Applied Industrial Technologies Faces Financial Struggle and Labor Cost Concerns, Investors Advised to Stay Away

October 15, 2024

🌧️Trending News

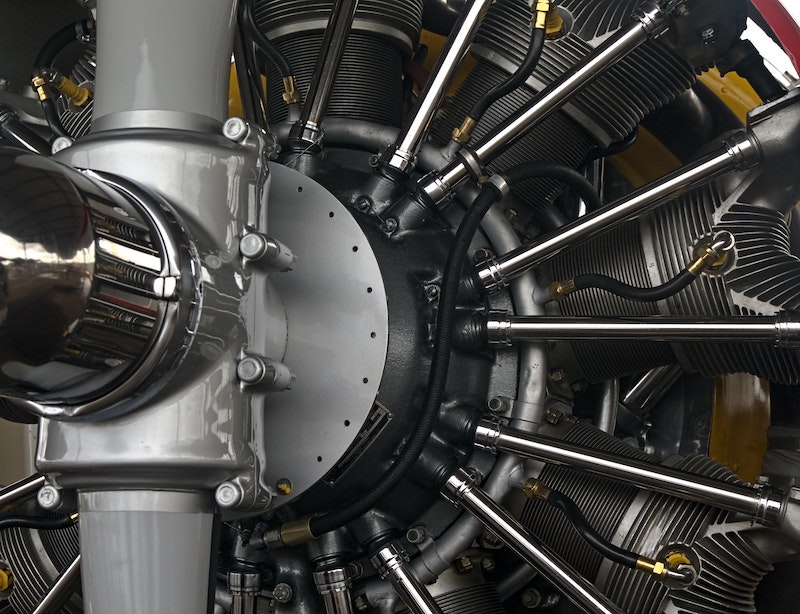

APPLIED INDUSTRIAL TECHNOLOGIES ($NYSE:AIT), also known as Applied Industrial, is a global distributor of industrial products and services. They offer a wide range of products including bearings, power transmission components, fluid power components, and systems, as well as general maintenance and repair supplies. The company serves a variety of industries such as agriculture, food and beverage, manufacturing, and mining. Despite its long-standing presence in the industrial market, Applied Industrial Technologies currently faces a difficult financial situation. As a result, investors are being advised to steer clear of the company’s stock at the moment. One of the main reasons for this warning is the company’s weak performance in the Engineered Solutions segment. This segment provides customized solutions for complex industrial challenges and has historically been a strong source of revenue for Applied Industrial.

However, in recent years, it has been experiencing a decline in sales and profitability. The primary culprit behind this decline is the high labor expenses associated with providing these customized solutions. As the company strives to meet the specific needs of each customer, it often requires a significant amount of labor to design and implement these solutions. This has resulted in lower profit margins and ultimately threatens the overall financial stability of Applied Industrial. In addition to this issue, the company’s overall financial performance has also been impacted by the current economic climate. The ongoing trade tensions and market volatility have affected many of the industries that Applied Industrial serves, leading to a decrease in demand for their products and services. The company’s financial struggles and labor cost concerns may continue to hinder its performance in the near future. However, it is worth monitoring the company’s efforts to improve its financial stability and address these issues before making any long-term investment decisions.

Price History

APPLIED INDUSTRIAL TECHNOLOGIES, a leading distributor of industrial parts and supplies, has recently been facing financial struggles and concerns over labor costs. This has led to a decrease in investor confidence, with experts advising investors to stay away from the company’s stock. On Wednesday, APPLIED INDUSTRIAL TECHNOLOGIES’ stock opened at $220.15 and closed at $221.88, showing a slight increase of 0.79% from the previous closing price of $220.14. While this may seem like a positive sign, it is important to note that the stock price has been on a downward trend in recent months. One of the main factors contributing to the company’s financial struggles is the increasing labor costs. As with many industries, APPLIED INDUSTRIAL TECHNOLOGIES has been faced with rising minimum wage laws and other labor-related expenses. This has put a strain on their bottom line and has raised concerns among investors. Additionally, the company has been struggling to meet revenue targets and has reported lower-than-expected earnings in recent quarters. This has further dampened investor confidence in the company’s performance. The current economic climate and uncertainty surrounding trade policies have also impacted APPLIED INDUSTRIAL TECHNOLOGIES’ business. With tariffs and trade tensions affecting the industrial sector, the company’s sales have been impacted, adding to their financial struggles. With these challenges facing the company, investors are being advised to steer clear of APPLIED INDUSTRIAL TECHNOLOGIES’ stock. While the short-term outlook may seem uncertain, it is important to note that the company has a strong track record and a solid foundation.

