Reckitt Benckiser Intrinsic Stock Value – RECKITT BENCKISER to Lead Vitamin D Deficiency Treatment Industry with Highest CAGR by 2030

May 27, 2023

Trending News ☀️

Reckitt Benckiser ($LSE:RKT) is a leading consumer goods company that has been operating in many countries around the world. It has a long history and established itself as a well-known and respected brand in the consumer industry. Recently, the Vitamin D Deficiency Treatment Industry is on the rise and is projected to have the highest Compound Annual Growth Rate by 2030. This industry is expected to dominate the market due to its increasing demand for its services and products. Reckitt Benckiser is poised to play an important role in this industry as it has the resources and experience to lead it.

The company has a wide portfolio of products and services related to Vitamin D Deficiency Treatment, such as nutritional supplements, food products, and pharmaceuticals. It is also investing in research and development for new products and services that can help improve its efficiency and effectiveness in treating Vitamin D Deficiency. It has also established a strong presence in various markets, giving it an edge over its competitors. With its dedicated team of experts, Reckitt Benckiser can continue to provide high-quality solutions for treating Vitamin D Deficiency, helping to make the industry more profitable and successful in the future.

Price History

On Friday, RECKITT BENCKISER stock opened at £63.4 and closed at £64.2, up by 0.8% from prior closing price of 63.6. This slight increase in stock price is an indication of the market’s increasing confidence in Reckitt Benckiser’s ability to lead the industry. Reckitt Benckiser has long been involved in the consumer health and hygiene sector, and it is no surprise that the company has now set their sights on the ever-growing vitamin D deficiency treatment sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Reckitt Benckiser. More…

| Total Revenues | Net Income | Net Margin |

| 14.45k | 2.33k | 16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Reckitt Benckiser. More…

| Operations | Investing | Financing |

| 2.4k | -139 | -2.38k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Reckitt Benckiser. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.74k | 19.26k | 12.47 |

Key Ratios Snapshot

Some of the financial key ratios for Reckitt Benckiser are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | -0.5% | 23.0% |

