Home Depot: Invest Now and Reap the Rewards

April 11, 2023

Trending News ☀️

Home Depot ($NYSE:HD) is one of the largest home improvement retailers in the world and its stock presents an exciting opportunity for those seeking long-term success. Its vast selection of products, combined with its convenient locations, make Home Depot an idealinvestment option. The stock has had an impressive track record since its inception, providing steady returns to shareholders. By investing in Home Depot, investors can benefit from their large customer base, experienced management team, and strong financial position. All of these factors have contributed to their successful history, as well as their forecasted success. Home Depot’s stock is extremely liquid, making it easy for investors to trade in and out of their positions. Plus, the company pays out dividends on a regular basis, giving investors an added incentive to choose Home Depot as an investment option.

Additionally, Home Depot continues to invest heavily in research and development to ensure their products remain competitive and up to date. In conclusion, Home Depot presents a great chance for investors to capitalize on its success. By investing in Home Depot stock now, investors can reap the rewards for years to come. With its vast selection of products, excellent customer service, and strong financial position, Home Depot is an ideal investment option for those looking for long-term success.

Share Price

Home Depot (HOME DEPOT) is a great investment for those seeking to reap the rewards of the stock market. On Monday, HOME DEPOT stock opened at $286.1 and closed at $291.2, up by a strong 0.9% from its last closing price of 288.6. This indicates that the company is performing well and is likely to continue to experience growth in the near future. As one of the largest employers in the US, Home Depot provides a stable job market and a great investment opportunity. The company has consistently delivered returns on investment and dividends to shareholders. This makes it an attractive option for investors looking to build their portfolio with stable stocks.

Home Depot is well-positioned to continue to grow over the coming years, making it a great investment for those seeking to add a solid stock to their portfolio. In conclusion, Home Depot is a great option for investors looking to reap the rewards of the stock market. With its strong performance on Monday and its long history of success, Home Depot is an excellent choice for those looking to add a safe and reliable stock to their portfolio. Invest now and enjoy the rewards of this great company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Home Depot. More…

| Total Revenues | Net Income | Net Margin |

| 157.4k | 17.11k | 10.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Home Depot. More…

| Operations | Investing | Financing |

| 14.62k | -3.14k | -10.99k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Home Depot. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 76.44k | 74.88k | 1.27 |

Key Ratios Snapshot

Some of the financial key ratios for Home Depot are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.6% | 14.9% | 15.3% |

