10x Genomics Intrinsic Stock Value – Of Genomics Solutions

April 7, 2023

Trending News ☀️

10x Genomics ($NASDAQ:TXG) is a leading biotechnology company pioneering the development of innovative tools for genomic analysis. With a wide range of tools and features, 10x Genomics empowers scientists and researchers to better understand the complexities of genetic interactions and gain insights into the unknown realms of genetics. The suite of 10x Genomics tools includes Linked-Reads, Chromium Single Cell, Chromium Immune Profiling, Long Ranger, GemCode, Feature Barcoding and Loupe Browser. Linked-Reads is designed to generate long-range information from short-read sequencing. Chromium Single Cell offers a single cell resolution view of the transcriptome. Chromium Immune Profiling provides deep profiling of the immune system and reveals new insights into how immunity works.

Long Ranger is an analysis pipeline that enables researchers to quickly and easily analyze complex genetic data. Feature Barcoding enables scientists to explore the transcriptome of cells at specified depths. Lastly, Loupe Browser is a powerful software for interactive visualization and analysis of sequencing data. With its range of products, 10x Genomics is helping to advance the field of genomics from basic research to clinical applications. By unlocking the potential of genomic solutions, 10x Genomics is helping scientists and researchers gain better insights into the complexities of genetic interactions and further explore the unknown realms of genetics.

Price History

On Thursday, 10X GENOMICS stock opened at $51.1 and closed at $52.1, up by 1.4% from prior closing price of 51.3. 10X GENOMICS is a company that is focused on enabling scientists to develop innovative solutions for some of the world’s most complex genomic problems. Its solutions range from powerful single cell sequencing systems to data analysis and visualization tools that help scientists to interpret and interpret their data. It has also developed a suite of products for genetic engineering, gene editing, and other technologies that enable researchers to develop novel gene therapies and treatments.

In addition, its software helps researchers to analyze large amounts of genetic data, producing results that are accurate and reliable. 10X GENOMICS is committed to providing scientists with the tools they need to make the most of their genetic research. With its solutions, researchers can unlock the potential of genomics and push the boundaries of discovery. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 10x Genomics. More…

| Total Revenues | Net Income | Net Margin |

| 516.41 | -166 | -32.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 10x Genomics. More…

| Operations | Investing | Financing |

| -33.61 | -350.89 | 15.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 10x Genomics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.03k | 223.24 | 6.78 |

Key Ratios Snapshot

Some of the financial key ratios for 10x Genomics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.1% | – | -31.3% |

