Cowen Sees Opportunity in Arhaus Investment: An ‘Attractive Entry Point’

April 7, 2023

Trending News ☀️

Cowen recently announced that they view Arhaus ($NASDAQ:ARHS) as an attractive entry point for their investments. Arhaus is a publicly-traded furniture and home decor company that has been making waves in the global home decor industry. Their dedication to craftsmanship and design has made them a leader in the industry, offering a unique selection of modern, timeless pieces that customers can’t find anywhere else. Cowen analysts believe that Arhaus’ commencement at Buy is an appealing starting point for investments.

Not only does Arhaus have a well-established brand presence, but they also have a loyal customer base and an impressive track record of growth. The company also has a strong balance sheet and continues to be profitable in a highly competitive market. With an expanding online presence and various partnerships with major retailers, Cowen is confident that Arhaus is well-positioned for future success.

Price History

On Wednesday, ARHAUS closed at $7.5, a slight increase of 0.2% from the prior closing price of $7.5. Cowen, an investment banker and financial services firm, sees this as an attractive entry point for investors. Cowen issued a note on Wednesday calling ARHAUS a “buy” and advising investors to take advantage of the current stock price. They cited the company’s strong leadership and strong financial performance across its product categories as reasons for their positive outlook.

Cowen also noted that the current stock price presents investors with an opportunity to benefit from future upside potential. With the right strategy and investment, Cowen believes that ARHAUS can reach its full potential in the near future. Arhaus_Investment_An_Attractive_Entry_Point”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arhaus. More…

| Total Revenues | Net Income | Net Margin |

| 1.23k | 136.63 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arhaus. More…

| Operations | Investing | Financing |

| 74.45 | -52.66 | -0.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arhaus. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 931.79 | 722.1 | 1.51 |

Key Ratios Snapshot

Some of the financial key ratios for Arhaus are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.4% | 83.9% | 15.1% |

