Arizona State Retirement System Increases Holdings in Teladoc Health, by 3.1%

May 20, 2023

Trending News 🌥️

Teladoc Health ($NYSE:TDOC), Inc. is a leading global provider of virtual health care services. The company offers members access to virtual visits with licensed providers, digital therapeutic services, and personalized care plans. Teladoc Health connects patients to the right care when they need it most, helping them receive care quickly and conveniently. In its most recent filing with the Securities and Exchange Commission, the Arizona State Retirement System increased its holdings of Teladoc Health, Inc. shares by 3.1% in the fourth quarter. This move demonstrates the confidence that the Arizona State Retirement System has in the company and its continued success. This news comes at an exciting time for Teladoc Health as the company continues to expand its reach to new markets. The company recently opened a new office in Germany and has been actively expanding its services across Europe.

Additionally, Teladoc Health is investing in new technologies and partnerships to accelerate its growth in the virtual health care sector. The increased holdings by the Arizona State Retirement System come as a sign of approval for the work that Teladoc Health is doing in the field of virtual health care and indicates that the company is well-positioned for continued success. As more people turn to online health services, Teladoc Health is becoming an increasingly preferred provider for those seeking convenient and quality health care services.

Analysis

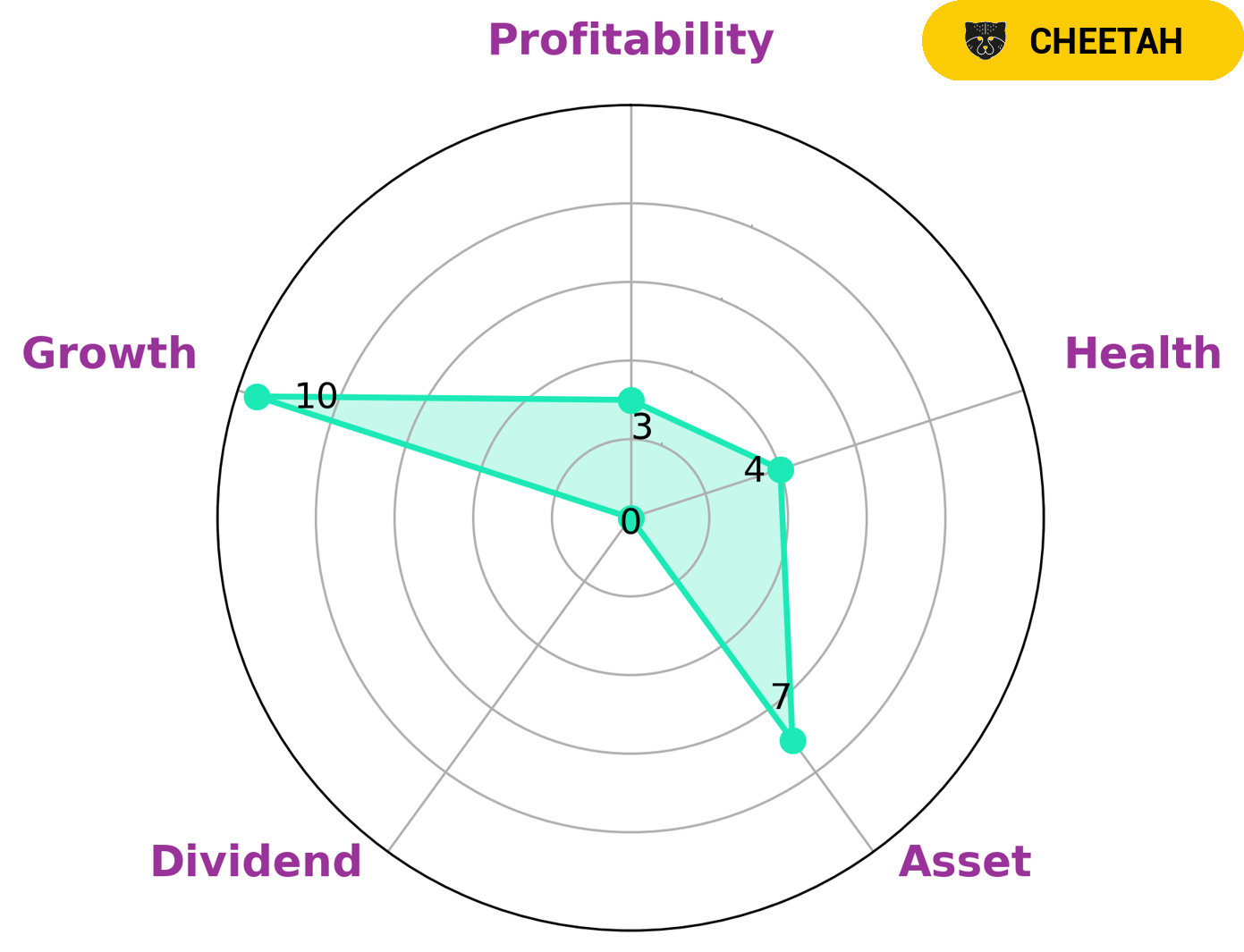

GoodWhale conducted an analysis of TELADOC HEALTH‘s fundamentals, and based on the Star Chart, the company is strong in asset, growth, and weak in dividend, profitability. After further evaluation, we classified it as a ‘cheetah’ type of company; one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company would likely be of interest to investors with a higher risk tolerance and those who seek to gain returns from capital appreciation rather than dividend income. It should be noted, however, that TELADOC HEALTH has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that it is likely to sustain future operations in times of crisis. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Teladoc Health. More…

| Total Revenues | Net Income | Net Margin |

| 2.47k | -7.05k | -9.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Teladoc Health. More…

| Operations | Investing | Financing |

| 234.19 | -185.8 | 7.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Teladoc Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.31k | 2.02k | 14 |

Key Ratios Snapshot

Some of the financial key ratios for Teladoc Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 59.8% | – | -285.3% |

| FCF Margin | ROE | ROA |

| 1.9% | -191.6% | -102.2% |

Peers

– American Well Corp ($NYSE:AMWL)

American Well Corp is a healthcare technology company that provides telehealth services. The company has a market cap of 984.84M as of 2022 and a Return on Equity of -13.04%. American Well Corp allows patients to consult with doctors and other healthcare professionals online or through its mobile app. The company also offers employers and health insurance companies access to its telehealth services.

– Dialogue Health Technologies Inc ($TSX:CARE)

Healthcare technology company Dialogue provides a digital platform that helps manage chronic conditions. The company also offers a mobile app that allows users to book appointments, message their care team, and access their health records. As of 2022, Dialogue Health Technologies Inc has a market cap of 181.53M and a Return on Equity of -16.56%. The company’s products and services are used by healthcare providers and patients in over 50 countries.

– Evolent Health Inc ($NYSE:EVH)

Evolent Health Inc is a healthcare technology company that provides software and services to health plans, provider organizations, and employers. The company has a market cap of 3.04B as of 2022 and a Return on Equity of -0.15%. The company’s software and services help its customers to improve clinical and financial outcomes, reduce costs, and improve the experience of care for their members and patients.

Summary

Teladoc Health, Inc. has seen increased investment activity recently, with the Arizona State Retirement System increasing its holdings in the company by 3.1% in the fourth quarter. This could be a sign that investors are taking a more positive outlook on the company, seeing potential for growth and solid returns. Other investors may be drawn to Teladoc Health, Inc. due to its already established presence in the health care industry, with its telemedicine services providing accessible and efficient patient care. With more investors looking to get in on the action, it will be interesting to see how Teladoc Health, Inc.’s stock price moves in the coming months.

Recent Posts