Beauty Health Company Sees Double-Digit Share Price Rise Despite Being a Small-Cap Stock

June 12, 2023

☀️Trending News

The Beauty Health ($NASDAQ:SKIN) Company, a small-cap stock, has seen a remarkable double-digit increase in its share price. Currently standing at US$9.19, it has been one of the market’s strong performers of late and is worth closer inspection. The company produces and markets an innovative line of beauty and health products for women and men, ranging from makeup to skincare to nutritional supplements. The company has established itself as a leader in the beauty and health category with its innovative products that are designed with safety, efficacy, and convenience in mind. Its products are designed to meet customers’ needs quickly and effectively by incorporating natural ingredients that are free of harmful substances. Furthermore, the company employs a team of experienced professionals with a variety of backgrounds in health, wellness, and beauty to ensure its products are of the highest quality.

The Beauty Health Company is committed to providing customers with top-notch products and unbeatable customer service. It strives to create an environment where customers can find the products they need, at prices that fit their budget. These factors have all contributed to the strong growth of the company’s share price and have made it an attractive option for investors looking for a safe bet with potential for long-term growth. With its strong products, dedication to customer satisfaction, and commitment to corporate responsibility, the Beauty Health Company is definitely one worth keeping an eye on.

Stock Price

On Friday, BEAUTY HEALTH stock opened at $8.9 and closed at $8.7, representing a 1.7% decrease from its prior closing price of $8.9. This could be attributed to the fact that its products and services have been well received in the market, with investors confident in its potential for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Beauty Health. More…

| Total Revenues | Net Income | Net Margin |

| 376.76 | -10.42 | -5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Beauty Health. More…

| Operations | Investing | Financing |

| -106.6 | -18.87 | -205.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Beauty Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 994.9 | 847.3 | 1.11 |

Key Ratios Snapshot

Some of the financial key ratios for Beauty Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.0% | – | -0.7% |

