payments and a strong return on their investments. Analysing the company’s fundamentals with the VI app reveals that FINNING INTERNATIONAL has a high health score of 8/10, which indicates that it has the capability to pay off its debts and fund future operations. It is also strong in dividend and profitability, while it has a relatively medium score in asset and growth. This suggests that the company has a strong potential for long-term growth. For investors looking for a company with consistent dividend payments and a strong return on their investments, FINNING INTERNATIONAL is an excellent choice. Its fundamentals indicate that it is capable of paying off its debts and funding its future operations, and its strong competitive advantage promises long-term growth potential. More…

VI Peers

The competition between Finning International Inc and its competitors – Titan Machinery Inc, Hoe Leong Corp Ltd, and XCMG Construction Machinery Co Ltd – is fierce. They are all vying for the top spot in the heavy equipment industry, offering a wide range of products and services to their customers. Each of these companies has a distinct strategy that sets them apart from the competition, but their ultimate goal is to be the industry leader.

– Titan Machinery Inc ($NASDAQ:TITN)

Titan Machinery Inc is a leading global manufacturer and retailer of agricultural and construction equipment. The company has a market cap of 873.31 million as of 2022, making it one of the largest companies in its sector. Its Return on Equity (ROE) of 18.58% is also impressive, indicating that the company’s management is able to generate high returns on its invested capital. The company operates a network of stores and service centers across various states in the US and has established a strong presence in the agricultural and construction equipment markets.

– Hoe Leong Corp Ltd ($SGX:H20)

Hoe Leong Corp Ltd is a Singapore-based publicly listed company that specializes in the design, manufacture and supply of original equipment and aftermarket parts, components and systems for the agricultural, construction and industrial machinery industries. As of 2022, the company has a market cap of 41.25M and a Return on Equity of 6.03%. The market capitalization of Hoe Leong Corp Ltd is an indication of its size and value, while its Return on Equity (ROE) is an indicator of its profitability and financial stability.

– XCMG Construction Machinery Co Ltd ($SZSE:000425)

XCMG Construction Machinery Co Ltd is a Chinese construction machinery manufacturer, producing a variety of heavy machinery used in construction projects around the world. The company has a market capitalization of 61.8 billion dollars as of 2022 and a Return on Equity of 6.21%. This indicates that the company is performing well and is a strong investment for those looking to diversify their portfolio. XCMG specializes in the production of hydraulic excavators, wheeled loaders, and cranes, making it a go-to choice for construction companies in need of reliable equipment.

Summary

Finning International (TSX:FTT) recently crossed above its 200-day moving average, marking a milestone for the company. Analysts have generally been positive on Finning International’s prospects, with a few expressing concern over its long-term growth. Finning International is an international distributer of Caterpillar equipment and parts, providing services to customers in the construction, mining, and energy industries. Finning International has a strong balance sheet and cash flow, making it an attractive investment opportunity for investors looking for long-term returns.

Recent Posts