10x Genomics Highlights Expanded Addressable Market and Launch of Xenium, Refrains from Providing Mid-Term Guidance Updates

December 29, 2022

Trending News 🌥️

10x Genomics ($NASDAQ:TXG) is a biotechnology company based in California that focuses on developing and commercializing innovative products to support genetic research. At its inaugural investor day earlier this month, 10x Genomics highlighted the potential for a much larger addressable market long-term. Management believes that the single-cell and spatial transcriptomics markets are set to grow at a rapid pace over the next decade, driven by a greater need for researchers to understand the complexity of life through single-cell analysis. In addition, 10x Genomics announced the launch of Xenium, its new product that allows for in-situ analysis instruments to be used in the field of single-cell analysis. This further strengthens the near-term growth outlook of 10x Genomics.

However, management refrained from providing mid-term guidance updates or further details regarding their FY23 outlook. By not committing to any guidance ranges, 10x Genomics keeps investors in the dark regarding their future prospects, which may be concerning for some. Nonetheless, this is likely due to the uncertainty surrounding the biotechnology sector and the ongoing pandemic. In conclusion, 10x Genomics highlighted the potential for a much larger addressable market long-term, as well as a strengthened near-term growth outlook following the launch of Xenium. The company is confident in its ability to capitalize on this growing market, but is not yet ready to commit to any mid-term guidance updates.

Market Price

The news was met with positive sentiment from analysts, yet the stock price at market close decreased 0.7%, opening at $31.6 and closing at $31.7 from the previous closing price of $31.9. This new product is expected to significantly reduce time and cost associated with single-cell research, making it more accessible to a broader group of users and increasing their addressable market. In addition to their product launch, 10X GENOMICS also provided an overview of their current market position and the ability to further expand their presence in the industry.

Although 10X GENOMICS refrained from providing mid-term guidance updates, they remain optimistic about their ability to grow their presence in the industry. With their expanded product offerings and increased addressable market, 10X GENOMICS is positioning itself to be a leader in single-cell gene expression solutions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 10x Genomics. More…

| Total Revenues | Net Income | Net Margin |

| 503.71 | -167.23 | -33.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 10x Genomics. More…

| Operations | Investing | Financing |

| -58.18 | -106.73 | 35.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 10x Genomics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 996.21 | 220.41 | 6.88 |

Key Ratios Snapshot

Some of the financial key ratios for 10x Genomics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.6% | – | -32.0% |