| FCF Margin | ROE | ROA |

| 7.3% | 1160.2% | 19.7% |

Analysis

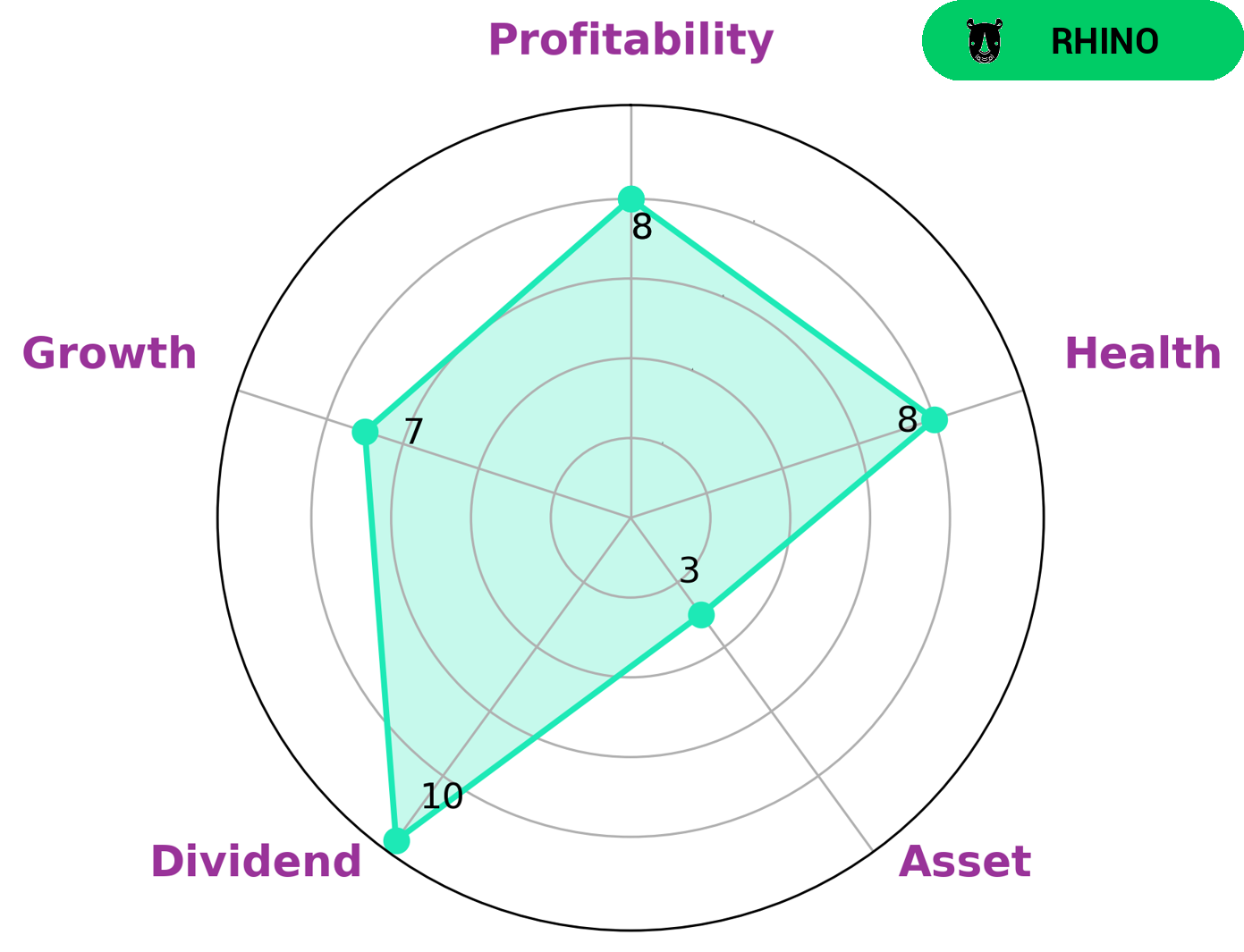

At GoodWhale, we have conducted an analysis of HOME DEPOT‘s wellbeing. Investors who may be interested in such company are those who prioritize safety and stability, as HOME DEPOT has a high health score of 8/10 with regard to its cashflows and debt, making it able to safely ride out any crisis without the risk of bankruptcy. Additionally, HOME DEPOT is strong in dividend, growth, and profitability, making it an attractive investment for those interested in a long-term return on investment. The company is weak in assets, which may be seen as a risk by some investors. More…

Peers

The Home Depot Inc is one of the leading home improvement retailers in the United States. The company operates more than 2,200 stores across the country. Lowe’s Companies Inc is another leading home improvement retailer in the United States. The company operates more than 1,700 stores across the country. Floor & Decor Holdings Inc is a leading specialty retailer of hard surface flooring in the United States. The company operates more than 100 stores across the country. Wayfair Inc is a leading online retailer of home furnishings and home décor products.

– Lowe’s Companies Inc ($NYSE:LOW)

Lowe’s Companies, Inc. is a home improvement company that operates stores in the United States, Canada, and Mexico. The company offers a wide variety of home improvement products, including appliances, tools, hardware, flooring, and more. Lowe’s is also involved in home improvement services, such as installation, repair, and remodeling. The company has a market cap of $114.17B and a return on equity of -99.39%.

– Floor & Decor Holdings Inc ($NYSE:FND)

Floor & Decor Holdings Inc is a specialty retailer of hard surface flooring and related accessories, with 97 stores across 27 states in the United States. The company offers a wide selection of ceramic tile, porcelain tile, natural stone, wood flooring, laminate, and vinyl flooring products. It also provides installation services for customers who purchase their products. Floor & Decor Holdings Inc has a market cap of 7.06B as of 2022, a Return on Equity of 14.88%.

– Wayfair Inc ($NYSE:W)

As of 2022, Wayfair Inc has a market cap of 3.37B and a Return on Equity of 29.2%. The company provides an online platform for home goods and furniture retailers. It operates through two segments, Direct and Marketplace. The Direct segment offers products through its own website. The Marketplace segment offers products through third-party websites.

Summary

The Home Depot Inc. (HD) is a solid investment opportunity for those looking to capitalize on the growing market for home improvement supplies. Its stock has grown steadily over the years, and analysts predict a bright future for the company. The company’s strong balance sheet and solid operations management team have been major contributors to the company’s overall success.

Additionally, its research and development efforts have paid off in the form of innovative products, allowing HD to gain market share. The company’s recent initiatives in green energy and sustainability are also likely to benefit shareholders.

Recent Posts