Teladoc Health Stock Soars on Expansion into Weight Management

April 20, 2023

Trending News 🌥️

Teladoc Health ($NYSE:TDOC), a publicly traded company based in Purchase, New York, has seen its stock price soar after announcing its expansion into weight management. This expansion will allow Teladoc Health to use its telemedicine services to offer nutritionists and registered dietitians to help customers achieve their weight loss goals. The increase in Teladoc Health’s stock price is due to the potential for increased revenue from the new services it is offering. With the global market for weight management services being so large, Teladoc has the potential to tap into a significant source of income. Furthermore, the company is already well established in the telemedicine industry, giving it a head start in the implementation of its new services. The move into weight management is also seen as a way for Teladoc Health to diversify its portfolio.

By offering customers more services, it can increase its customer base and revenue streams. The company already offers a wide range of telemedicine services such as mental health, dermatology, and sexual health services. The addition of weight management services further expands the range of options available to customers, making it an attractive option for those looking for comprehensive health care services. Overall, Teladoc Health’s expansion into weight management has been well received by investors, pushing the company’s stock price up. With the potential to tap into a huge market and offer customers more comprehensive services, it is clear that this move could be profitable for Teladoc Health.

Price History

On Tuesday, Teladoc Health stock soared with an opening price of $26.5 and closing at $27.3, a 5.7% increase from its previous closing price of $25.9. Teladoc Health will now provide nutrition counseling and weight loss programs via its digital health platform, allowing users to access such services from their own home. This is an example of Teladoc Health’s ongoing commitment to providing comprehensive healthcare services to its customers.

In addition to nutrition counseling, Teladoc Health also provides telehealth services, digital mental healthcare, and other remote medical services. The strong uptick in its stock price is a testament to the company’s dedication to providing high-quality, comprehensive care to its customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Teladoc Health. More…

| Total Revenues | Net Income | Net Margin |

| 2.41k | -13.66k | -9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Teladoc Health. More…

| Operations | Investing | Financing |

| 189.29 | -167.74 | 6.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Teladoc Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.35k | 2.04k | 14.17 |

Key Ratios Snapshot

Some of the financial key ratios for Teladoc Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 63.2% | – | -567.3% |

