Lowe’s Top Investment Quality Propels it to Buy List Amid Market Dip

May 6, 2023

Trending News ☀️

Despite the recent market dip, Lowe’s ($NYSE:LOW) has proven to be an investment of top quality with its steady growth rate, making it a favorable stock pick to add to the Buy List. Furthermore, Lowe’s has proven to be well-positioned to handle a market downtrend with its strong balance sheet, solid cash flows, and prudent capital allocation strategy. Analysts at Trefis highlight that Lowe’s is well-positioned to benefit from the post-pandemic recovery due to its strong operational performance and long-term investments in e-commerce and omni-channel capabilities.

Stock Price

On Friday, LOWE’S COMPANIES opened at $204.0 and closed at $205.8, a 1.5% increase from its previous closing price of $202.8. This jump in the company’s stock is largely due to its investment quality, which experts have identified as one of the main reasons that LOWE’S COMPANIES has become a sought-after stock on the market. Investors are drawn to the quality of the company, confident that it will remain a strong investment even amid market dips. This has prompted several analysts and firms to include LOWE’S COMPANIES on their “buy” list, providing further evidence of the company’s promising prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lowe’s Companies. More…

| Total Revenues | Net Income | Net Margin |

| 97.06k | 6.42k | 6.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lowe’s Companies. More…

| Operations | Investing | Financing |

| 8.59k | -1.31k | -7.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lowe’s Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.71k | 57.96k | -23.72 |

Key Ratios Snapshot

Some of the financial key ratios for Lowe’s Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.4% | 17.2% | 10.5% |

