Premier Stock Fair Value – Russell Investments Reduces Stake in Premier Inc: A Strategic Decision or Permanent Change?

May 31, 2023

🌥️Trending News

The recent announcement that Russell Investments has sold off a significant portion of its stake in Premier ($NASDAQ:PINC) Inc. has raised a lot of questions. Namely, can Premier Inc. count on Russell Investments’ long-term commitment or was this just a tactical move? Premier Inc. is a leading healthcare technology and services company based in Charlotte, North Carolina. The company specializes in helping healthcare organizations reduce costs, improve patient outcomes, and increase operational efficiency. They provide services such as strategic consulting, financial modeling, supply chain management, and technology implementation.

They are also the industry leader in leveraging big data to drive better patient outcomes. At the same time, Russell Investments is one of the largest asset managers in the world with over $2 trillion under management. Their decision to reduce their stake in Premier Inc. could indicate a lack of confidence in the company’s long-term growth prospects or it could simply be a strategic decision to diversify their portfolio. At the end of the day, only time will tell if Russell Investments’ decision to reduce its stake is a sign of things to come or merely a momentary shift in market sentiment.

Price History

On Tuesday, Russell Investments announced that they had reduced their stake in PREMIER Inc, causing the company’s stock to open at $25.6 and close at $25.2, down by 1.5% from its previous closing price of 25.6. This decision has caused investors to question whether or not this is a short term strategic decision or a permanent change in the company’s ownership. It is possible that this decision was a strategic move by Russell Investments in order to take advantage of current market conditions and gain a better return on their investment. Alternatively, it could be a sign of a longer-term shift in the company’s ownership structure as Russell Investments seeks to divest from PREMIER Inc. Only time will tell how this decision will affect PREMIER Inc in the long run, and investors will be keenly watching to see what the outcome of this change in ownership will be. Premier_Inc_A_Strategic_Decision_or_Permanent_Change”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Premier. More…

| Total Revenues | Net Income | Net Margin |

| 1.34k | 183.47 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Premier. More…

| Operations | Investing | Financing |

| 440.62 | -276.16 | -252.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Premier. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.51k | 1.18k | 19.4 |

Key Ratios Snapshot

Some of the financial key ratios for Premier are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.6% | -12.5% | 20.9% |