| FCF Margin | ROE | ROA |

| -32.0% | -12.8% | -9.8% |

Analysis – 10x Genomics Intrinsic Stock Value

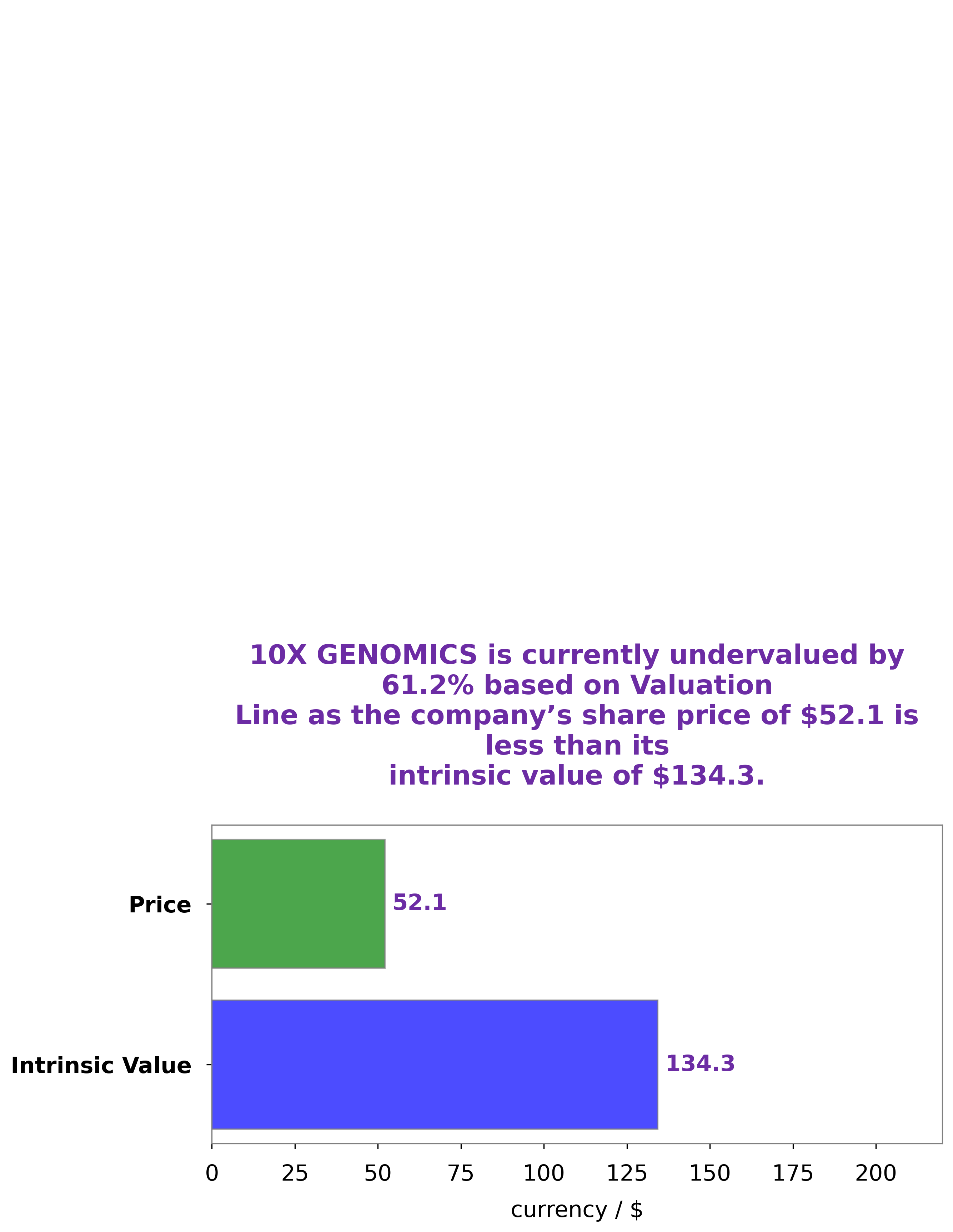

GoodWhale has conducted an analysis of 10X GENOMICS‘s wellbeing. Our proprietary Valuation Line has determined the intrinsic value of 10X GENOMICS share to be around $134.3. However, at present, the 10X GENOMICS stock is being traded at $52.1, which is undervalued by 61.2%. This presents an opportunity for investors to buy the stock at a bargain price, and reap huge rewards when the stock price goes up to its intrinsic value. More…

Peers

The company’s products include the Chromium System, an integrated solution for genome sequencing and data analysis, and the Visium Spatial Transcriptomics System, amicroarray platform for analyzing transcriptome activity in tissue samples. 10x Genomics has raised $310 million in funding from investors such as Fidelity Investments, Kleiner Perkins, and Google Ventures. 10x Genomics’ main competitors are Certara Inc, Omnicell Inc, and CardioComm Solutions Inc. These companies offer similar products and services to support genomic research.

– Certara Inc ($NASDAQ:CERT)

Certara Inc is a biopharmaceutical company that uses data and technology to improve drug development decisions. The company has a market cap of 2.49B as of 2022 and a Return on Equity of 1.81%. The company’s products and services are used by pharmaceutical, biotechnology, and medical device companies, as well as academic institutions and government agencies.

– Omnicell Inc ($NASDAQ:OMCL)

Omnicell is a leading provider of medication management solutions and adherence tools for healthcare systems and pharmacies. Their market cap of 2.49B as of 2022, and ROE of 2.67% indicates a strong and growing company. Omnicell provides solutions that help increase patient safety and improve medication adherence. Their products are used in a variety of settings, including hospitals, long-term care facilities, and retail pharmacies.

– CardioComm Solutions Inc ($TSXV:EKG)

CardioComm Solutions Inc is a medical device company that provides cardiac monitoring and arrhythmia detection solutions. It has a market cap of 2.26M as of 2022 and a return on equity of -59.73%. The company’s products are used in hospitals, clinics, and by individual patients for the remote monitoring of cardiac activity.

Summary

10X Genomics is a biotechnology company offering innovative solutions for biological research. Through its portfolio of powerful, cost-effective products, 10X Genomics enables researchers to access the full complexity of biological systems. This includes single cell sequencing technologies, which provide unprecedented insight into gene expression and cell biology, and a suite of powerful bioinformatics tools for the analysis of data from high complexity experiments.

For investors, 10X Genomics provides a unique opportunity to capitalize on the increasing demand for more advanced methods of biological research and to gain exposure to breakthroughs in the field of genomics. 10X Genomics offers a wide range of opportunities for active investors and long-term capital growth.

Recent Posts