| FCF Margin | ROE | ROA |

| 7.0% | -47.0% | 14.6% |

Analysis

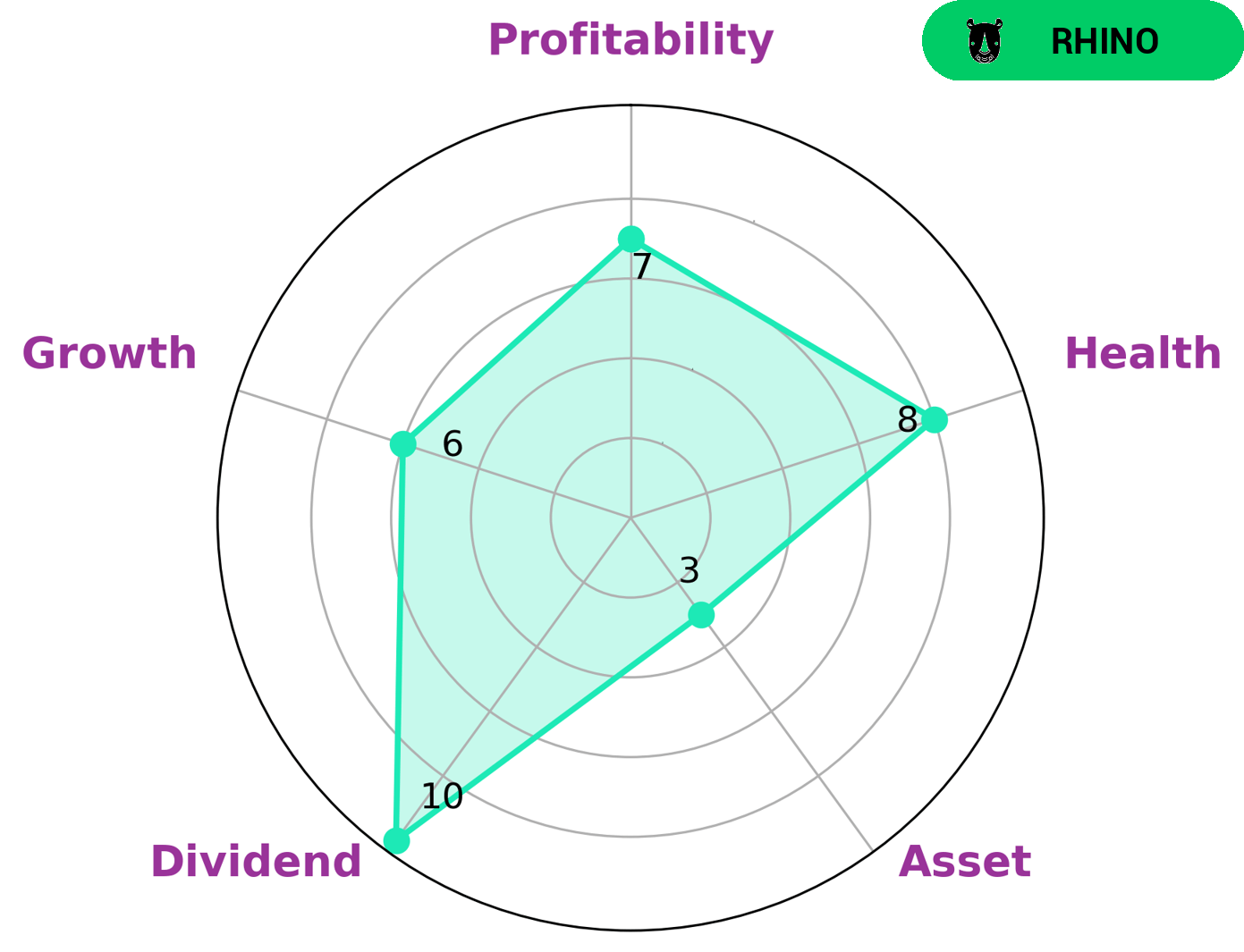

At GoodWhale, we specialize in analyzing the fundamentals of LOWE’S COMPANIES. After our examination, we can conclude that LOWE’S COMPANIES is strong in dividend, profitability, and medium in growth. Additionally, the company is weak in its assets. We also find that LOWE’S COMPANIES has a high health score of 8/10. This is mainly because of the company’s capability to pay off its debt and fund future operations through its cashflows. From our analysis, LOWE’S COMPANIES is classified as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This means that investors interested in moderate growth opportunities may be well-suited for this company. More…

Peers

Headquartered in Mooresville, North Carolina, the company employs over 290,000 people. Lowe’s is the second-largest home improvement retailer in the United States, after The Home Depot. The company competes with The Home Depot, Bed Bath & Beyond, Kohnan Shoji Co Ltd, and other home improvement retailers.

– The Home Depot Inc ($NYSE:HD)

The Home Depot Inc is a home improvement retailer that operates in the United States, Canada, and Mexico. It was founded in 1978 and is headquartered in Atlanta, Georgia. The company has a market capitalization of $282.03 billion as of 2022 and a return on equity of -2020.81%. Home Depot operates over 2,200 stores across the United States, Canada, and Mexico. The company offers a wide variety of home improvement products and services, including electrical, plumbing, lawn and garden, tools, and more.

– Bed Bath & Beyond Inc ($NASDAQ:BBBY)

Bath & Beyond Inc is a home goods retailer that operates in the United States and Canada. As of 2022, the company had a market capitalization of 401.26 million and a return on equity of 146.77%. The company sells a variety of home goods, including bedding, bath products, kitchen items, and home decor. It also operates a website and mobile app.

– Kohnan Shoji Co Ltd ($TSE:7516)

Kohnan Shoji Co Ltd is a Japanese company that manufactures and sells construction materials, tools, and hardware. It has a market cap of 94.2B as of 2022 and a return on equity of 9.73%. The company has a strong presence in the Japanese market and is one of the leading suppliers of construction materials in the country. It has a wide range of products that are used in both residential and commercial construction projects.

Summary

Lowe’s Companies Inc. is a strong investment for volatile markets, offering a high degree of value for investors. The company has a strong balance sheet and liquidity, with a long track record of creating returns for shareholders. Lowe’s has excellent brand recognition, which allows it to maintain market share even during recessions. Its consistent growth in sales and operating income, along with its low debt-to-equity ratio, demonstrates it is well-positioned to withstand economic downturns.

Lowe’s also has a strong dividend track record and moderate payout ratio, providing shareholders with an attractive option to generate income while maintaining capital. Finally, its efficient operations and track record of success in the retail home improvement market make it a top pick for the buy list in a market dip.

Recent Posts