Veeva Systems Continues to be a Powerful Catalyst in the Market, Closing at $174.07 on 2023.

March 28, 2023

Trending News ☀️

Veeva Systems ($NYSE:VEEV) Inc. continues to be a powerful catalyst in the market, closing at $174.07 on 2023. This close is a 0.12% increase from its previous close of $173.86, providing evidence of continuing market power for the company. Veeva Systems Inc. is a leading cloud-based software provider to the global life sciences industry, and its innovative solutions have made it an industry leader. The company’s solutions are used to store and manage vast amounts of data, helping pharmaceutical companies increase efficiency in areas such as regulatory compliance and product development.

Additionally, Veeva Systems Inc. invests heavily in research and development, resulting in the launch of new products and services to further advance the capabilities of its customers. These investments in customer success and innovation have helped Veeva Systems Inc. to become an integral part of the life sciences industry, helping propel it to its current success in the market.

Stock Price

The company has seen mostly positive news coverage as of late, and that momentum has translated into a solid performance on Monday. VEEVA SYSTEMS stock opened at $177.0 and closed at $177.5, up by 1.1% from previous closing price of 175.6. This marks a strong start to the week for the company and reflects investors’ confidence in the company’s outlook. The future looks bright for Veeva Systems Inc., and investors are likely to keep an eye on the performance of their stock in the coming days and weeks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Veeva Systems. More…

| Total Revenues | Net Income | Net Margin |

| 2.16k | 487.71 | 22.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Veeva Systems. More…

| Operations | Investing | Financing |

| 780.47 | -1.01k | -19.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Veeva Systems. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.8k | 1.09k | 21.97 |

Key Ratios Snapshot

Some of the financial key ratios for Veeva Systems are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 25.0% | 17.1% | 21.3% |

