In 2023, Lowe’s Stock Sinks Despite Market Gains of 0.98%.

March 25, 2023

Trending News 🌧️

Lowe’s Companies ($NYSE:LOW), Inc. stock price has taken a hit of 0.98% in the latest trading session and dropped to $189.69 despite market gains of 0.98%. This has raised many questions and speculations. Investors are now asking whether this decrease is a sign of more trouble ahead for the company. Lowe’s stock is currently trading at a three-month low, hurting its overall performance in the market. Analysts have speculated that the decrease may be due to weaker than expected profit margins in some of Lowe’s core retail businesses. Other analysts point to the increasing competition from online retailers, which has made it difficult for Lowe’s to remain competitive in the market.

The company is also facing issues related to its supply chain, as well as rising labor costs, which have also put a strain on their bottom line. Despite the recent losses, Lowe’s is still seen as a reliable and safe investment option, with potential for growth. Overall, while the Lowe’s Companies, Inc. stock price has taken a hit, the company still has potential to bounce back and regain its footing in the market. Investors should monitor the situation closely to make sure that they’re making the right decisions on their investments.

Stock Price

With mostly negative news surrounding the company, the stock opened on Friday at $188.8, only to close the day at $189.5, a decrease of 0.1% from the prior closing price of 189.7. This marks yet another disappointing dip in the company’s stock, with no end in sight. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lowe’s Companies. More…

| Total Revenues | Net Income | Net Margin |

| 97.06k | 6.44k | 6.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lowe’s Companies. More…

| Operations | Investing | Financing |

| 8.59k | -1.31k | -7.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lowe’s Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.71k | 57.96k | -23.72 |

Key Ratios Snapshot

Some of the financial key ratios for Lowe’s Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.4% | 17.2% | 10.5% |