| FCF Margin | ROE | ROA |

| 26.6% | 7.5% | 5.0% |

Analysis – Premier Stock Fair Value

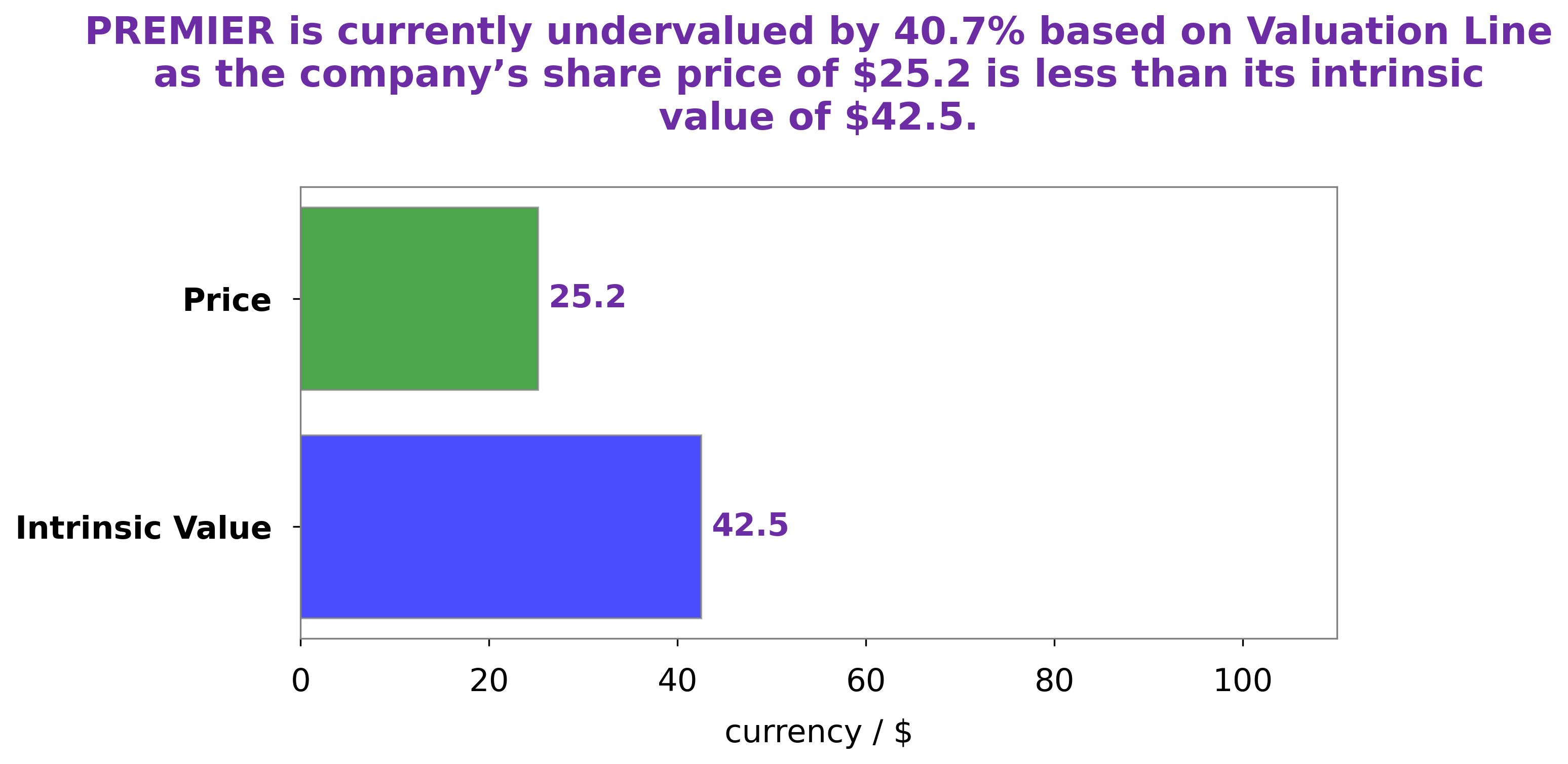

GoodWhale has conducted a thorough analysis of essential components of PREMIER. We have found that the fair value of PREMIER share is around $42.5. This value was calculated by our proprietary Valuation Line which takes into account the company’s financial situation, market trends, and competitors’ performance. Now, PREMIER stock is traded at $25.2, undervalued by 40.6%. This indicates a good investment opportunity for those who are looking to maximize returns. Premier_Inc_A_Strategic_Decision_or_Permanent_Change”>More…

Peers

Premier‘s products and services include supply chain management, data and analytics, revenue cycle management, and more. The company’s competitors include SpotLite IOT Solutions Inc, Akerna Corp, and H-Source Holdings Ltd.

– SpotLite IOT Solutions Inc ($OTCPK:SPLTF)

SpotLite IOT Solutions Inc is a Canadian technology company that specializes in the development and deployment of Internet of Things (IoT) solutions. The company has a market cap of 8.07M as of 2022. SpotLite IOT Solutions Inc’s IoT solutions are used in a variety of industries, including healthcare, transportation, logistics, and manufacturing. The company’s products are designed to improve the efficiency of operations and reduce costs.

– Akerna Corp ($NASDAQ:KERN)

Akerna Corp is a provider of compliance solutions for the global cannabis industry. Its software solutions allow cannabis businesses to track their products from seed to sale and ensure compliance with government regulations. The company’s market cap is 7.76M as of 2022. Its ROE is -45.77%.

– H-Source Holdings Ltd ($OTCPK:HSCHF)

H-Source Holdings Ltd is a market leading company that provides innovative solutions for the healthcare industry. The company has a strong focus on research and development, and is always looking for new ways to improve the quality of healthcare. H-Source Holdings Ltd has a market capitalization of 1.18k as of 2022, and a return on equity of 14.04%. The company’s strong financial performance is a testament to its commitment to excellence in the healthcare industry.

Summary

Premier Inc (NASDAQ: PINC) has recently seen a decrease in its share price, following news that Russell Investments had cut its position in the company. This move has raised questions as to whether it is a tactical decision on behalf of Russell or a long-term verdict on the stock. Analysts suggest that the move could be due to rising concerns around PREMIER’s ability to navigate the current healthcare landscape, particularly with respect to its visibility into the effects of the pandemic. They also point out the potential for further healthcare reform, such as value-based care.

In addition, investors appear to be looking for more clarity around PREMIER’s financials and business strategy as the company looks to grow market share. As such, investors should continue to keep an eye on PREMIER’s earnings reports and other updates from the company to better gauge how the company is trending.

Recent Posts