Lowe’s Companies Offers 12% Annual Total Return Potential Despite Challenges

December 29, 2023

🌧️Trending News

Lowe’s Companies ($NYSE:LOW), Inc., is one of America’s largest retailers and home improvement stores, and it offers potential investors an annual total return potential of over 12%, even in these challenging times. Lowe’s Companies has a strong track record of delivering value to its shareholders through prudent financial management, operational excellence, and innovative product offerings. Despite the challenges facing Lowe’s Companies, its stock price has steadily increased over the past few years and it boasts an impressive total return potential of 12%. The company is well known for its focus on customer satisfaction, cost efficiency, and technology.

In addition, Lowe’s Companies has developed a large base of loyal customers who shop at its stores and reliable suppliers who provide consistent quality products. Overall, Lowe’s Companies offers investors an attractive 12% annual total return potential despite the challenging conditions. It is well positioned to capitalize on the current retail environment and to continue to deliver value for its shareholders through prudent financial management, operational excellence, and innovative product offerings.

Analysis

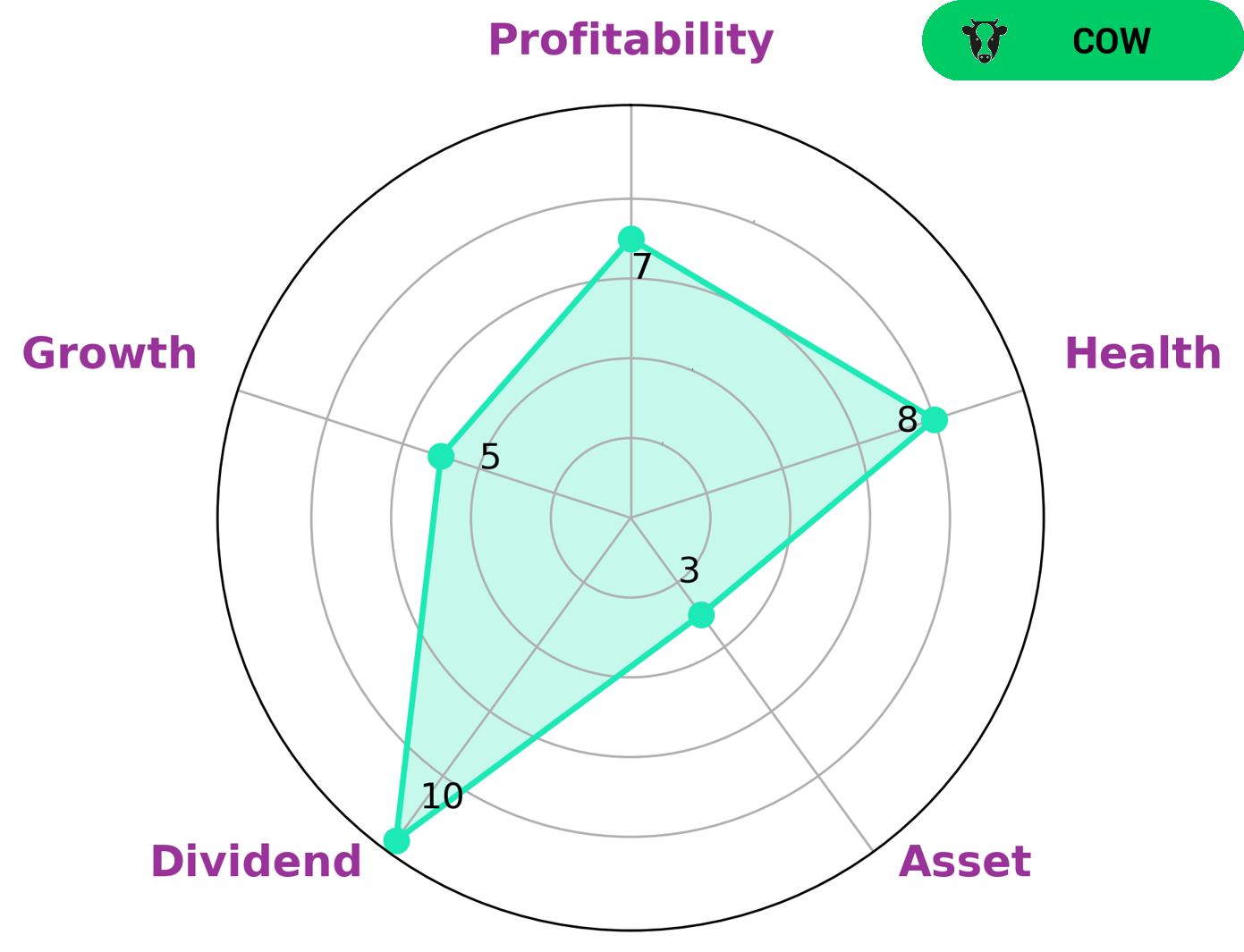

We at GoodWhale have conducted an analysis of LOWE’S COMPANIES‘s fundamentals, and based on its Star Chart classification of ‘cow’ we can conclude that the company has a track record of paying out consistent and sustainable dividends. Investors interested in this type of company may find LOWE’S COMPANIES especially appealing due to its high health score of 8/10 in regards to cashflows and debt, indicating that the company is capable of sustaining future operations even in difficult times. Additionally, LOWE’S COMPANIES scores strong in dividend and profitability, medium in growth, and weak in asset, all of which are encouraging metrics for investors looking for a dependable stock to add to their portfolio. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lowe’s Companies. More…

| Total Revenues | Net Income | Net Margin |

| 90.22k | 7.64k | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lowe’s Companies. More…

| Operations | Investing | Financing |

| 7.48k | -1.5k | -7.98k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lowe’s Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.52k | 57.67k | -26.34 |

Key Ratios Snapshot