| FCF Margin | ROE | ROA |

| -32.0% | -12.9% | -10.1% |

VI Analysis

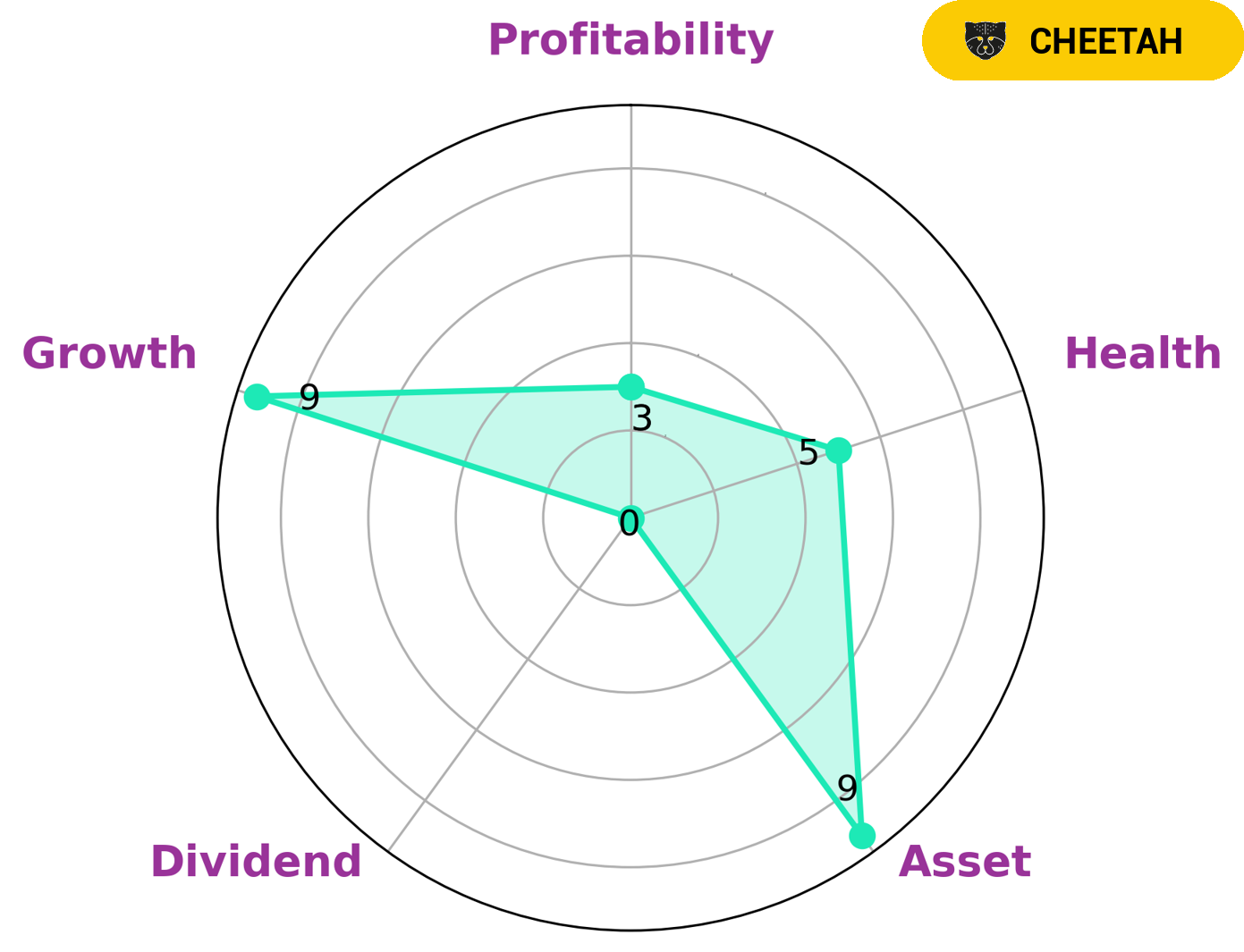

Investors looking to capitalize on a company with long-term potential should consider 10X GENOMICS. VI app makes it easy to analyze the company’s fundamentals. The VI Star Chart gives 10X GENOMICS an intermediate health score of 5/10 in terms of cashflows and debt, which suggests it could safely endure any crisis without the risk of bankruptcy. The company is strong in terms of assets and growth, but weak when it comes to dividends and profitability. 10X GENOMICS is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to its lower profitability. This makes 10X GENOMICS an attractive investment target for investors seeking fast growth and willing to accept the associated risks. Investors looking for a more stable and predictable return may want to look elsewhere. Nonetheless, investors interested in the high-growth potential of 10X GENOMICS would do well to consider this company as an investment opportunity. More…

VI Peers

The company’s products include the Chromium System, an integrated solution for genome sequencing and data analysis, and the Visium Spatial Transcriptomics System, amicroarray platform for analyzing transcriptome activity in tissue samples. 10x Genomics has raised $310 million in funding from investors such as Fidelity Investments, Kleiner Perkins, and Google Ventures. 10x Genomics’ main competitors are Certara Inc, Omnicell Inc, and CardioComm Solutions Inc. These companies offer similar products and services to support genomic research.

– Certara Inc ($NASDAQ:CERT)

Certara Inc is a biopharmaceutical company that uses data and technology to improve drug development decisions. The company has a market cap of 2.49B as of 2022 and a Return on Equity of 1.81%. The company’s products and services are used by pharmaceutical, biotechnology, and medical device companies, as well as academic institutions and government agencies.

– Omnicell Inc ($NASDAQ:OMCL)

Omnicell is a leading provider of medication management solutions and adherence tools for healthcare systems and pharmacies. Their market cap of 2.49B as of 2022, and ROE of 2.67% indicates a strong and growing company. Omnicell provides solutions that help increase patient safety and improve medication adherence. Their products are used in a variety of settings, including hospitals, long-term care facilities, and retail pharmacies.

– CardioComm Solutions Inc ($TSXV:EKG)

CardioComm Solutions Inc is a medical device company that provides cardiac monitoring and arrhythmia detection solutions. It has a market cap of 2.26M as of 2022 and a return on equity of -59.73%. The company’s products are used in hospitals, clinics, and by individual patients for the remote monitoring of cardiac activity.

Summary

10X Genomics is a biotechnology company that has recently announced the launch of its new product, Xenium, as well as expansion of its addressable market. Investors are optimistic about the company’s potential, as it has been successful in developing innovative products and technologies. 10X Genomics’ current product portfolio includes platforms used to study the genetic basis of cancer, immunology, and other diseases.

The company has also seen increased attention from investors due to its strong financial performance and potential for future growth. Despite not providing mid-term guidance updates, 10X Genomics remains an attractive investment option for investors looking for high-growth biotechnology stocks.

Recent Posts