| FCF Margin | ROE | ROA |

| 1.8% | 62.7% | 12.5% |

Analysis

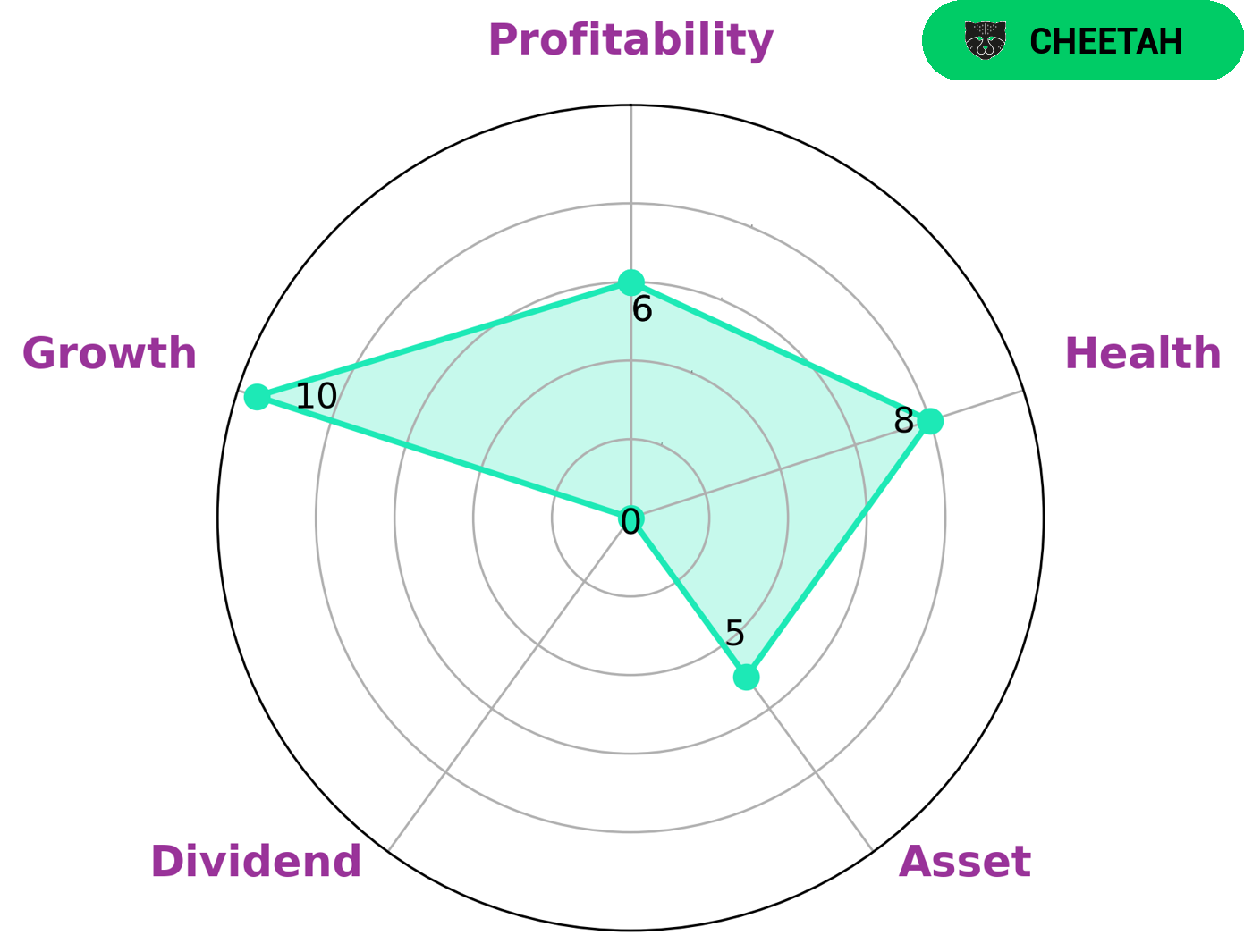

GoodWhale were approached by ARHAUS to perform an analysis of their wellbeing. Upon using our Star Chart assessment tool, we found that ARHAUS is strong in growth, medium in asset, profitability and weak in dividend. Based on this, we classify ARHAUS as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the characteristics of ARHAUS, we believe they may be of interest to investors who are looking to take on more risk in exchange for potential higher returns. Despite the risks associated with this type of company, ARHAUS still has a high health score of 8/10 considering its cashflows and debt, which indicates that they are capable of safely riding out any crisis without the risk of bankruptcy. Arhaus_Investment_An_Attractive_Entry_Point”>More…

Peers

The company has a strong competition with other companies such as Haverty Furniture Companies Inc, RH, and Williams-Sonoma Inc. All of these companies offer similar products and services, making it difficult for Arhaus Inc to differentiate itself from the others.

However, Arhaus Inc has managed to remain successful by offering quality products and excellent customer service.

– Haverty Furniture Companies Inc ($NYSE:HVT)

Haverty Furniture Companies, Inc. is a retailer of home furnishings in the United States, with over 120 showrooms in 17 states. Founded in 1885, Havertys provides its customers with a wide selection of furniture, including living room, dining room, and bedroom sets, as well as mattresses, home decor, and accessories. The company’s website offers a virtual showroom, online ordering, and delivery options. Haverty Furniture Companies, Inc. is a publicly traded company listed on the New York Stock Exchange under the ticker symbol HVT. As of 2021, the company had a market capitalization of 447.4 million and a return on equity of 28.05%.

– RH ($NYSE:RH)

The company’s market cap is 6.06B as of 2022 and its ROE is 35.86%. The company is engaged in the business of providing healthcare services.

– Williams-Sonoma Inc ($NYSE:WSM)

Williams-Sonoma, Inc. is a multi-channel specialty retailer of high quality products for the home. It operates through two segments: E-commerce and Retail. The company’s products include cookware, tools, electrics, cutlery, tabletop and bar, outdoor, furniture, and a range of home decoration and gift items. Williams-Sonoma, Inc. was founded in 1956 and is headquartered in San Francisco, California.

Summary

ARHAUS is a home furnishings retailer that recently attracted the attention of investment firm Cowen, who believes that the current market presents an attractive entry point for investors. Cowen’s analysis suggests that the company has strong potential for growth, pointing to a number of positive factors such as its strong market share, wide product offerings, and experienced management team. The firm believes that investing in the company now will yield strong returns in the future. Cowen’s assessment may be an indication that other investors are likely to take note and take advantage of the favorable entry point as well.

Recent Posts