| FCF Margin | ROE | ROA |

| 36.2% | 8.0% | 6.0% |

Analysis

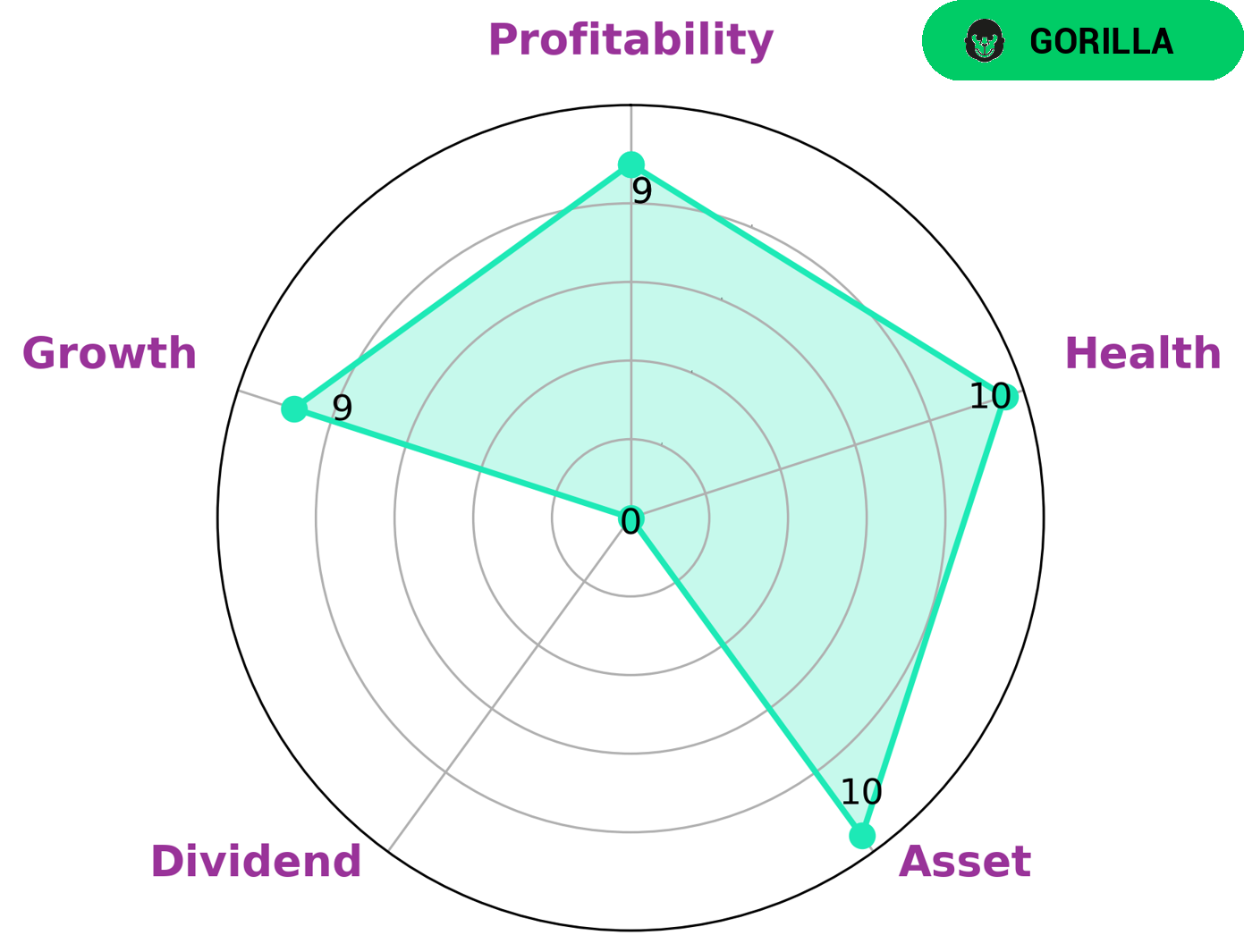

GoodWhale is pleased to present the wellbeing analysis of VEEVA SYSTEMS. Our star chart shows that the company is strong in terms of asset, growth, and profitability and weak in dividend. In light of this, we classify VEEVA SYSTEMS as a ‘gorilla’, indicating that this firm has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given its strong competitive advantage, we anticipate that investors who are interested in safe, yet high-yield investments may be particularly keen on VEEVA SYSTEMS. Besides, VEEVA SYSTEMS also has a high health score of 10/10 with regard to its cash flows and debt, which shows that the company is capable of sustaining future operations in times of crisis. More…

Peers

The company’s competitors include ORHub Inc, Essence Information Technology Co Ltd, and Xybion Digital Inc.

– ORHub Inc ($OTCPK:ORHB)

CrowdStrike Holdings, Inc. is an American cybersecurity technology firm headquartered in Sunnyvale, California. It provides endpoint security, threat intelligence, and cyber attack response services. The company was founded in 2011 by George Kurtz and Dmitri Alperovitch.

– Essence Information Technology Co Ltd ($SHSE:688555)

Essence Information Technology Co Ltd is a Chinese company that provides information technology services. It has a market cap of 1.01B as of 2022 and a Return on Equity of -2.84%. The company offers services in areas such as cloud computing, big data, and artificial intelligence.

– Xybion Digital Inc ($TSXV:XYBN)

Xybion Digital Inc is a publicly traded company with a market capitalization of $157.07 million as of 2022. The company has a negative return on equity of 12.47% and is involved in the digital media industry. Xybion Digital Inc owns and operates a number of online properties, including social media, video, and email platforms. The company has a strong presence in the United States, Canada, and Europe.

Summary

Currently trading at $174.07, the company continues to show strong performance and has seen the majority of news coverage being positive in nature. Despite the high share price, many investors are still looking to capitalize on the stock’s solid performance by buying shares and expecting further growth. Analysts have praised the company’s business model, which focuses heavily on cloud-based software as a service (SaaS) and data management solutions. Veeva Systems is expected to benefit from continued growth in the healthcare and pharmaceuticals industries, which both have a need for modernized technology solutions. Investors should remain optimistic about the company’s future, as there is plenty of room for further growth.

Recent Posts