| FCF Margin | ROE | ROA |

| 0.7% | -204.1% | -196.4% |

Analysis

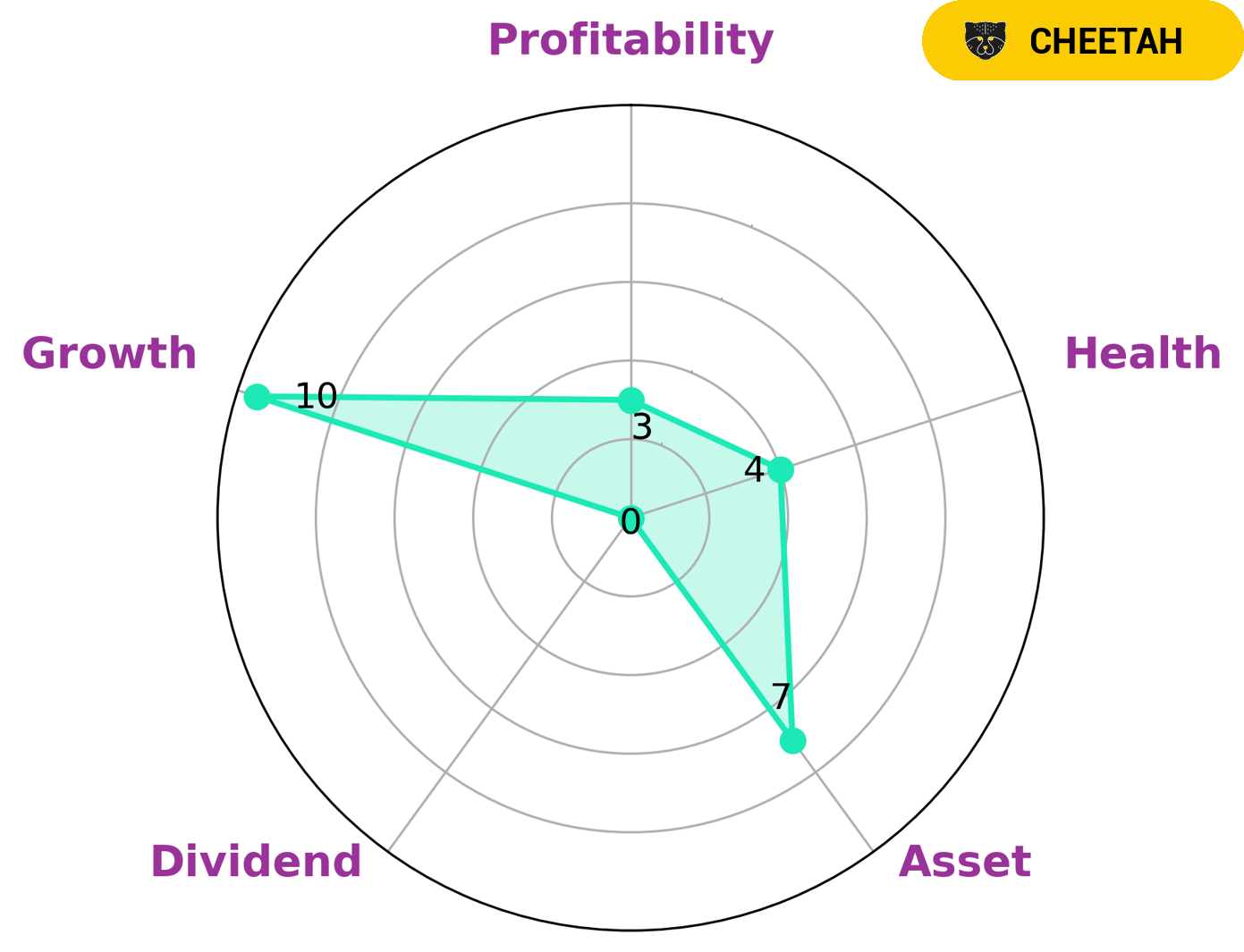

After analyzing the financials of TELADOC HEALTH with GoodWhale, I observed that the company is relatively strong in terms of asset and growth, but has a lower score in terms of dividend and profitability. After classifying the company as a ‘cheetah’ type company, which means that it has achieved high revenue or earnings growth but faces a certain degree of instability due to low profitability, I was able to identify what type of investors may find TELADOC HEALTH attractive. Generally speaking, these would be investors looking for high growth potential, at the risk of some instability and difficulty in sustaining profits. On the other hand, I also observed that TELADOC HEALTH had an intermediate health score of 4/10 with regard to its cash flows and debt, which means that the company is likely to survive any crisis without the risk of bankruptcy. More…

Peers

– American Well Corp ($NYSE:AMWL)

American Well Corp is a healthcare technology company that provides telehealth services. The company has a market cap of 984.84M as of 2022 and a Return on Equity of -13.04%. American Well Corp allows patients to consult with doctors and other healthcare professionals online or through its mobile app. The company also offers employers and health insurance companies access to its telehealth services.

– Dialogue Health Technologies Inc ($TSX:CARE)

Healthcare technology company Dialogue provides a digital platform that helps manage chronic conditions. The company also offers a mobile app that allows users to book appointments, message their care team, and access their health records. As of 2022, Dialogue Health Technologies Inc has a market cap of 181.53M and a Return on Equity of -16.56%. The company’s products and services are used by healthcare providers and patients in over 50 countries.

– Evolent Health Inc ($NYSE:EVH)

Evolent Health Inc is a healthcare technology company that provides software and services to health plans, provider organizations, and employers. The company has a market cap of 3.04B as of 2022 and a Return on Equity of -0.15%. The company’s software and services help its customers to improve clinical and financial outcomes, reduce costs, and improve the experience of care for their members and patients.

Summary

Teladoc Health (TDOC) is a leading provider of virtual healthcare delivery solutions. In recent news, the company announced an expansion into weight management services, which has been met with positive investor sentiment and helped drive the stock price higher. Analysts are bullish on the stock due to the strong fundamentals and growth potential of the company. Teladoc’s current share price is well below its all-time highs, but reflects an attractive entry point with potential upside.

The company’s solid balance sheet and low debt levels provide additional assurance, along with its impressive customer base and expanding service offerings. Investors should keep a close eye on Teladoc’s performance and consider investing in the stock for the long-term.

Recent Posts