Beauty Health Company Finds Strength in Face of Growing Uncertainty

April 5, 2023

Trending News ☀️

The Beauty Health ($NASDAQ:SKIN) Company has been a leader in the beauty and health industry, providing quality products and services to customers all over the world. In the face of growing uncertainties, the company has managed to remain strong and resilient. With a strong commitment to customer satisfaction, Beauty Health has been able to meet the rising demands of its customers both at home and abroad. In addition to its product offering, the company has been proactive in responding to the changing market environment. It has invested heavily in research and development, as well as engaging in partnerships with leading suppliers to ensure that it can grow with the ever-evolving industry. This commitment has enabled Beauty Health to remain a leader in its sector, even in the face of increasing uncertainty.

The company’s stock has also seen a steady rise over the past few years, despite the current economic climate. This can be attributed to its strong financial position and commitment to providing quality products and services. It has managed to maintain a healthy dividend for shareholders, as well as expanding its reach in different markets. Overall, Beauty Health Company has been able to remain resilient and strong despite the growing uncertainties of today’s world. With its commitment to innovation and customer satisfaction, it is well-positioned to continue its strong performance.

Stock Price

On Monday, the stock of BEAUTY HEALTH opened at $12.6 and closed at $13.3, a 5% increase from the previous day’s closing price. While other companies have seen their stocks dip and plummet, BEAUTY HEALTH has managed to maintain and even increase its stock price. Its products and services have been consistently successful, attracting customers who are willing to spend money even when resources are limited.

This has been a great source of strength for BEAUTY HEALTH as it works to remain competitive in the current market. The company’s ability to increase its stock price despite market circumstances speaks volumes about its commitment to customers and its ability to remain steady in the face of uncertainty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Beauty Health. More…

| Total Revenues | Net Income | Net Margin |

| 365.88 | 44.38 | -8.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Beauty Health. More…

| Operations | Investing | Financing |

| -106.6 | -18.87 | -205.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Beauty Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.01k | 837.43 | 1.3 |

Key Ratios Snapshot

Some of the financial key ratios for Beauty Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.0% | – | 16.0% |

