Ferguson Plc Stock Fair Value Calculation – Fourteen Research Firms Give ‘Moderate Buy’ Recommendation for Ferguson Plc Shares

May 27, 2023

Trending News ☀️

Ferguson ($NYSE:FERG) plc is a leading manufacturer and distributor of plumbing and heating goods, operating in the United States and United Kingdom. The company is listed on the London Stock Exchange and currently has fourteen research firms covering its stock. This week, these firms have given Ferguson plc a consensus recommendation of “Moderate Buy”. The recommendation from the research firms is a positive indicator for investors.

Not only does it suggest that the current market price for Ferguson plc shares is attractive, but it also signals that analysts believe the company’s prospects are good and that it has the potential to generate strong returns for shareholders. Given the favourable outlook from analysts, investors should continue to have confidence in the stock. Although it will be important to pay attention to any potential changes in the company’s performance or outlook, now could be an attractive time to invest in Ferguson plc.

Share Price

On Friday, shares of FERGUSON PLC opened at $145.2 and closed at $147.7, up by 2.6% from the last closing price of $143.9. This recommendation was given after taking into consideration the market trends, company performance, financials, and industry outlook for FERGUSON PLC. The ‘Moderate Buy’ rating is indicative of the fact that the research firms believe that the stock will perform moderately well over the short-term, but may not be as profitable as other stocks in the long-term.

The research firms also noted that the stock of FERGUSON PLC is attractive for investors looking for mid- to long-term gains, as well as income investors searching for reliable dividend payments. Overall, FERGUSON PLC seems to be gaining momentum among research firms, and this could potentially result in further increase in stock prices in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ferguson Plc. More…

| Total Revenues | Net Income | Net Margin |

| 30.01k | 2.1k | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ferguson Plc. More…

| Operations | Investing | Financing |

| 2.09k | -1k | -1.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ferguson Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.22k | 10.49k | 24.79 |

Key Ratios Snapshot

Some of the financial key ratios for Ferguson Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.7% | 26.3% | 9.7% |

