Lowe’s Companies Intrinsic Value Calculator – Lowe’s Companies Urges Investors to Look Beyond Short-Term Noise and Focus on Long-Term Goals

May 13, 2023

Trending News 🌥️

Recently, Lowe’s Companies ($NYSE:LOW) has been urging its investors to look beyond the noise of the present and instead focus on the company’s long-term goals. While short-term market fluctuations may present some distraction, Lowe’s believes that focusing on the potential of its long-term investments will result in better returns for shareholders. The company has invested heavily in digital technology and omnichannel capabilities to enhance customer experience and improve efficiencies. This focus on future plans has allowed Lowe’s to remain competitive despite recent market volatility. Lowe’s has also committed to expanding its presence in the international market, a move that could open up a massive new revenue stream. The company has already opened retail stores in Canada and Mexico, with plans to expand further into Europe and Asia in the coming years.

In addition, the company is looking at ways to strengthen its supply chain to reduce costs and improve efficiency. By doing so, it seeks to provide shareholders with an opportunity for greater returns and improved customer satisfaction.

Share Price

On Friday, the company’s stock opened at $203.3 and closed at the same price, making it an attractive buy for investors. Lowe’s Companies has recently announced a number of initiatives that it says will lead to long-term growth, such as expanding its e-commerce offerings, focusing on innovation and technology, and investing in its stores and associates. These efforts are seen as a sign that Lowe’s Companies is looking to remain competitive in an increasingly dynamic home improvement market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lowe’s Companies. More…

| Total Revenues | Net Income | Net Margin |

| 97.06k | 6.42k | 6.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lowe’s Companies. More…

| Operations | Investing | Financing |

| 8.59k | -1.31k | -7.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lowe’s Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.71k | 57.96k | -23.72 |

Key Ratios Snapshot

Some of the financial key ratios for Lowe’s Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.4% | 17.2% | 10.5% |

