. takes a smart approach to investing by reducing their stake in CVS Health Corp.

May 3, 2023

Trending News ☀️

Burney Co. has demonstrated its dedication to astute investments by reducing its holdings in CVS ($NYSE:CVS) Health Corp. This shift in Burney Co.’s investment strategy is a smart move for the company. CVS Health Corp. is one of the largest health care companies in the U.S. It provides pharmacy services and plans for individuals, businesses, and government organizations. The company also has retail stores that offer a variety of products, including prescription drugs, over-the-counter medications, health care items, beauty items, and general merchandise. By taking a more cautious approach to investing, the firm is putting itself in a better position to make profitable investments in the long run. This move also signals its commitment to responsible investing as it continues to seek out beneficial investments in the future.

Stock Price

This small uptick in share prices provides a clear indication that Burney Co. is taking the correct course of action in managing its investments. Trimming their holding in CVS Health Corp. also serves to free up capital that can be used to take advantage of new opportunities in the market. It’s clear that Burney Co. is taking a thoughtful approach to investing, one that looks beyond simply chasing short-term gains. With their strategy of trimming their stake in CVS Health Corp., they are demonstrating an understanding of the long-term potential of their portfolio and how reducing risk can lead to greater returns over time. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cvs Health. More…

| Total Revenues | Net Income | Net Margin |

| 322.47k | 4.15k | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cvs Health. More…

| Operations | Investing | Financing |

| 16.18k | -5.05k | -10.52k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cvs Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 228.28k | 156.96k | 54.63 |

Key Ratios Snapshot

Some of the financial key ratios for Cvs Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | 10.3% | 2.5% |