| FCF Margin | ROE | ROA |

| 5.6% | 35.4% | 11.9% |

Analysis – Ferguson Plc Stock Fair Value Calculation

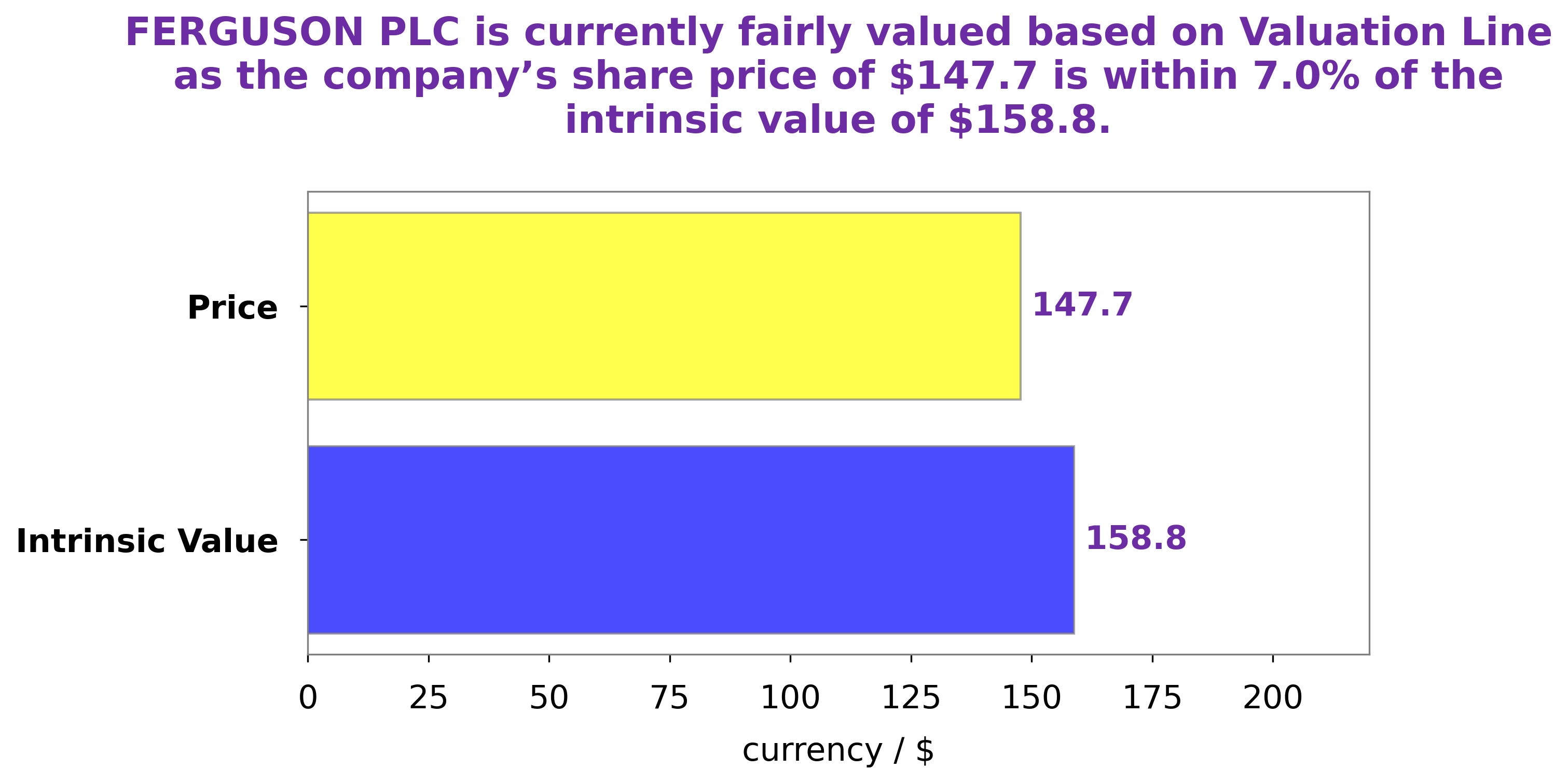

At GoodWhale, we have conducted an extensive analysis of the wellbeing of FERGUSON PLC. Using our proprietary Valuation Line, we have estimated that the fair value of FERGUSON PLC’s share is around $158.8. However, this is currently undervalued in the market, as the share is currently being traded at $147.7. This is a fair price that is 7.0% below the estimated fair value. More…

Peers

The company operates through two segments, Wholesale and Retail. The Wholesale segment involves the distribution of plumbing and heating products to professional contractors, builders, and industrial customers. The Retail segment involves the sale of plumbing and heating products to do-it-yourself consumers through company-operated stores. The company was founded in 1884 and is headquartered in London, the United Kingdom. Ferguson’s competitors include W.W. Grainger Inc, Watsco Inc, and Fastenal Co. These companies also engage in the distribution of plumbing and heating products.

– W.W. Grainger Inc ($NYSE:GWW)

W.W. Grainger is a Fortune 500 company and one of the largest suppliers of maintenance, repair, and operating products in the United States. The company has a market cap of $30.17 billion and a return on equity of 58.61%. Grainger’s products are used in a variety of industries, including manufacturing, healthcare, government, and education. The company operates through a network of over 1,700 branches and distribution centers across the United States.

– Watsco Inc ($NYSE:WSO)

Watsco is one of the world’s largest manufacturers and distributors of air conditioning, heating and refrigeration equipment. The company has a market cap of 10.72B as of 2022 and a return on equity of 27.3%. Watsco products are used in residential, commercial and industrial applications. The company’s products are sold under the brands Carrier, Bryant, Payne, Honeywell and Trane.

– Fastenal Co ($NASDAQ:FAST)

The company has a market cap of 29.59B as of 2022 and a Return on Equity of 28.04%. The company is engaged in the business of manufacturing and distributing fasteners and other industrial and construction supplies. The company operates through two segments: Industrial and Construction. The Industrial segment offers fasteners, tools, and other supplies for use in manufacturing, repairs, and maintenance applications. The Construction segment provides fasteners and other supplies used by professional contractors in the construction of commercial, institutional, and industrial buildings.

Summary

Investors looking to invest in Ferguson plc may be encouraged by the consensus recommendation from fourteen research firms, which is “Moderate Buy”. This suggests that analysts have a positive outlook for the company and that it could potentially provide a good return. Investing in Ferguson plc may be appropriate for those looking to diversify their portfolios, or for those who are seeking a stock with good potential growth. However, investors should always conduct their own research into factors such as financials, competitive landscape, and management before investing.

Recent Posts