| FCF Margin | ROE | ROA |

| 7.0% | -46.8% | 14.5% |

Analysis

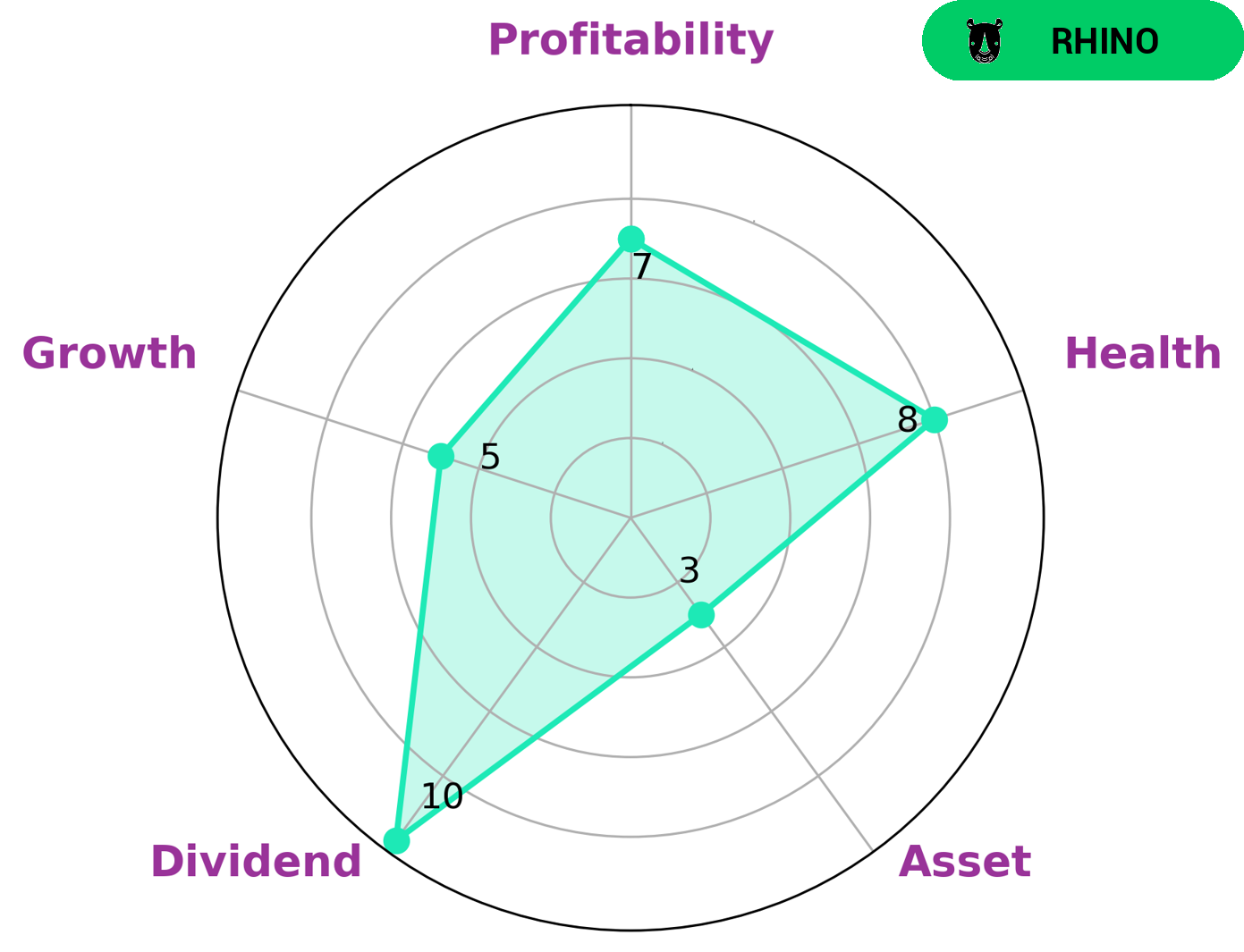

At GoodWhale, we specialize in analyzing the fundamentals of companies so investors can make informed decisions. We recently took a look at LOWE’S COMPANIES and found that it has strong ratings in both dividend and profitability, medium ratings in growth, and weak ratings in assets. After careful consideration of its performance metrics, we concluded that LOWE’S COMPANIES is classified as a ‘rhino’, a type of company with moderate revenue or earnings growth. For investors who are looking for a company that can provide consistent returns and offer a good level of stability, LOWE’S COMPANIES may be a good fit. Additionally, our health score for LOWE’S COMPANIES is 8/10, which means that the company is well-positioned to sustain its operations during periods of economic hardship. All these factors make LOWE’S COMPANIES an attractive option for investors who are searching for a low-risk investment. More…

Peers

Headquartered in Mooresville, North Carolina, the company employs over 290,000 people. Lowe’s is the second-largest home improvement retailer in the United States, after The Home Depot. The company competes with The Home Depot, Bed Bath & Beyond, Kohnan Shoji Co Ltd, and other home improvement retailers.

– The Home Depot Inc ($NYSE:HD)

The Home Depot Inc is a home improvement retailer that operates in the United States, Canada, and Mexico. It was founded in 1978 and is headquartered in Atlanta, Georgia. The company has a market capitalization of $282.03 billion as of 2022 and a return on equity of -2020.81%. Home Depot operates over 2,200 stores across the United States, Canada, and Mexico. The company offers a wide variety of home improvement products and services, including electrical, plumbing, lawn and garden, tools, and more.

– Bed Bath & Beyond Inc ($NASDAQ:BBBY)

Bath & Beyond Inc is a home goods retailer that operates in the United States and Canada. As of 2022, the company had a market capitalization of 401.26 million and a return on equity of 146.77%. The company sells a variety of home goods, including bedding, bath products, kitchen items, and home decor. It also operates a website and mobile app.

– Kohnan Shoji Co Ltd ($TSE:7516)

Kohnan Shoji Co Ltd is a Japanese company that manufactures and sells construction materials, tools, and hardware. It has a market cap of 94.2B as of 2022 and a return on equity of 9.73%. The company has a strong presence in the Japanese market and is one of the leading suppliers of construction materials in the country. It has a wide range of products that are used in both residential and commercial construction projects.

Summary

Investors in Lowe’s Companies, Inc. have been disappointed in recent years as the stock has struggled to keep up with the overall market growth. Analysts attribute the poor performance to several factors such as weak economic conditions, rising costs, and lower-than-expected sales. Many investors are now wary of investing in Lowe’s Companies at this time as there is still significant uncertainty in the market.

Recent Posts