Some of the financial key ratios for Lowe’s Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.9% | 8.4% | 12.9% |

| FCF Margin | ROE | ROA |

| 6.0% | -48.8% | 17.1% |

Peers

Headquartered in Mooresville, North Carolina, the company employs over 290,000 people. Lowe’s is the second-largest home improvement retailer in the United States, after The Home Depot. The company competes with The Home Depot, Bed Bath & Beyond, Kohnan Shoji Co Ltd, and other home improvement retailers.

– The Home Depot Inc ($NYSE:HD)

The Home Depot Inc is a home improvement retailer that operates in the United States, Canada, and Mexico. It was founded in 1978 and is headquartered in Atlanta, Georgia. The company has a market capitalization of $282.03 billion as of 2022 and a return on equity of -2020.81%. Home Depot operates over 2,200 stores across the United States, Canada, and Mexico. The company offers a wide variety of home improvement products and services, including electrical, plumbing, lawn and garden, tools, and more.

– Bed Bath & Beyond Inc ($NASDAQ:BBBY)

Bath & Beyond Inc is a home goods retailer that operates in the United States and Canada. As of 2022, the company had a market capitalization of 401.26 million and a return on equity of 146.77%. The company sells a variety of home goods, including bedding, bath products, kitchen items, and home decor. It also operates a website and mobile app.

– Kohnan Shoji Co Ltd ($TSE:7516)

Kohnan Shoji Co Ltd is a Japanese company that manufactures and sells construction materials, tools, and hardware. It has a market cap of 94.2B as of 2022 and a return on equity of 9.73%. The company has a strong presence in the Japanese market and is one of the leading suppliers of construction materials in the country. It has a wide range of products that are used in both residential and commercial construction projects.

Summary

Investing in Lowe’s Companies, Inc. can potentially provide investors with an annual total return of over 12%.

In addition, Lowe’s solid balance sheet, diverse market segments, strong operational execution, and healthy same-store sales growth make it a safe and attractive choice. The company has a long history of growing its core business and investing in its own expansion. Lowe’s is also well-positioned to benefit from the continued growth of the U.S. housing market, which should drive sales for the foreseeable future. With competitive advantages and a strong financial position, Lowe’s Companies is set to deliver value to investors who are looking for long-term returns.

Recent Posts