Teladoc Health Q1 Results Set to Impact Stock Price

April 26, 2023

Trending News 🌥️

Teladoc Health ($NYSE:TDOC) is a company that provides virtual healthcare services and telehealth solutions. Investors are keenly awaiting the results to see if the stock will continue its positive momentum. Analysts are optimistic that the Q1 results will be strong, predicting a continued increase in Teladoc’s stock price. The success of Teladoc Health has been driven by the increasing demand for virtual healthcare services.

Teladoc Health has positioned itself as one of the leading providers of these services and has seen substantial growth as a result. As investors await the Q1 results of Teladoc Health, they are expecting to see an increase in stock price. If the results are as strong as predicted, it could be an indication of further growth and success for the company in the coming months.

Price History

On Tuesday, TELADOC HEALTH stock opened at $27.9 and closed at $26.5, representing a drop of 5.9% from the previous closing price of 28.2. This news had a significant impact on the stock price, which is likely to continue in the near future. This caused concern among investors, as the company had not reached its projected goal of a net income for Q1. These numbers were also below expectations, causing further concern for investors.

The stock price of TELADOC HEALTH will be significantly impacted by these results, as investors look to see if the company is able to recover from the losses it posted in Q1. The company will need to demonstrate an improvement in its performance and outlook in order to reassure investors and increase the stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Teladoc Health. More…

| Total Revenues | Net Income | Net Margin |

| 2.41k | -13.66k | -9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Teladoc Health. More…

| Operations | Investing | Financing |

| 189.29 | -167.74 | 6.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Teladoc Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.35k | 2.04k | 14.17 |

Key Ratios Snapshot

Some of the financial key ratios for Teladoc Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 63.2% | – | -567.3% |