However, until there is a significant improvement in their financial performance and labor cost concerns are addressed, it may be wise for investors to wait on the sidelines. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AIT. More…

| Total Revenues | Net Income | Net Margin |

| 4.46k | 374.46 | 8.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AIT. More…

| Operations | Investing | Financing |

| 423.11 | -53.46 | -126.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AIT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.78k | 1.17k | 39.63 |

Key Ratios Snapshot

Some of the financial key ratios for AIT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.5% | 34.7% | 11.1% |

| FCF Margin | ROE | ROA |

| 9.0% | 20.1% | 11.1% |

Analysis

Based on its Star Chart classification, APPLIED INDUSTRIAL TECHNOLOGIES falls under the ‘gorilla’ category, indicating that it has achieved stable and high revenue or earning growth due to its strong competitive edge in the market. This makes it an attractive option for investors looking for steady returns. In terms of financial health, APPLIED INDUSTRIAL TECHNOLOGIES scores a perfect 10 out of 10. This is due to its strong cashflows and low debt levels, indicating that it is well-equipped to weather any potential financial crises in the future. This is an important factor for investors to consider, as it shows the company’s ability to sustain its operations even in difficult times. One of the key strengths of APPLIED INDUSTRIAL TECHNOLOGIES is its assets. The company has a solid asset base, which is crucial for its continued growth and success. Additionally, APPLIED INDUSTRIAL TECHNOLOGIES also scores well in the areas of dividend, growth, and profitability. This further adds to its appeal for investors, as it demonstrates the company’s ability to generate returns and drive growth. Overall, I believe that APPLIED INDUSTRIAL TECHNOLOGIES would be an excellent choice for investors looking for a stable and strong company with a competitive advantage. Its impressive financial health and performance in key areas make it a desirable investment option for those seeking long-term returns. More…

Peers

Applied Industrial Technologies Inc is in competition with Wajax Corp, Ohashi Technica Inc, and TAT Technologies Ltd. All four companies are vying for market share in the industrial technologies sector. Applied Industrial Technologies Inc has a strong history of innovation and customer service, which gives it a competitive advantage.

– Wajax Corp ($TSX:WJX)

Wajax is a leading provider of industrial products and services in Canada. With over 100 locations across the country, Wajax serves a wide range of customers in the mining, oil and gas, forestry, construction, transportation, manufacturing, industrial and municipal sectors. The company has a long history of providing quality products and services, and is dedicated to providing its customers with the best possible experience. Wajax has a market cap of 378.35M as of 2022, and a Return on Equity of 15.27%.

– Ohashi Technica Inc ($TSE:7628)

Ohashi Technica Inc is a Japanese company that manufactures and sells machinery and equipment. It has a market capitalization of 18.92 billion as of 2022 and a return on equity of 4.44%. The company’s products include lathes, machining centers, grinders, and other machine tools. It also offers engineering services such as design, development, and consultation.

– TAT Technologies Ltd ($NASDAQ:TATT)

TAT Technologies Ltd is an aerospace and defense company that provides products and services to the aviation, aerospace, and defense industries. The company has a market cap of $56.27 million and a return on equity of -3.57%. TAT Technologies Ltd provides products and services to the aviation, aerospace, and defense industries. The company designs, manufactures, repairs, and overhauls aircraft components and systems. It also provides engineering, technical, and aftermarket services.

Summary

Investors should avoid investing in Applied Industrial Technologies, Inc. due to its current financial instability attributed to weakness in the Engineered Solutions segment. The company is facing challenges due to elevated labor costs which are impacting its profitability. These factors make it a risky investment at the moment. It is advisable for investors to wait and monitor the company’s financial performance before considering investing in it.

Recent Posts