AIT Stock Intrinsic Value – CI Investments Invests $57000 in Applied Industrial Technologies,

June 24, 2023

🌥️Trending News

CI Investments Inc. has recently made a bold investment decision – they have invested $57000 in Applied Industrial Technologies ($NYSE:AIT), Inc. Applied Industrial Technologies, Inc. is a publicly-traded company listed on the New York Stock Exchange and the Toronto Stock Exchange. The company is a global leader in industrial parts and supplies, providing customers with products and services designed to improve efficiency and productivity. Applied Industrial Technologies, Inc. offers a wide range of products, including mechanical components, power transmission, fluid power, bearings, electrical control components, and industrial supplies. They also provide value-added services such as product engineering and technical support.

Share Price

On Tuesday, CI Investments Inc. made a strategic investment of $57000 in Applied Industrial Technologies, Inc. The company’s stock opened at $128.5 and closed at $128.0, indicating a slight 0.1% decrease from its previous closing price of 128.1. This investment is one of several recent investments CI Investments Inc. has made in order to expand their portfolio and diversify their holdings. It is a reflection of the confidence they have in the success of Applied Industrial Technologies, Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AIT. More…

| Total Revenues | Net Income | Net Margin |

| 4.32k | 333.64 | 7.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AIT. More…

| Operations | Investing | Financing |

| 217.77 | -62.08 | -161.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AIT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.61k | 1.23k | 33.57 |

Key Ratios Snapshot

Some of the financial key ratios for AIT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.2% | 23.0% | 10.5% |

