Molina Healthcare Stock Fair Value Calculator – DekaBank increases stake in Molina Healthcare by 2.2% in third quarter

October 31, 2024

🌥️Trending News

Molina Healthcare ($NYSE:MOH), Inc. is a leading healthcare provider that offers affordable and quality health plans to individuals and families across the United States. With a strong commitment to providing accessible and comprehensive healthcare services, Molina has gained the trust of millions of members and has become a prominent player in the healthcare industry. In a recent development, it was announced that DekaBank Deutsche Girozentrale, one of Germany’s largest banks, has increased its stake in Molina Healthcare by 2.2% during the third quarter. This move by DekaBank highlights its confidence in Molina’s financial performance and growth potential in the coming months. Molina Healthcare has been showing promising results in recent times, with a steady increase in its share price and strong financial performance. DekaBank’s decision to increase its stake in Molina Healthcare reflects its belief in the company’s long-term growth prospects. With a growing market share and a solid financial standing, Molina is well-positioned to continue its upward trajectory in the healthcare industry.

This increase in ownership also showcases DekaBank’s confidence in Molina’s established leadership team and their strategic vision for the company’s future. This move by DekaBank also aligns with Molina Healthcare’s overall growth strategy, which includes expanding its footprint and diversifying its revenue streams. The company has been actively investing in new markets and partnerships to offer more options and better services to its members. With this increase in stake, DekaBank adds to Molina’s financial stability and provides additional resources for the company to execute its growth plans successfully. With a proven track record of delivering quality care and a sound financial outlook, Molina is well-positioned to continue its growth trajectory and create value for its shareholders. This move also highlights the potential and attractiveness of Molina Healthcare as a long-term investment option.