| FCF Margin | ROE | ROA |

| -33.9% | 17.0% | 3.6% |

Analysis

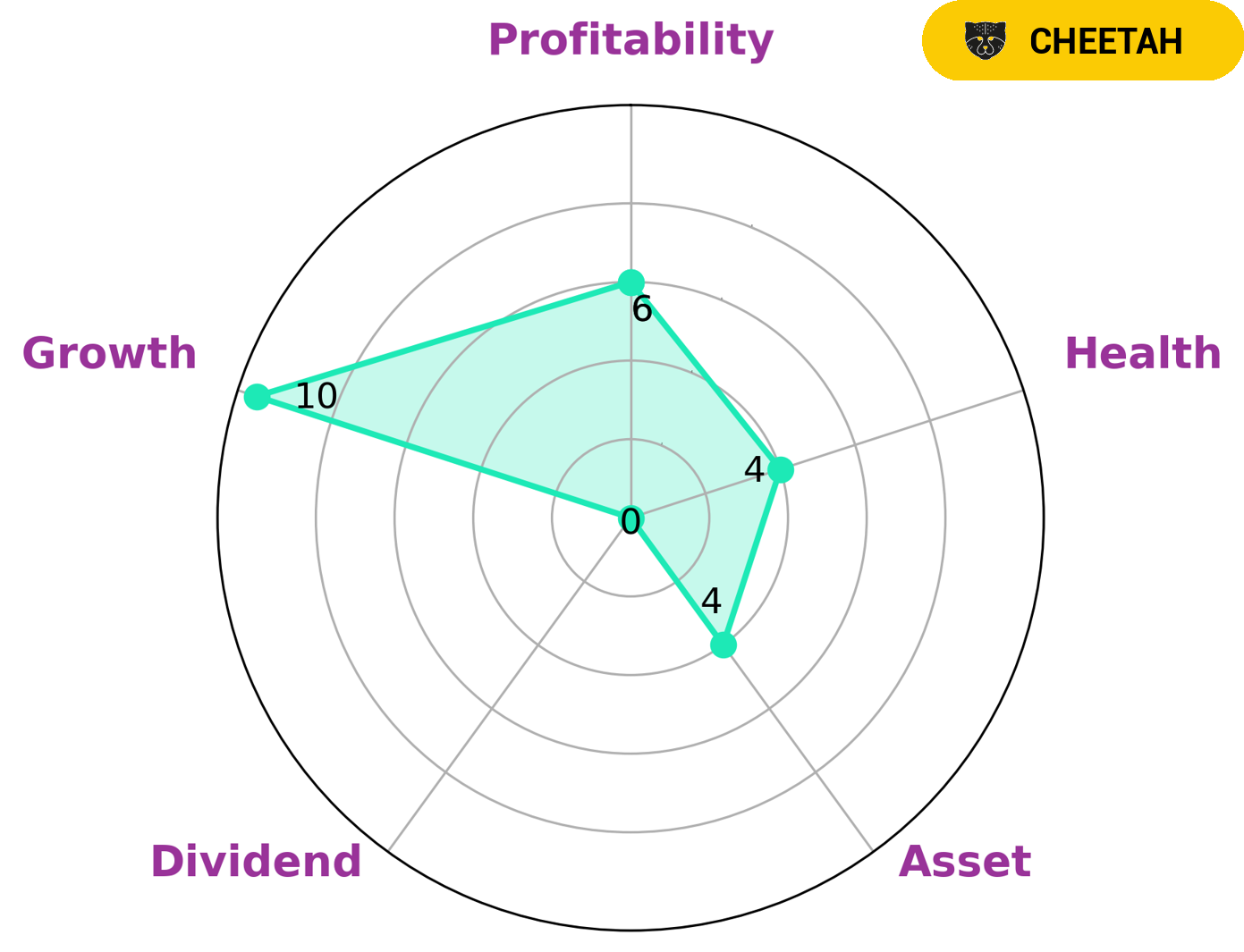

At GoodWhale, we conducted an analysis of BEAUTY HEALTH‘s financials and found that based on our Star Chart, the company is strong in growth, medium in asset, profitability, and weak in dividend. Our conclusion is that BEAUTY HEALTH is classified as a ‘cheetah’ – meaning a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be attractive to certain investors who are seeking a higher risk profile, such as those looking for growth opportunities. BEAUTY HEALTH has an intermediate health score of 4/10 considering its cashflows and debt, which suggests it might be able to sustain future operations in times of crisis. More…

Peers

The company’s products are available in more than 30 countries and it has a strong presence in the United States, Europe, and Asia. The company’s products are sold through a network of distributors, retailers, and online retailers. The company has a strong focus on research and development and has a team of scientists that are constantly innovating new products. The company’s products are backed by a 100% satisfaction guarantee.

– Hims & Hers Health Inc ($NYSE:HIMS)

Hims & Hers Health Inc. is a digital healthcare company that offers direct-to-consumer telehealth and online pharmacy services. The company was founded in 2017 and is headquartered in San Francisco, California. As of 2022, the company had a market cap of 880.33M and a ROE of -15.86%. The company offers a range of services including primary care, sexual health, mental health, and more.

– Yoshitsu Co Ltd ($NASDAQ:TKLF)

The company has a market cap of 47.13M as of 2022. The company’s ROE for the same period is 14.38%. The company is engaged in the business of manufacturing textile products.

– CI Medical Co Ltd ($TSE:3540)

Founded in 1971, CIC Medical is a leading provider of medical devices and services. The company’s products are used in a variety of medical applications, including surgery, diagnostics, and patient care. CIC Medical has a market cap of 51.4 billion as of 2022 and a return on equity of 15.93%. The company’s products are used in a variety of medical applications, including surgery, diagnostics, and patient care.

Summary

Investing in Beauty Health Company (BEAUTY) right now may be seen as a slightly risky but potentially profitable venture. The stock price moved up the same day as they reiterated their hold in the face of more uncertainty due to the global pandemic. Investors are encouraged to conduct their own research and make their own decisions, as this is an individualized decision.

However, there is potential upside due to their diversified product portfolio and their international presence, which may lead to long-term success. Ultimately, investors should weigh their options carefully and decide if BEAUTY is the right fit for their portfolio.

Recent Posts