| FCF Margin | ROE | ROA |

| 0.7% | -204.1% | -196.4% |

Analysis

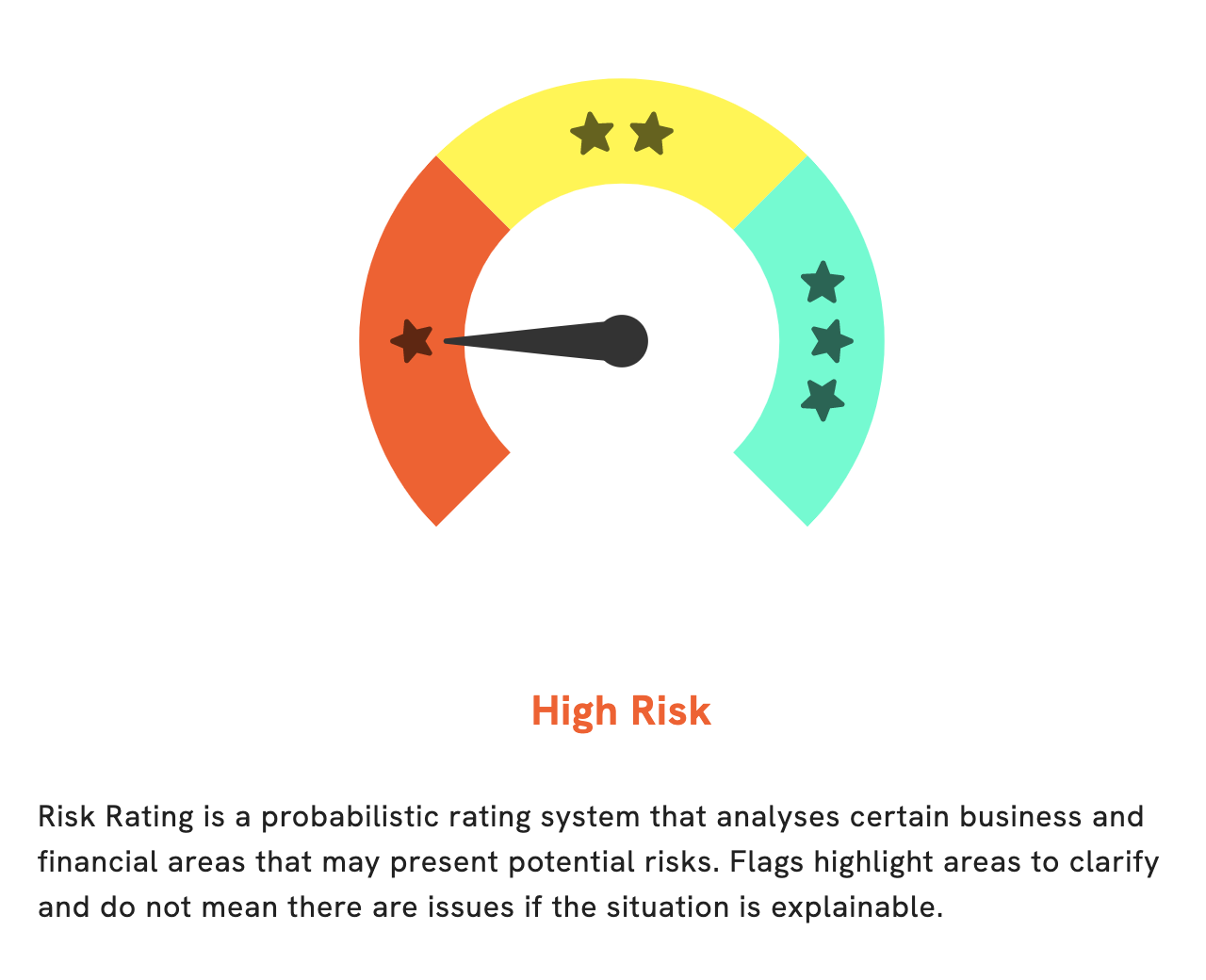

At GoodWhale, we have done a thorough analysis of TELADOC HEALTH‘s fundamentals. After examining all the available financial and business data, our Risk Rating has determined that TELADOC HEALTH is a high risk investment. We have detected five risk warnings in the income sheet, balance sheet, cashflow statement, non financial and financial journal. If you would like to get an in-depth look at these warning signals, be sure to register with us. We’ll provide further details on the risks associated with investing in TELADOC HEALTH. More…

Peers

– American Well Corp ($NYSE:AMWL)

American Well Corp is a healthcare technology company that provides telehealth services. The company has a market cap of 984.84M as of 2022 and a Return on Equity of -13.04%. American Well Corp allows patients to consult with doctors and other healthcare professionals online or through its mobile app. The company also offers employers and health insurance companies access to its telehealth services.

– Dialogue Health Technologies Inc ($TSX:CARE)

Healthcare technology company Dialogue provides a digital platform that helps manage chronic conditions. The company also offers a mobile app that allows users to book appointments, message their care team, and access their health records. As of 2022, Dialogue Health Technologies Inc has a market cap of 181.53M and a Return on Equity of -16.56%. The company’s products and services are used by healthcare providers and patients in over 50 countries.

– Evolent Health Inc ($NYSE:EVH)

Evolent Health Inc is a healthcare technology company that provides software and services to health plans, provider organizations, and employers. The company has a market cap of 3.04B as of 2022 and a Return on Equity of -0.15%. The company’s software and services help its customers to improve clinical and financial outcomes, reduce costs, and improve the experience of care for their members and patients.

Summary

Teladoc Health is an American telemedicine services provider that offers access to healthcare consultation and diagnosis via phone or video services. Investing analysis of Teladoc Health reveals a company with a strong financial performance and significant potential for growth. The company is also expanding its presence in the U.S. healthcare market through strategic partnerships and acquisitions.

Analysts believe that Teladoc Health has a bright future ahead of it, as more consumers are likely to take advantage of its services and adoption of telemedicine continues to grow. Long-term investors should consider TELADOC HEALTH for its solid financials and potential for growth.

Recent Posts