| FCF Margin | ROE | ROA |

| 13.5% | 22.6% | 7.2% |

Analysis – Reckitt Benckiser Intrinsic Stock Value

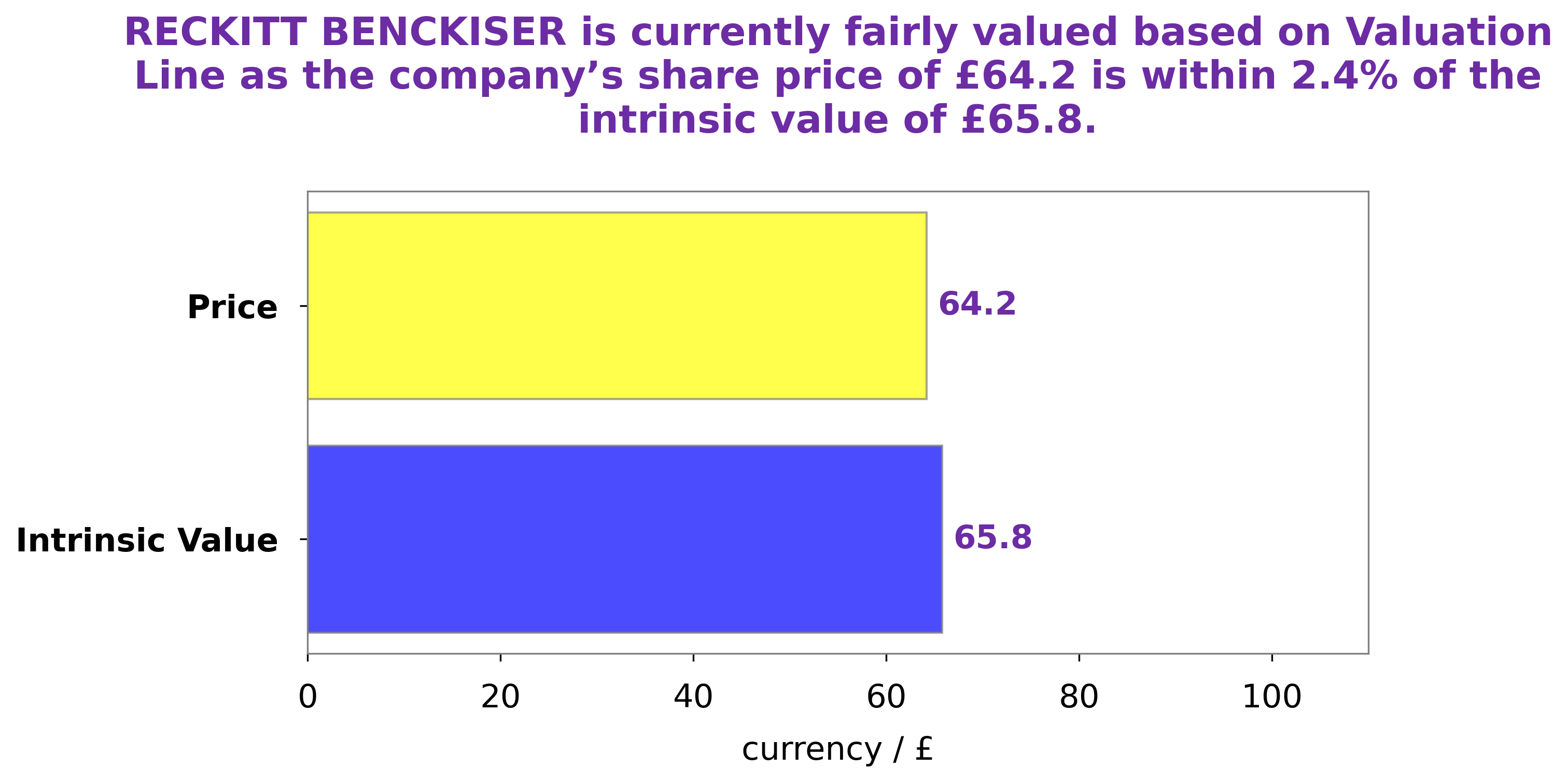

At GoodWhale, we analyzed RECKITT BENCKISER’s financials and our proprietary Valuation Line indicates that the fair value of RECKITT BENCKISER share is around £65.8. However, the current trading price of RECKITT BENCKISER stock sits at £64.2, which is a fair price undervalued by 2.5%. For investors who are looking to enter the market or add RECKITT BENCKISER to their portfolio, this may represent a great buying opportunity. More…

Peers

It is one of the world’s leading consumer goods companies and is in direct competition with other major players such as Anagenics Ltd, Halo Food Co Ltd, and Hindustan Unilever Ltd. All four companies have a strong presence in the global market and are continuously striving to provide customers with the best products and services.

– Anagenics Ltd ($ASX:AN1)

Anagenics Ltd is a biotechnology company that specializes in the research and development of novel therapeutics to treat neurological disorders. With a market cap of 5.53M as of 2022, the company is relatively small when compared to its competitors. Despite this, Anagenics Ltd has produced a negative return on equity of -23.53%, indicating that the company’s shareholders are not benefitting from their investment. This low ROE could be due to several factors, such as the company not having sufficient profits or the company being in a highly competitive market.

– Halo Food Co Ltd ($ASX:HLF)

Halo Food Co Ltd is a food processing and distribution company based in Manchester, England. The company has been in business since 1887 and is known for its high-quality products. The company has a market cap of 11.22M as of 2022, which suggests that it has a moderate level of market capitalization. This indicates that the company has some financial strength, but is not considered a major player in the industry. Additionally, the Return on Equity (ROE) of the company is -11.05%, which suggests that the company is not generating a significant return on its equity. This could indicate that the company may have difficulty generating sufficient profits to cover its expenses.

– Hindustan Unilever Ltd ($BSE:500696)

Hindustan Unilever Ltd is an Indian consumer goods company with a market cap of 6.07T as of 2022. It is one of the biggest companies in India and is a subsidiary of Unilever, the Anglo-Dutch consumer goods company. The company has a Return on Equity (ROE) of 16.24%, which is an indication of its strong financial performance. Hindustan Unilever produces a wide range of products in the areas of food and beverages, personal care, home care, and water purification. It also has a strong presence in the emerging markets of India and South Asia, with a wide network of distributors and retailers.

Summary

Reckitt Benckiser is an international consumer goods company that has become a household name in many countries. For investors considering Reckitt Benckiser as a potential investment, the company has been performing well in recent years. Reckitt Benckiser has strong brand recognition and offers products in many industries, making it an attractive option for investors.

Additionally, the company has a strong balance sheet with low leverage and high liquidity. Overall, Reckitt Benckiser is an attractive option for investors who are looking for a large, stable consumer goods company with a strong portfolio of products and positive fundamentals.

Recent Posts