| FCF Margin | ROE | ROA |

| 4.4% | 21.8% | 10.8% |

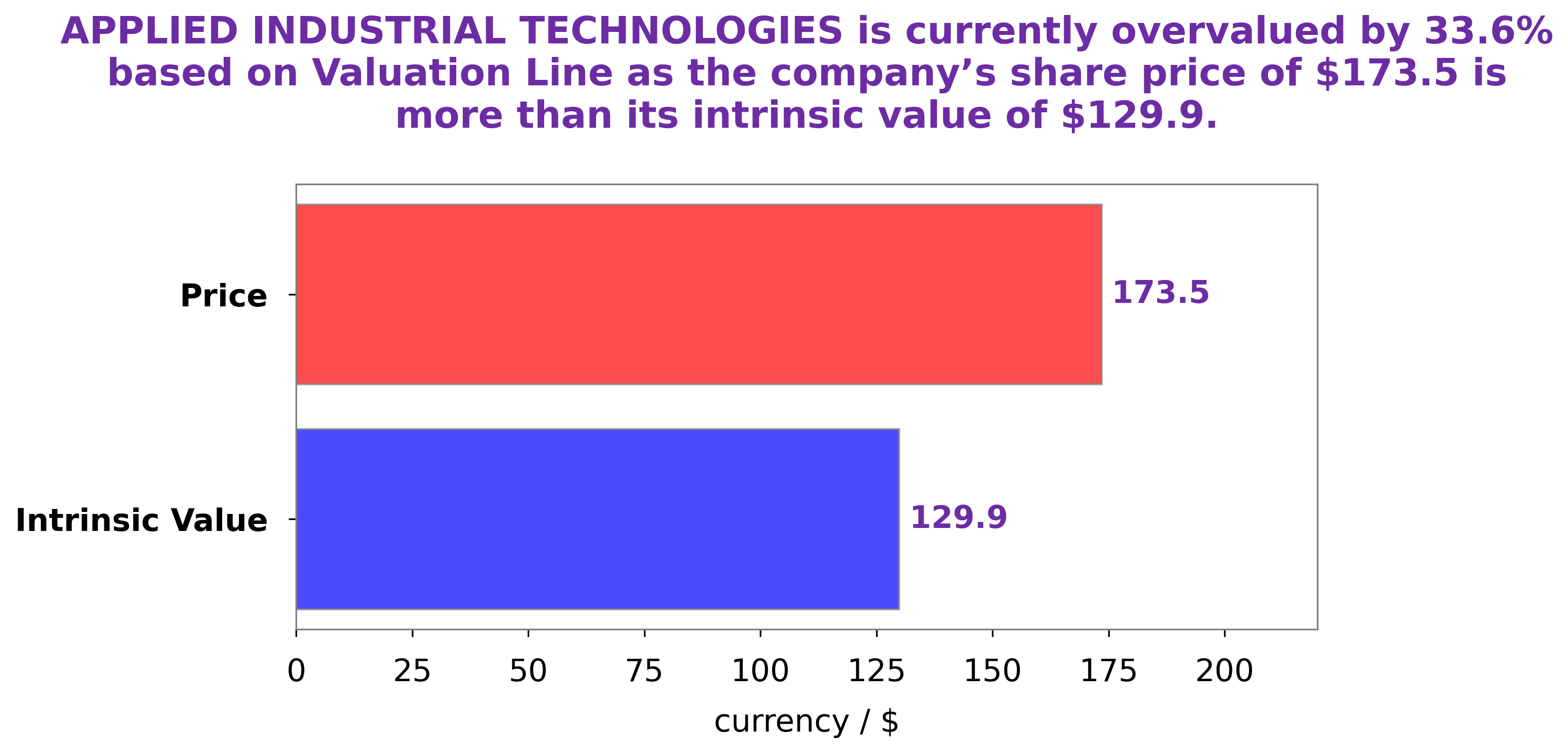

Analysis – AIT Stock Intrinsic Value

After analyzing APPLIED INDUSTRIAL TECHNOLOGIES’s fundamentals, we at GoodWhale have determined that its intrinsic value is around $115.6. This was calculated using our proprietary Valuation Line. Currently, APPLIED INDUSTRIAL TECHNOLOGIES stock is trading at a fair price of $128.0, which is overvalued by 10.8%. As such, investors looking to invest in this stock should consider doing so with caution, as it may not provide the best return on investment. More…

Peers

Applied Industrial Technologies Inc is in competition with Wajax Corp, Ohashi Technica Inc, and TAT Technologies Ltd. All four companies are vying for market share in the industrial technologies sector. Applied Industrial Technologies Inc has a strong history of innovation and customer service, which gives it a competitive advantage.

– Wajax Corp ($TSX:WJX)

Wajax is a leading provider of industrial products and services in Canada. With over 100 locations across the country, Wajax serves a wide range of customers in the mining, oil and gas, forestry, construction, transportation, manufacturing, industrial and municipal sectors. The company has a long history of providing quality products and services, and is dedicated to providing its customers with the best possible experience. Wajax has a market cap of 378.35M as of 2022, and a Return on Equity of 15.27%.

– Ohashi Technica Inc ($TSE:7628)

Ohashi Technica Inc is a Japanese company that manufactures and sells machinery and equipment. It has a market capitalization of 18.92 billion as of 2022 and a return on equity of 4.44%. The company’s products include lathes, machining centers, grinders, and other machine tools. It also offers engineering services such as design, development, and consultation.

– TAT Technologies Ltd ($NASDAQ:TATT)

TAT Technologies Ltd is an aerospace and defense company that provides products and services to the aviation, aerospace, and defense industries. The company has a market cap of $56.27 million and a return on equity of -3.57%. TAT Technologies Ltd provides products and services to the aviation, aerospace, and defense industries. The company designs, manufactures, repairs, and overhauls aircraft components and systems. It also provides engineering, technical, and aftermarket services.

Summary

CI Investments Inc. has recently made a $57000 investment in Applied Industrial Technologies, Inc. The company is a global distributor of motion control and bearing products, fluid power components, and other industrial supplies. The stock is expected to benefit from an increased demand for its products from manufacturers and other industries. Additionally, Applied Industrial Technologies is well positioned to capitalize on the growing trend towards automation and digitalization. Overall, the investment is seen as a positive sign for Applied Industrial Technologies and could help bolster its market share.

Recent Posts