| FCF Margin | ROE | ROA |

| 4.2% | 7.0% | 2.2% |

Analysis

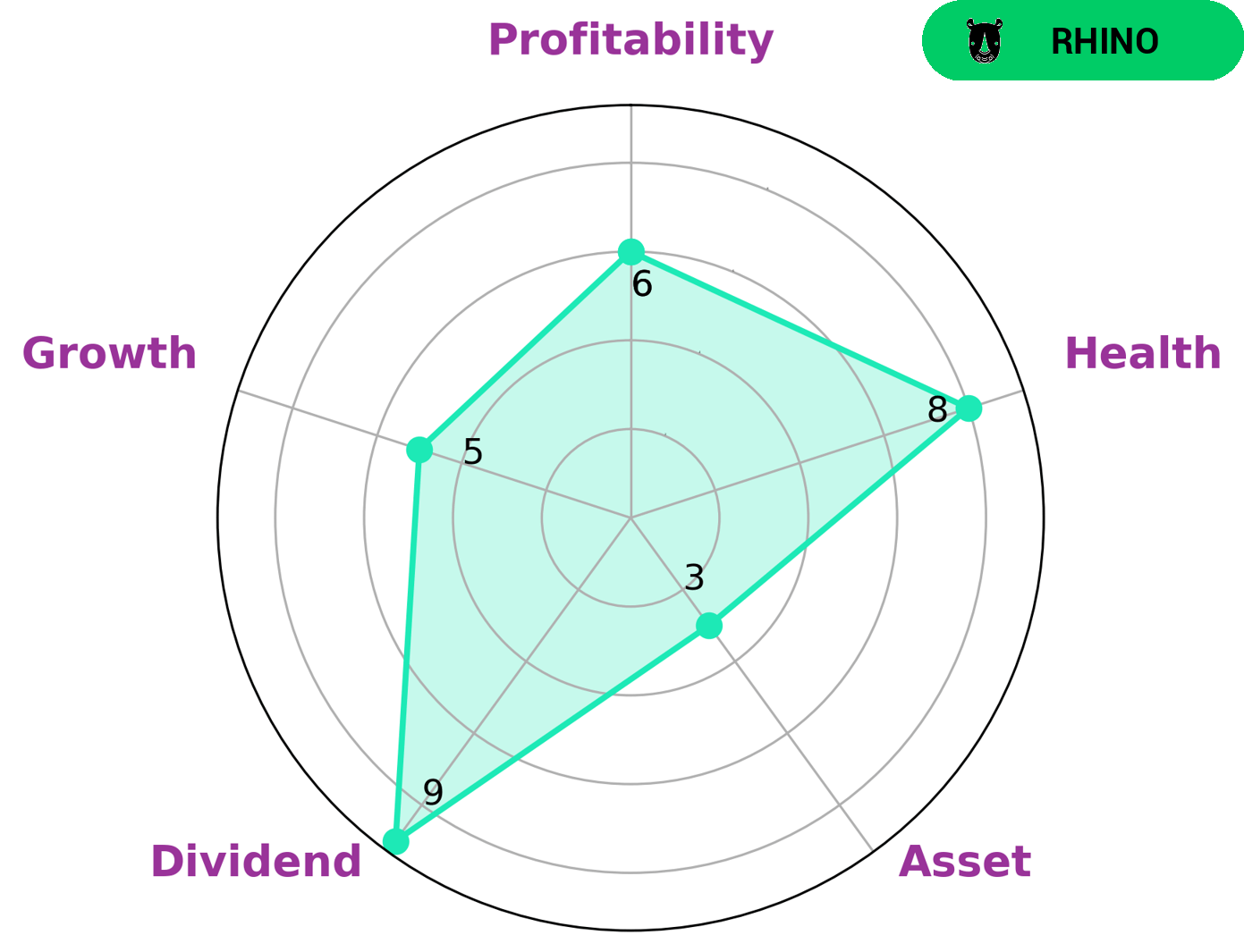

At GoodWhale, we’ve been closely analyzing CVS HEALTH‘s financials. We’re pleased to report that CVS HEALTH has an impressive health score of 8/10 with regard to its cashflows and debt, indicating that the company is capable of paying off debt and funding future operations. After further analysis, we classified CVS HEALTH as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. For investors looking to invest in CVS HEALTH, they should consider its strengths in dividend and its moderate growth, profitability and asset. As CVS HEALTH is classified as a rhino, investors should take into account the moderate growth before making a decision to invest. More…

Peers

The competition between CVS Health Corp and its competitors is fierce. Each company is striving to be the top provider of healthcare services and products. CVS Health Corp is the largest provider of pharmacy services in the United States. Marpai Inc is a close second. Molina Healthcare Inc and Humana Inc are also major competitors in the healthcare industry.

– Marpai Inc ($NASDAQ:MRAI)

Marpai Inc is a publicly traded company with a market capitalization of 20.89 million as of 2022. The company has a return on equity of -64.66%. Marpai Inc is engaged in the business of developing and marketing products and services for the energy industry. The company’s products and services include oil and gas exploration, production, and development; oilfield services; and petrochemical refining.

– Molina Healthcare Inc ($NYSE:MOH)

Molina Healthcare Inc is a health care company that provides Medicaid-related solutions for low-income families and individuals. As of 2022, the company had a market capitalization of 20.52 billion dollars and a return on equity of 24.89%. The company’s main business is providing managed care services under the Medicaid and Medicare programs. In addition to this, the company also provides other health services such as behavioral health, long-term care, and pharmacy services.

– Humana Inc ($NYSE:HUM)

Humana Inc is a healthcare company that offers a wide range of health and wellness products and services. The company has a market cap of 63.3B as of 2022 and a return on equity of 17.4%. Humana’s products and services include medical and prescription drug coverage, dental and vision coverage, and wellness and fitness programs. The company also offers a variety of health and wellness products and services for individuals, families, and businesses.

Summary

Burney Co. recently made a strategic move in its investment strategy by trimming its stake in CVS Health Corp. This suggests that the company is making prudent investments, as it believes that the stock of CVS Health may not be as profitable as it initially thought. This move highlights the importance of analyzing investment opportunities and considering the risk/reward aspect of the stock. While CVS Health may have had potential for growth in the past, Burney Co. decided to reduce its stake in order to minimize its potential losses. This is a sign that the company is taking a more conservative approach to investing and is likely to benefit from it in the future.

Recent Posts