EVI Industries Inc Stock Takes a Hit, Losing -7.03% This Week.

February 9, 2023

Trending News 🌧️

EVI ($NYSEAM:EVI) Industries Inc (EVI) has seen its stock take a hit this week, losing -7.03% over the last five trading days. This has led many investors to ask: Should they be paying attention to EVI Industries Inc after its 7.03% dip this week? Its products are used in a variety of industries, including automotive, aerospace, defense, and medical. Investors are optimistic that the stock will continue to increase in value as the company continues to grow. The company’s recent earnings report showed a strong performance, with total sales increasing by 10% year-over-year. This was driven by strong demand for its products in the automotive, aerospace and defense industries.

Additionally, the company has announced plans to expand into new markets, which could potentially lead to further growth. Its strong performance over the past year and recent expansion plans could bode well for the company’s future performance. Investors may want to look into EVI Industries Inc and consider whether or not it is a suitable investment for their portfolio.

Share Price

Media coverage of the company is mostly mixed right now. On Friday, the stock opened at $21.0 and closed at $22.3, up by 2.6% from its previous closing price of 21.7.

However, investors should take the long-term view and not be too concerned with short-term fluctuations. It is important to remember that the stock market is made up of many different companies and sectors, and one can find both winners and losers in any given week. EVI Industries Inc is no exception and they are well-positioned to recover from this setback in the future. Investors should look at the fundamentals of the company, such as their balance sheet, income statement, and cash flow statement to assess their financial health and decide whether to invest in their stock or not. It is also important to take into account any news or announcements that the company has made recently, as this can have an impact on the stock price. In conclusion, EVI Industries Inc has had a tough week with a -7.03% decline in their stock price but this should not be cause for alarm in the long run. Investors should look at the fundamentals of the company and keep an eye on any news or announcements they make before making any investment decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Evi Industries. More…

| Total Revenues | Net Income | Net Margin |

| 287 | 4.33 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Evi Industries. More…

| Operations | Investing | Financing |

| 2.33 | -17.08 | 15.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Evi Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 241.05 | 119.84 | 9.68 |

Key Ratios Snapshot

Some of the financial key ratios for Evi Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.1% | 5.7% | 2.8% |