Analysis – Molina Healthcare Stock Fair Value Calculator

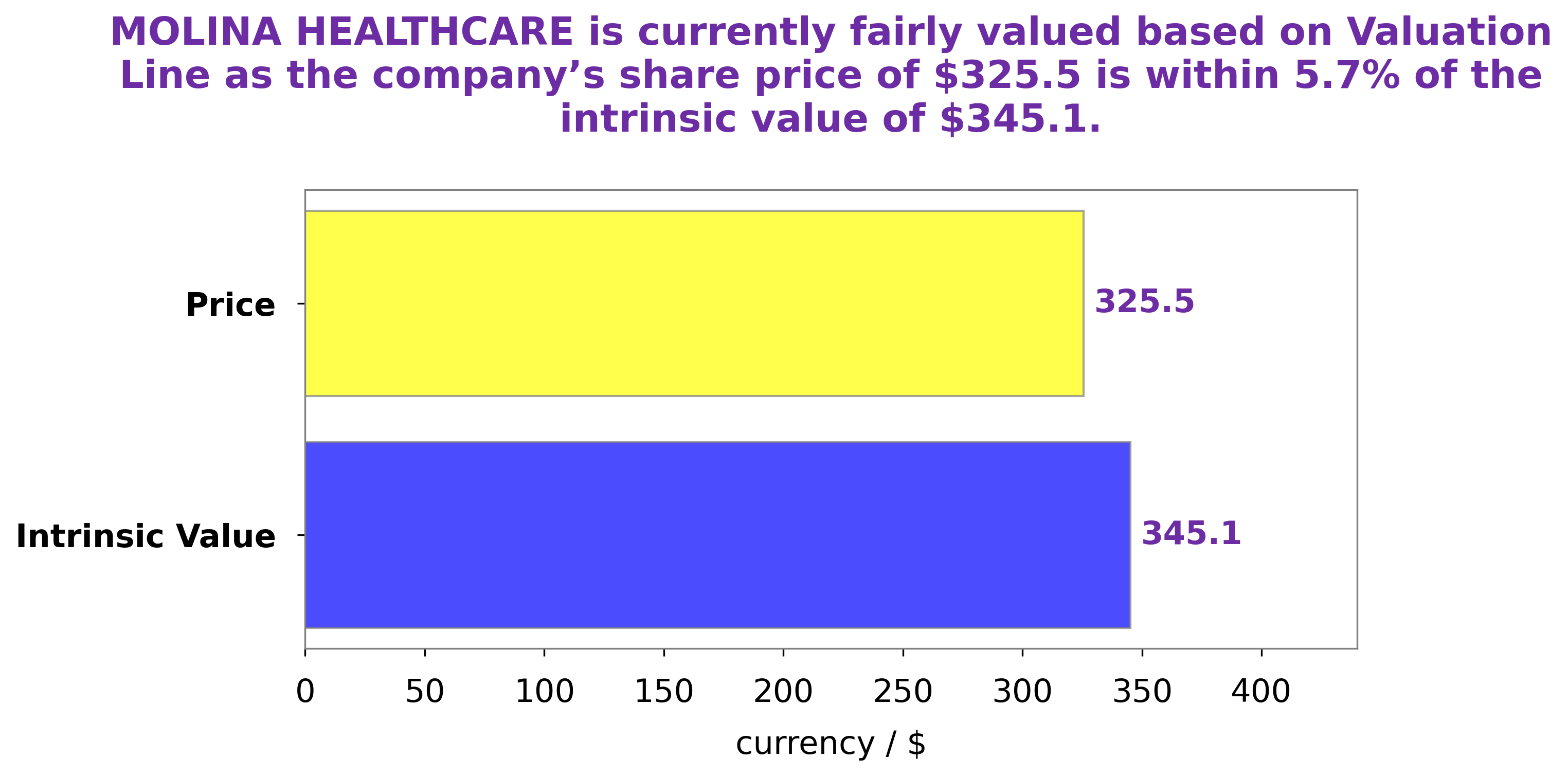

As I analyzed MOLINA HEALTHCARE, I focused on its fundamental aspects to determine its value. After conducting a thorough evaluation, I have calculated the fair value of MOLINA HEALTHCARE’s share to be around $345.1. This is based on our proprietary Valuation Line, which takes into account various financial metrics and market trends. Currently, MOLINA HEALTHCARE’s stock is being traded at $325.54, which is slightly lower than its fair value. This means that the stock is undervalued by approximately 5.7%. This presents a potential opportunity for investors to purchase the stock at a lower price and potentially see gains in the future. One of the key factors contributing to my analysis of MOLINA HEALTHCARE is its financial performance. The company has consistently shown strong financials, with steady revenue growth and solid profitability. This indicates a stable and well-managed business, which adds to its overall value. In addition, MOLINA HEALTHCARE operates in the healthcare industry, which is expected to experience continued growth in the coming years due to an aging population and increasing healthcare needs. This presents a positive outlook for the company and further justifies its fair value. Moreover, MOLINA HEALTHCARE has a strong market position and competitive advantage in its industry. It has a diversified portfolio of healthcare products and services, along with a strong customer base. These factors contribute to the company’s overall value and make it an attractive investment opportunity. In conclusion, my analysis of MOLINA HEALTHCARE shows that it is a fundamentally sound company with strong financials and a positive outlook. Its current stock price is undervalued, presenting an opportunity for investors to potentially see gains in the future. However, as with any investment, it is important to conduct further research and consider individual risk tolerance before making any investment decisions. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Molina Healthcare. More…

| Total Revenues | Net Income | Net Margin |

| 34.07k | 1.09k | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Molina Healthcare. More…

| Operations | Investing | Financing |

| 1.66k | -744 | -58 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Molina Healthcare. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.89k | 10.68k | 72.3 |

Key Ratios Snapshot

Some of the financial key ratios for Molina Healthcare are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.6% | 13.4% | 4.6% |

| FCF Margin | ROE | ROA |

| 4.6% | 24.3% | 6.6% |

Peers

Its competitors include Centene Corp, Humana Inc, Anthem Inc.

– Centene Corp ($NYSE:CNC)

Centene Corporation is a health services company that provides access to quality, affordable health care for low-income individuals and families. It operates through three segments: Medicaid, Medicare, and Commercial. The Medicaid segment provides Medicaid services to eligible low-income individuals and families through government-sponsored programs. The Medicare segment provides Medicare Advantage, Part D prescription drug, and supplemental health benefits to Medicare-eligible individuals. The Commercial segment provides health insurance to individuals and families through the Health Care Exchanges and the individual market.

– Humana Inc ($NYSE:HUM)

Humana Inc. is a for-profit American health insurance company based in Louisville, Kentucky. As of 2019, Humana ranked #4 in largest health insurers in the United States by revenue. founded in 1961, the company has about 50,000 employees as of 2016.

The company’s market cap is $64.61 billion as of 2022, and its return on equity is 17.4%. Humana provides health insurance coverage to over 13 million people in the United States, as well as pharmacy benefits management and other health services. The company serves customers through a network of over 60,000 physicians and 5,400 hospitals.

Summary

DekaBank Deutsche Girozentrale, a German financial institution, increased its stake in Molina Healthcare by 2.2% in the third quarter. This indicates a potential confidence in the company’s performance and future prospects. Molina Healthcare is a healthcare company that offers managed care services to individuals and families enrolled in government-sponsored programs. While the exact reasons for DekaBank’s increased investment are unknown, it could be due to positive earnings and growth potential in the healthcare industry. This move by DekaBank may also attract other investors to consider Molina Healthcare as a potential investment opportunity.

However, further analysis is necessary to fully understand the rationale behind this investment decision.

Recent Posts