| FCF Margin | ROE | ROA |

| 7.0% | -47.0% | 14.6% |

Analysis – Lowe’s Companies Intrinsic Value Calculator

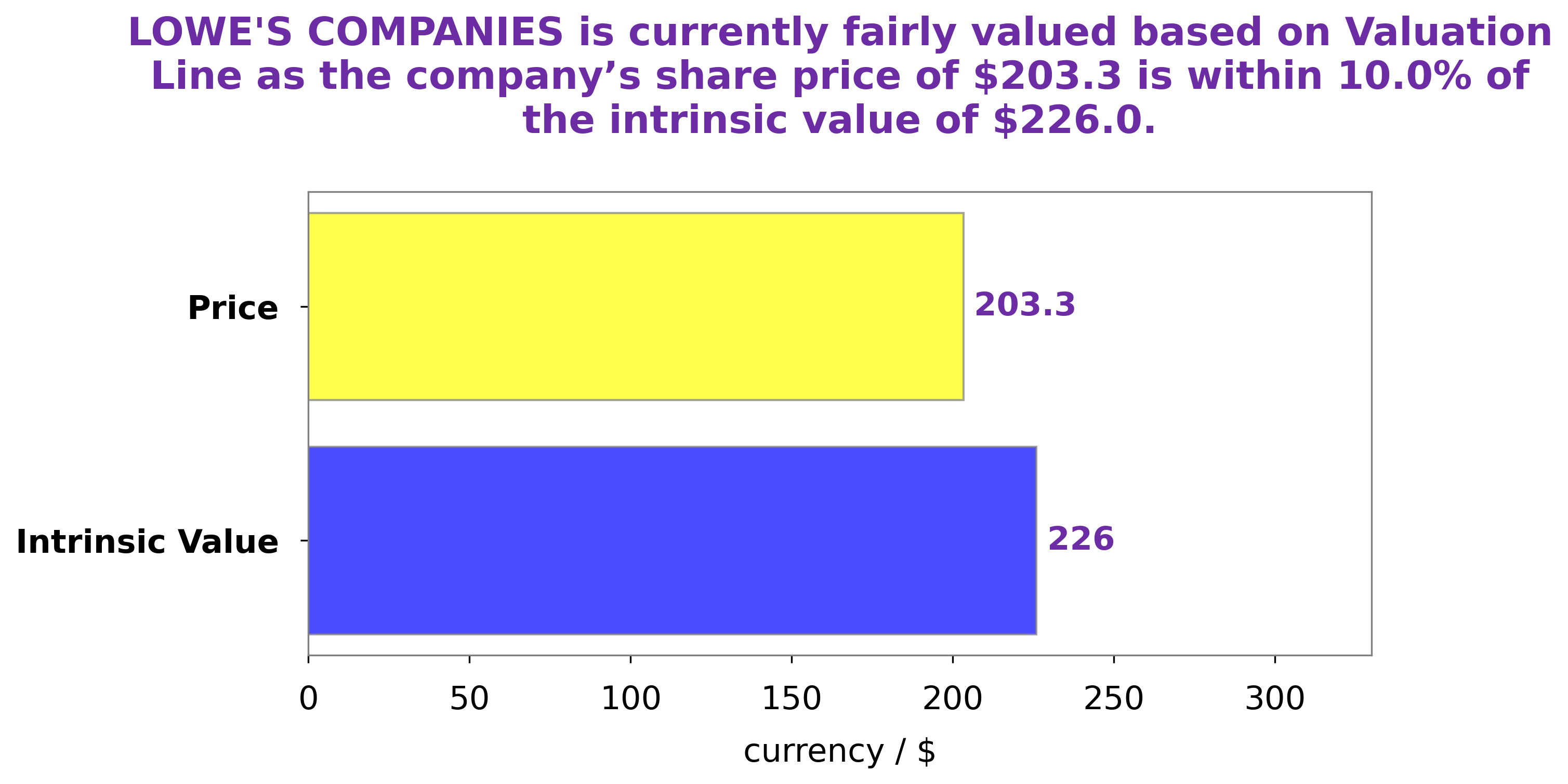

GoodWhale is pleased to analyze the fundamentals of LOWE’S COMPANIES. Using our proprietary Valuation Line, we have determined the intrinsic value of each share of LOWE’S COMPANIES to be approximately $226.0. Currently, LOWE’S COMPANIES stock is trading at $203.3, a price that is undervalued by 10.1%. We believe that this presents a good opportunity for investors to consider purchasing this stock at a fair price. More…

Peers

Headquartered in Mooresville, North Carolina, the company employs over 290,000 people. Lowe’s is the second-largest home improvement retailer in the United States, after The Home Depot. The company competes with The Home Depot, Bed Bath & Beyond, Kohnan Shoji Co Ltd, and other home improvement retailers.

– The Home Depot Inc ($NYSE:HD)

The Home Depot Inc is a home improvement retailer that operates in the United States, Canada, and Mexico. It was founded in 1978 and is headquartered in Atlanta, Georgia. The company has a market capitalization of $282.03 billion as of 2022 and a return on equity of -2020.81%. Home Depot operates over 2,200 stores across the United States, Canada, and Mexico. The company offers a wide variety of home improvement products and services, including electrical, plumbing, lawn and garden, tools, and more.

– Bed Bath & Beyond Inc ($NASDAQ:BBBY)

Bath & Beyond Inc is a home goods retailer that operates in the United States and Canada. As of 2022, the company had a market capitalization of 401.26 million and a return on equity of 146.77%. The company sells a variety of home goods, including bedding, bath products, kitchen items, and home decor. It also operates a website and mobile app.

– Kohnan Shoji Co Ltd ($TSE:7516)

Kohnan Shoji Co Ltd is a Japanese company that manufactures and sells construction materials, tools, and hardware. It has a market cap of 94.2B as of 2022 and a return on equity of 9.73%. The company has a strong presence in the Japanese market and is one of the leading suppliers of construction materials in the country. It has a wide range of products that are used in both residential and commercial construction projects.

Summary

Investing in Lowe’s Companies requires careful analysis of the company’s current financial position and its prospects for future growth. Investors should consider the company’s balance sheet, cash flow, and income statements to gain an understanding of the company’s financial health.

Additionally, analysts should assess the company’s competitive advantages, as well as its market position within the industry. Careful consideration should also be given to Lowe’s dividend policy, to evaluate whether it is in concert with the company’s overall strategy. Finally, investors should review the company’s management team and their track record of success in order to get a better idea of how the company is likely to perform in the future. By taking these factors into account, investors can make informed decisions regarding their investments in Lowe’s Companies.

Recent Posts