| FCF Margin | ROE | ROA |

| -0.5% | 4.2% | 2.1% |

Analysis

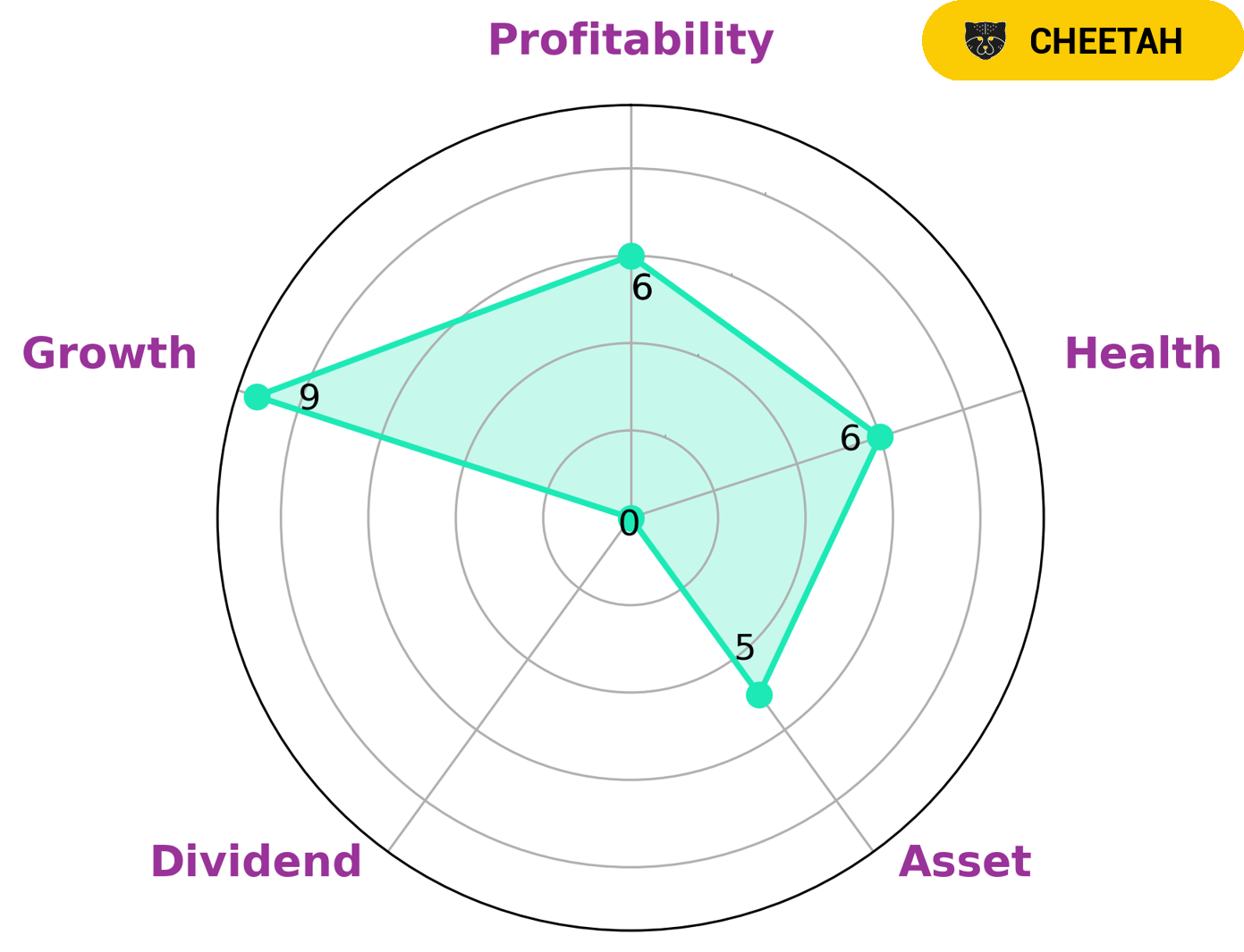

EVI INDUSTRIES has been classified as a ‘cheetah’ by GoodWhale’s Star Chart due to its high revenue or earnings growth but lower profitability. This type of company may be attractive to investors looking for a high-growth opportunity, as well as those who are comfortable with taking on more risk. EVI INDUSTRIES is particularly strong in terms of its growth prospects, but is considered to be medium in terms of its asset, profitability, and dividend. Although the company may not offer the highest returns, it is likely to pay off debt and fund future operations, as evidenced by its intermediate health score of 6/10. In addition to its financial performance, investors may also be interested in EVI INDUSTRIES’ competitive advantages and management team. As the company competes in a rapidly changing industry, it is important to understand how the firm has been able to stay ahead of the competition. Moreover, the success of any business depends largely on the leadership driving it, so investors should take an in-depth look at the company’s management team before investing. Ultimately, EVI INDUSTRIES offers investors an opportunity to invest in a high-growth company, albeit with higher risk. Investors should carefully weigh their options before investing and consider all aspects of the business, including its financial performance, competitive advantages, and management team. More…

Peers

EVI Industries Inc. is a leading provider of metal and plastic solutions in North America and Europe. The company operates in three segments: metals, plastics, and industrial services. It offers a broad range of products and services to customers in a variety of industries, including automotive, construction, energy, aerospace, and healthcare. The company has a strong competitive position in its markets and is well-positioned to continue to grow its business.

– A.M. Castle & Co ($OTCPK:CTAM)

A.M. Castle & Co. is a publicly traded company with a market capitalization of 363.48k as of 2022. The company has a return on equity of 93.07%. A.M. Castle & Co. is a provider of metal and plastic solutions, serving a customer base that includes the aerospace, medical and energy markets, among others.

– Global Industrial Co ($NYSE:GIC)

Global Industrial Co is a leading industrial company with a market cap of 1.09B and a ROE of 40.59%. The company operates in a variety of industries, including manufacturing, logistics, and distribution. It has a strong presence in the United States, Europe, and Asia. Global Industrial Co is a publicly traded company on the New York Stock Exchange.

– Toromont Industries Ltd ($TSX:TIH)

Toromont Industries Ltd is a diversified industrial company that operates in three main business segments: Equipment Group, Cimco Refrigeration, and Enerflex. The Equipment Group segment supplies and rents heavy equipment for the construction, mining, and forestry industries in Canada, the United States, and South America. The Cimco Refrigeration segment manufactures and rents industrial refrigeration products and systems for the food processing, chemical, and petroleum industries worldwide. The Enerflex segment provides natural gas compression, process, and power equipment for the oil and gas industry in Canada, the United States, South America, Europe, the Middle East, Africa, and Asia.

Summary

EVI Industries Inc. has experienced some losses this week, with its stock dropping by 7.03%. Reaction to the company from the media has been somewhat mixed. As a potential investor, it is important to do your own research and analysis into EVI Industries Inc. before investing. Look into the company’s financials, its competitive advantage, and other factors that may influence its performance.

Consider how much risk you are willing to take and if the stock is a good fit for your investment portfolio. Ultimately, the decision to invest in EVI Industries Inc. is up to you.

Recent Posts