| FCF Margin | ROE | ROA |

| -32.9% | -1.0% | -0.2% |

Analysis

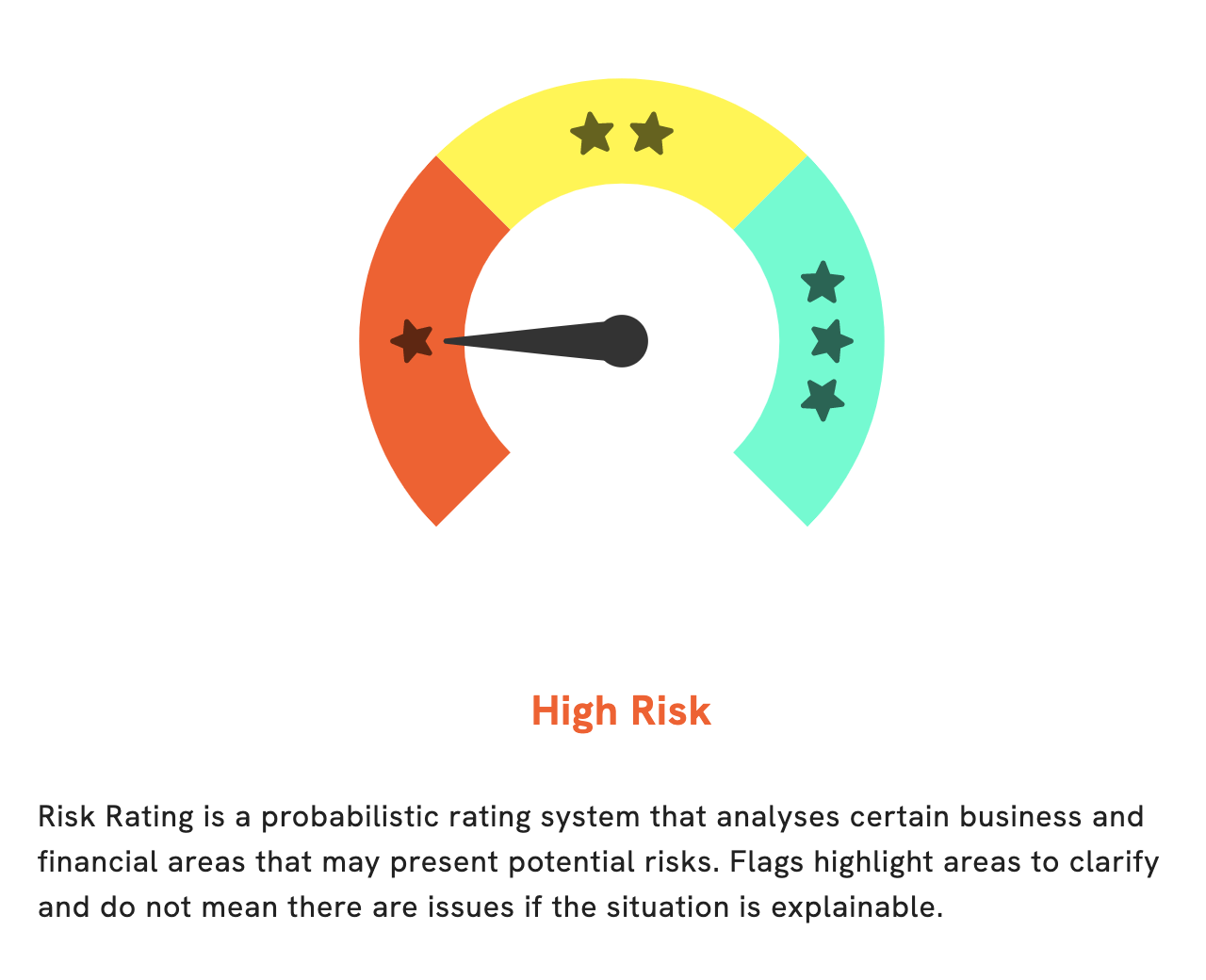

At GoodWhale, we have conducted an analysis of BEAUTY HEALTH‘s fundamentals. Our Risk Rating has determined that this is a high risk investment in terms of financial and business aspects. Upon closer examination, we have detected 3 risk warnings in the income sheet, balance sheet, and cashflow statement. We invite you to register with us to get an in-depth look at these warnings and more information about BEAUTY HEALTH’s financial health. Our team of experts is always ready to help you make an informed decision when it comes to investing. More…

Peers

The company’s products are available in more than 30 countries and it has a strong presence in the United States, Europe, and Asia. The company’s products are sold through a network of distributors, retailers, and online retailers. The company has a strong focus on research and development and has a team of scientists that are constantly innovating new products. The company’s products are backed by a 100% satisfaction guarantee.

– Hims & Hers Health Inc ($NYSE:HIMS)

Hims & Hers Health Inc. is a digital healthcare company that offers direct-to-consumer telehealth and online pharmacy services. The company was founded in 2017 and is headquartered in San Francisco, California. As of 2022, the company had a market cap of 880.33M and a ROE of -15.86%. The company offers a range of services including primary care, sexual health, mental health, and more.

– Yoshitsu Co Ltd ($NASDAQ:TKLF)

The company has a market cap of 47.13M as of 2022. The company’s ROE for the same period is 14.38%. The company is engaged in the business of manufacturing textile products.

– CI Medical Co Ltd ($TSE:3540)

Founded in 1971, CIC Medical is a leading provider of medical devices and services. The company’s products are used in a variety of medical applications, including surgery, diagnostics, and patient care. CIC Medical has a market cap of 51.4 billion as of 2022 and a return on equity of 15.93%. The company’s products are used in a variety of medical applications, including surgery, diagnostics, and patient care.

Summary

Analysts suggest that the company has good potential in the beauty and health sector. The company has been growing steadily over the past years and has seen strong revenue growth. In addition, the company has been making strategic investments in emerging technologies and building partnerships with other health and beauty industry leaders. Given these factors, it may be worth investing in The Beauty Health Company at its current price.

Recent Posts